Shift4 Payments (FOUR) just landed in the spotlight unexpectedly thanks to the White House. Jared Isaacman, the founder and chairman of the fintech firm, is once again President Donald Trump’s pick to lead NASA, barely five months after the original nomination was quietly pulled back in June. Isaacman is far from a conventional fintech executive. While he founded Shift4, he is also a trained pilot and commercial astronaut who has flown to space twice on private SpaceX missions.

In June, Isaacman stepped down as CEO of Shift4 but remained chairman, keeping a direct link to the company while turning his focus toward space-related ventures. This renewed nomination by Trump has suddenly pushed Shift4 back onto investors’ radar, something the company hasn’t enjoyed in a long time. And with Wall Street seeing plenty of upside potential ahead, here’s a fresh look at this little-known fintech player.

About Shift4 Stock

Pennsylvania-based Shift4 Payments is a fintech company that offers payment processing solutions and software for restaurants, hotels, stadiums, retail stores, and e-commerce brands. Founded in 1999 by Jared Isaacman, the company has evolved from a small payment processor into a major platform that handles billions of transactions. Its mission is simple: to make payments fast, secure, and hassle-free for businesses and their customers.

Unfortunately, even with the booming demand for digital payment solutions, Shift4 has struggled to win over Wall Street. The stock briefly captured investors’ attention on Nov. 5 after Jared Isaacman’s renewed NASA nomination made headlines, but its longer-term performance has been rough. Currently valued at almost $6 billion by market capitalization, shares have plunged nearly 36% over the past year and are down roughly 40% in 2025 alone.

In stark contrast, the broader S&P 500 Index ($SPX) has climbed almost 12.51% over the past year and 14% this year. Shift4 touched a 52-week low of $62.55 just this week. The stock also looks affordable in terms of valuation. Shift4 is trading at just 1.8 times sales, well below the sector average of 3x and even under its own five-year average of 2.4x.

Shift4’s Q3 Earnings Snapshot

Despite a choppy consumer spending environment, Shift4 still managed to release a strong fiscal 2025 third-quarter earnings report on Nov. 6, which exceeded both Wall Street’s top and bottom-line forecasts. Gross revenue for the quarter jumped 29% year-over-year (YOY) to $1.18 billion, while gross revenue less network fees soared 61% YOY to $589.2 million, topping analysts’ consensus estimate of $580.6 million.

Profitability told an equally strong story. Gross profit for the quarter surged 62% YOY, while adjusted EBITDA margin came in at a solid 50%. Additionally, non-GAAP earnings for the third quarter stood at $1.47 per share, representing a 5.8% annual increase, underscoring the company’s expanding profitability. The figure also surpassed Wall Street estimates by a narrow margin.

And the strength wasn’t just acquisition-driven. Stripping out the impact of July’s Global Blue acquisition, gross revenue less network fees still rose a healthy 19%, a clear sign that the core business remains resilient and highly competitive. Cash generation improved as well, with adjusted free cash flow up 27.5% annually to $141 million. To underscore its confidence, the company rolled out a massive $1 billion share repurchase plan, the largest buyback in Shift4’s history.

Looking to the whole year, the company forecasts $207 billion to $210 billion in total payment volume for fiscal 2025, marking 26%-27% growth from a year ago. Gross revenue less network fees is projected between $1.98 billion and $2.02 billion, up 46%-49% YOY, while adjusted EBITDA is expected to land between $970 million and $985 million, representing 43%-45% annual growth.

How Are Analysts Viewing Shift4 Stock?

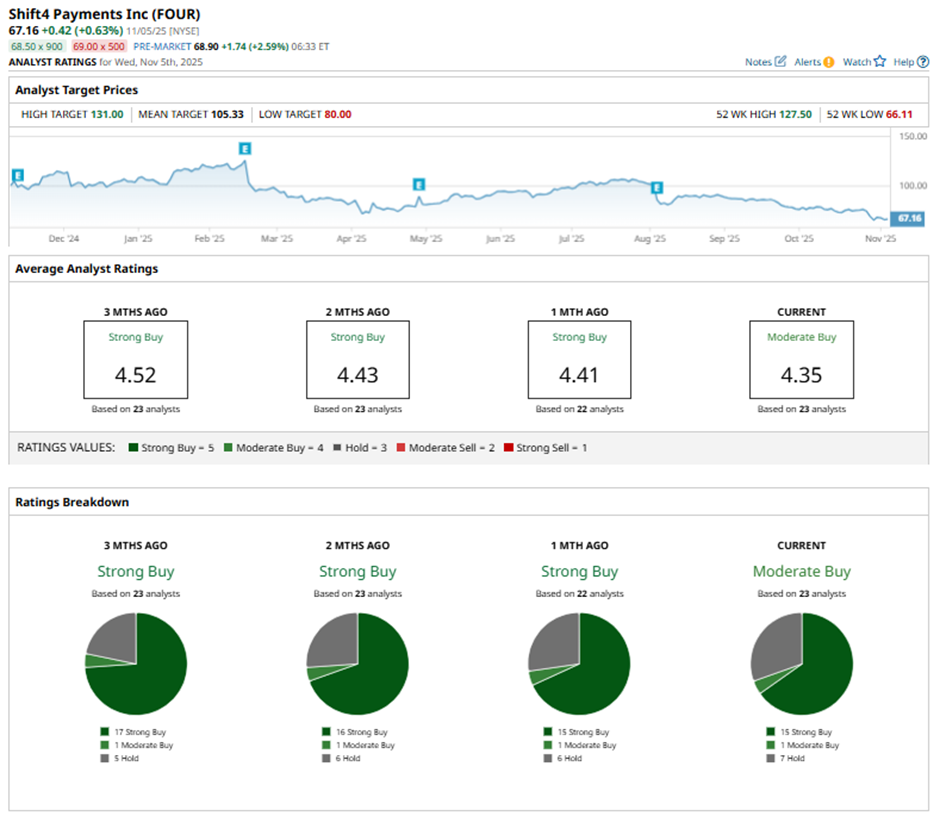

Even with the stock stuck in a slump, analysts aren’t walking away from Shift4 just yet. Wall Street still rates the company a consensus “Moderate Buy,” showing that confidence in its long-term growth story remains intact. Out of 23 analysts, 15 call it a “Strong Buy,” one labels it a “Moderate Buy,” and seven are sitting at “Hold.”

Price targets paint an even brighter picture. The average target of $105.33 suggests about 57% upside from current levels, while the Street-high forecast of $131 points to a massive 95% jump from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Saturday Spread: How the Game of Baseball Can Be Used to Effectively Trade Options

- Core Scientific Just Rejected CoreWeave’s Bid. Should You Buy CRWV Stock Here or Stay Far Away?

- This Little-Known Stock Just Got a Major Trump Boost and Analysts Think It Can Gain 95% from Here

- 5 Best Dividend Stocks Wall Street Calls Strong Buys