Ireland-based Aptiv PLC (APTV) engages in the design, manufacture, and sale of vehicle components. It provides electronic and safety technology solutions to the automotive and commercial vehicle markets. With a market cap of $16.7 billion, Aptiv operates through the Signal and Power Solutions and Advanced Safety and User Experience segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." Aptiv fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the auto parts industry. Its operations span the Americas, Europe, the Middle East, Africa, the Indo-Pacific, and internationally.

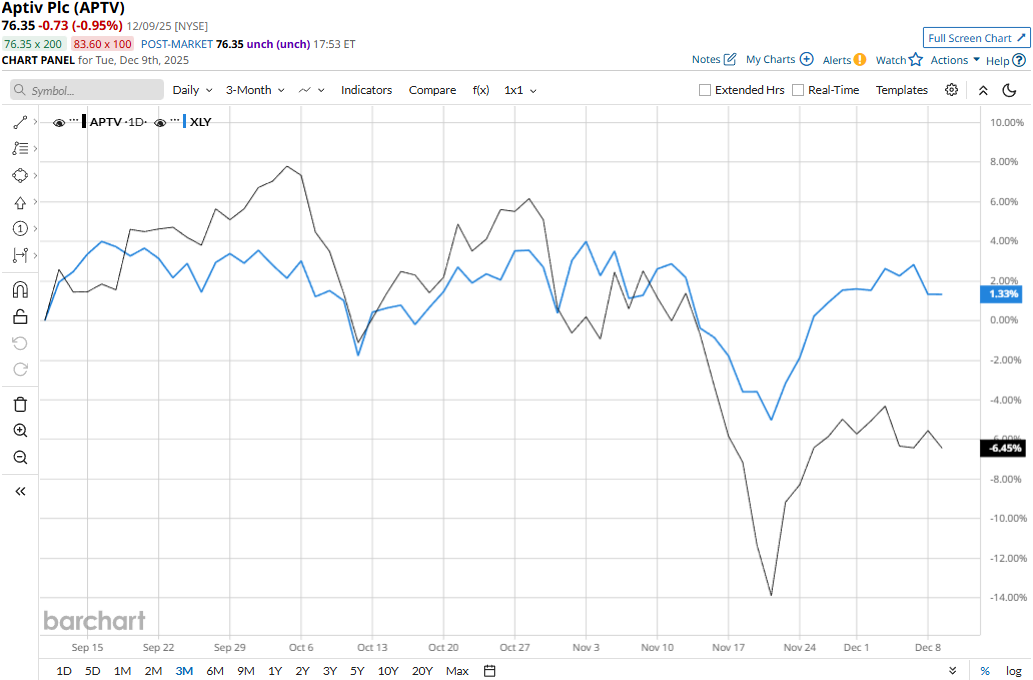

Despite its notable strengths, APTV stock has dropped 14% from its 52-week high of $88.80 touched on Oct. 6. Meanwhile, APTV stock prices have declined 7.1% over the past three months, lagging behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 11 bps uptick during the same time frame.

However, Aptiv’s performance has remained impressive over the longer term. APTV stock prices have soared 26.2% on a YTD basis and 33% over the past 52 weeks, compared to XLY’s 5.2% uptick in 2025 and modest 1.7% gains over the past year.

APTV stock has traded consistently above its 200-day moving average since mid-May and dropped below its 50-day moving average in late December, underscoring its previous bullish trend and recent downturn.

Despite reporting better-than-expected financials, Aptiv’s stock prices declined 4.3% in the trading session following the release of its Q3 results on Oct. 30. The company’s net sales for the quarter increased by a notable 7% year-over-year to a record $5.2 billion, beating the Street’s expectations by 3%. However, of this increase, 6% growth was attributable to currency and commodity movements, which didn’t impress investors.

Meanwhile, the company recorded a massive non-cash goodwill impairment charge of $648 million, which led to a massive drop in GAAP net income. Nonetheless, Aptiv’s non-GAAP EPS increased by 18.6% year-over-year to $2.17, beating the consensus estimates by 19.9%.

Aptiv has also outperformed compared to its peer Autoliv, Inc.’s (ALV) 23.8% surge in 2025 and 18.6% gains over the past 52 weeks.

Among the 22 analysts covering the APTV stock, the consensus rating is a “Moderate Buy.” Its mean price target of $97.89 suggests a 28.2% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Forget The Fed and Buy This Dividend Stock for 2026

- Morgan Stanley Is Sweetening on MP Materials Stock Following ‘Historic Deal.’ Should You Buy MP Here?

- This Semiconductor Giant Is in Talks With Microsoft for Custom Chips. Should You Buy Its Stock Now?

- Is MicroStrategy Stock a Buy Now Amid the Bitcoin Rally?