Louisville, Kentucky-based Brown-Forman Corporation (BF.B) manufactures, distills, bottles, imports, exports, markets, and sells various alcoholic beverages. Valued at $14 billion by market cap, the company’s products include branded whiskey, vodka, wines, tequila, bourbon, and gin.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and BF.B perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the beverages - wineries & distilleries industry. Brown-Forman's strengths include its premium spirits portfolio, led by iconic brands such as Jack Daniel's, and its strong brand equity, which enables premium pricing and high profit margins. The company has also taken proactive steps to enhance operational efficiency through restructuring, aiming for long-term savings and a more agile organization.

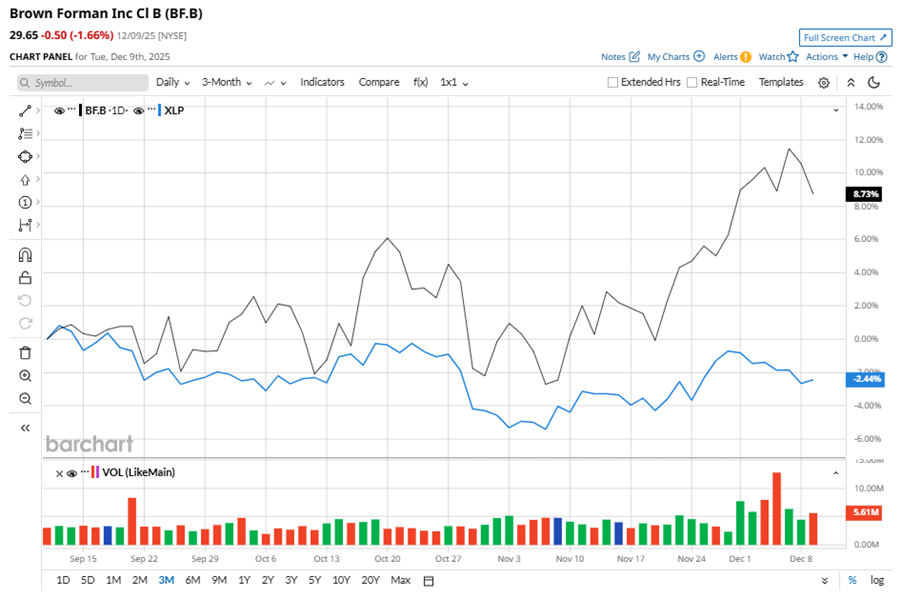

Despite its notable strength, BF.B slipped 45.2% from its 52-week high of $46.22, achieved on Dec. 5, 2024. Over the past three months, BF.B stock gained 8%, outperforming the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.4% dip during the same time frame.

In the longer term, shares of BF.B rose 7.2% on a six-month basis, outperforming XLP’s six-month losses of 4.4%. However, the stock fell 34.4% over the past 52 weeks, underperforming XLP’s 5.2% losses over the last year.

To confirm the bearish trend, BF.B has been trading below its 200-day moving average over the past year, with minor fluctuations. However, the stock is trading above its 50-day moving average since mid-November.

On Dec. 4, BF.B shares closed down more than 1% after reporting its Q2 results. Its net sales stood at $1 billion, down 5.4% year over year. The company’s EPS declined 14.5% year over year to $0.47.

In the competitive arena of beverages - wineries & distilleries, Diageo plc (DEO) has taken the lead over BF.B, with 31% losses over the past 52 weeks, but lagged behind the stock with a 20.4% downtick on a six-month basis.

Wall Street analysts are cautious on BF.B’s prospects. The stock has a consensus “Hold” rating from the 18 analysts covering it, and the mean price target of $30.56 suggests a potential upside of 3.1% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart