When nations sharpen their tools, their rivals sharpen faster, and in this age of digital warfare, the front line is not just land or sea, it is algorithms. Inside the Department of Defense (DOD), officials are not watching from the sidelines but racing to rewire the future with artificial intelligence (AI). And the latest spark is the Pentagon unveiling GenAI.mil, its new military-focused AI platform now running on Alphabet's (GOOG) (GOOGL) Gemini.

This week, Google confirmed that Gemini for Government has been chosen as the first enterprise AI backbone for the Pentagon’s massive workforce – nearly 3 million military and civilian personnel. Handpicked by the Chief Digital and AI Office, Gemini’s mission is to supercharge real-time decision-making, streamline operations, and replace creaking legacy systems with modern intelligence.

From onboarding to contracting workflows, policy summaries to risk assessments, Google’s AI will handle unclassified tasks while keeping defense data locked down – never training its models on military information. With high federal security ratings, a prior $200 million DOD contract, and growing ties with the Navy, Air Force, and Defense Innovation Unit, Google’s military footprint is expanding fast.

With Alphabet’s shares rising after the announcement, and Gemini marching deeper into the defense world, should you buy GOOGL stock here?

About Alphabet Stock

Alphabet, which began as a modest search engine experiment in a Stanford dormitory, has evolved into a $3.8 trillion tech powerhouse still firmly in expansion mode. Headquartered in California, the company now extends far beyond Google, orchestrating advancements across AI, cloud computing, autonomous mobility through Waymo, and frontier research via DeepMind.

Its Gemini models further reinforce Alphabet’s leadership in next-generation AI architecture. Whether advancing healthcare innovation or shaping tomorrow's intelligence systems, Alphabet is not just stepping into the digital future but actively shaping what it will look like.

Yet GOOGL stock’s performance tells an equally compelling story. The renewed confidence in its AI execution sent Alphabet’s valuation surging toward the $4 trillion mark, placing it firmly among the world’s most valuable companies. Investors may have stepped into 2025 questioning whether Google was falling behind in AI, but the stock has flipped the script and is up 67.59% year-to-date (YTD). GOOGL now leads the elite “Magnificent Seven” this year.

Zooming out only amplifies the scale of the climb. By comparison, the S&P 500 Index ($SPX), rising a respectable 16.48% in 2025, has been left far behind as Alphabet’s ascent continues at a different cadence altogether. The stock recently marked a 52-week high at $328.83, and its current 3.4% dip from that peak is less like a weakness and more like a consolidation phase.

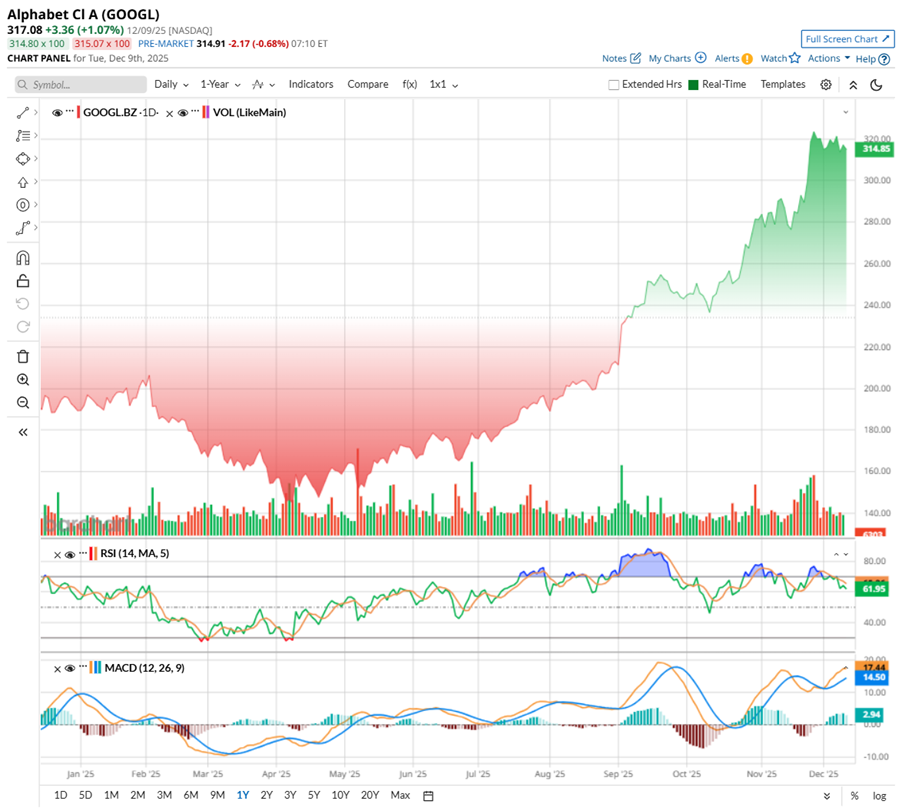

From the chart below, the technicals show GOOGL stock catching its breath after a powerful run. The 14-day RSI has cooled to around 64.29, slipping from overbought territory and signaling a healthier, more sustainable setup.

Meanwhile, the MACD oscillator looks encouraging, with the yellow MACD line crossed above the blue signal line in December, keeping momentum in positive territory and hinting that the broader uptrend remains firmly intact.

A Closer Look at Alphabet's Q3 Earnings Report

Alphabet’s Q3 earnings results, released on Oct. 29, raked in revenue of $102.3 billion, rising 16% year-over-year (YOY), clearing the Street’s forecast. The engine behind this surge is Google Services, that vast digital cathedral of Search, YouTube, subscriptions, platforms, and devices, which grew 14% annually to $87.1 billion.

Search, ever the company’s lodestar, delivered a commanding 14.6% YOY revenue jump to $56.6 billion, reaffirming its status as the internet’s tollbooth. Advertising grew 12.6% annually to $74.2 billion, showing that marketers still line up eagerly to buy attention on Google’s turf. But the real star of the quarter was the division glowing with enterprise ambition – Google Cloud, which rose 34% to $15.2 billion as AI workloads and digital modernization lit up demand across sectors.

Profitability followed suit. Operating income climbed 9% to $31.2 billion, clocking a robust 30.5% margin. Strip out the European Commission’s hefty $3.5 billion antitrust penalty, and that margin would have stood near 34%, a testament to operational discipline beneath the sprawling empire. EPS soared 35.4% YOY to $2.87, beating analyst estimates by a wide 27%, and that’s the sort of outperformance that makes even seasoned investors sit up.

Moreover, AI is no longer Alphabet’s experiment. Management emphasized the strength of its “full-stack AI” strategy, with Gemini and its other first-party models now processing a mind-bending seven billion tokens per minute. The Gemini app, too, is gaining traction, with 650 million monthly active users, a user base large enough to rival the populations of continents. Google Cloud backlog orders have surged past $155 billion, a monumental queue of demand for cloud and AI infrastructure. It is, in a sense, the company’s future revenue already waiting in line.

Looking ahead, management guided capital expenditures to be between $91 billion and $93 billion for fiscal 2025, a signal flare announcing that the next leg of growth will be built on colossal investments in AI, data centers, and the hardware needed to power the next era of computation.

For fiscal 2025, Wall Street analysts tracking Alphabet anticipate its EPS to be $10.52, hinting at a 30.9% YOY surge, and then rise by 4.1% annually to $10.95 in fiscal 2026.

What Do Analysts Expect for Alphabet Stock?

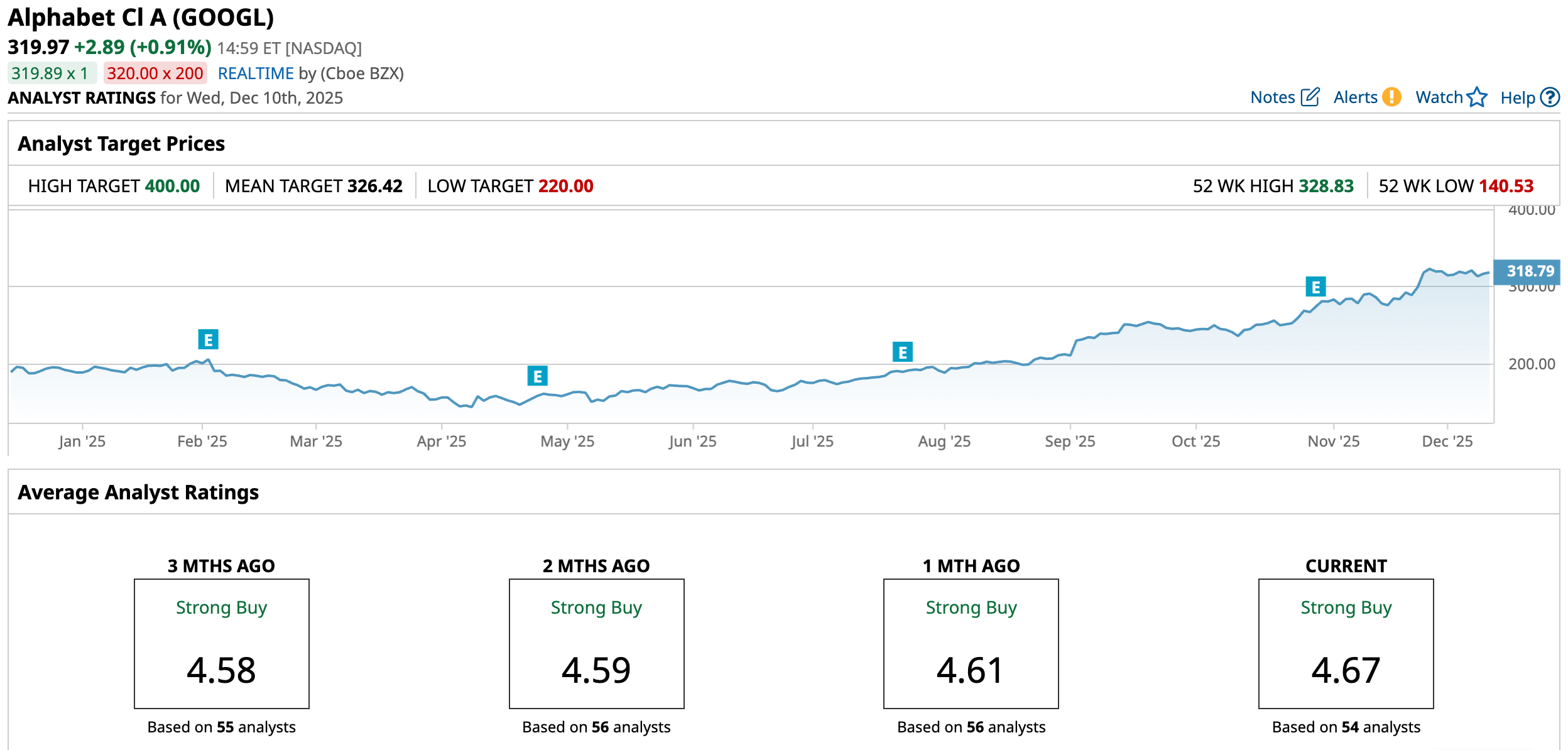

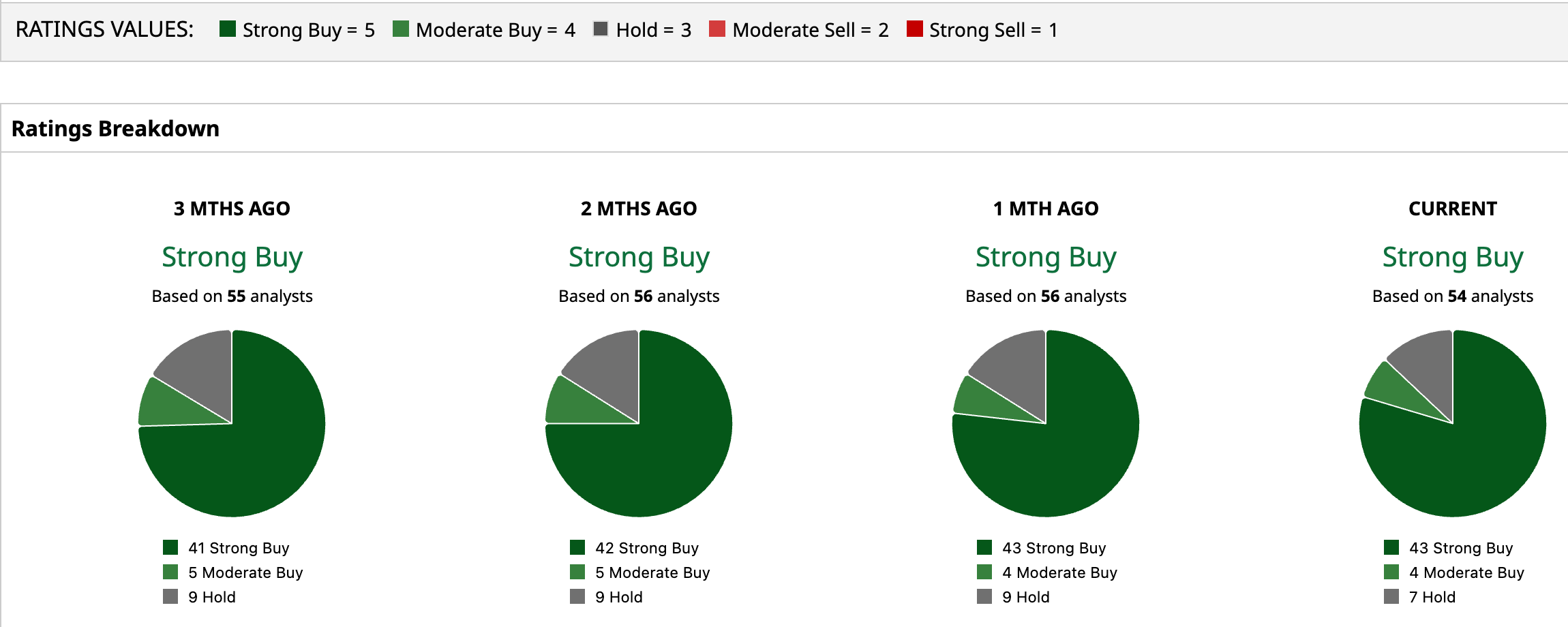

Analysts monitoring GOOGL are optimistic, with consensus leaning heavily toward a “Strong Buy.” Out of 54 analysts, 43 advise a “Strong Buy,” four recommend a “Moderate Buy,” and seven are cautious with a “Hold” rating.

The average price target of $326.42 suggests a 2.07% upside potential from here. Meanwhile, the Street-high target of $400 suggests GOOGL stock could rise 25.19%.

Final Thoughts on Alphabet

In many ways, Google’s deepening military ties feel like the next chapter of a story already in motion. Gemini’s entry into the Pentagon is not just a contract win, but a signal that Alphabet’s AI is maturing into mission-critical infrastructure. As GenAI.mil rolls out across millions of defense workers, Google gains something Wall Street values even more than revenue – validation. This could cement trust, expand influence, and open doors to future defense and government deals. For GOOGL stock, this momentum acts like a tailwind, which is steady, strategic, and potentially transformative, raising the question of how high this story can climb next.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.