With a market cap of $12.8 billion, Ball Corporation (BALL) is a global supplier of aluminum packaging products serving the beverage, personal care, and household industries. The company produces aluminum beverage containers for fillers of soft drinks, beer, energy drinks, and other beverages.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Ball Corporation fits this criterion perfectly. It also manufactures extruded aluminum aerosol containers, recloseable bottles, aluminum cups, and aluminum slugs.

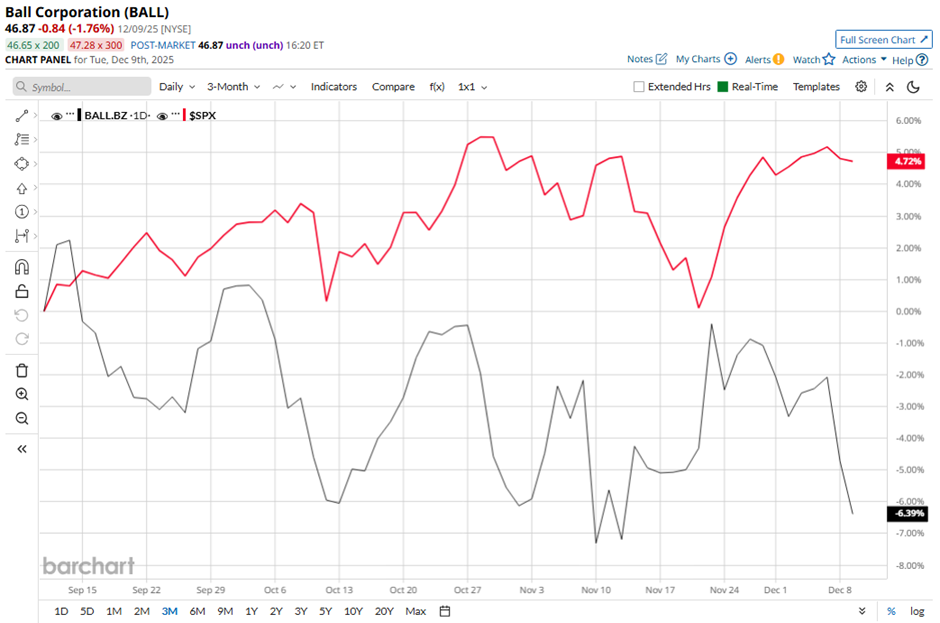

Shares of the Westminster, Colorado-based company have fallen 22.3% from its 52-week high of $60.28. BALL stock has declined over 7% over the past three months, underperforming the broader S&P 500 Index’s ($SPX) over 5% gain over the same time frame.

Longer term, BALL stock is down nearly 15% on a YTD basis, lagging behind SPX's 16.3% increase. Shares of the aluminum packaging maker have decreased 18.7% over the past 52 weeks, compared to the 13% return of the SPX over the same time frame.

Despite recent fluctuations, the stock has been trading below its 50-day and 200-day moving averages since early August.

Shares of Ball Corporation rose 1.5% on Nov. 4 as the company reported Q3 2025 revenue of $3.38 billion, above estimates, and reported strong demand for aluminum packaging, including a 3.9% increase in global shipments. Beverage packaging sales in North and Central America also grew to $1.64 billion from $1.46 billion a year earlier. Investors were further encouraged by Ball reaffirming its outlook for 12% - 15% earnings growth in 2025.

In comparison, rival International Paper Company (IP) has lagged behind BALL stock. Shares of International Paper have dipped 32.6% over the past 52 weeks and 30.2% on a YTD basis.

Despite Ball Corporation’s weak performance, analysts remain moderately optimistic about its prospects. Among the 15 analysts covering the stock, there is a consensus rating of “Moderate Buy,” and the mean price target of $60.08 suggests a premium of 28.2% to its current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart