Cardinal Health, Inc. (CAH), based in Dublin, Ohio, is a worldwide healthcare services and products firm. It manages the distribution of pharmaceuticals and medical supplies and offers logistics services to hospitals, pharmacies, and healthcare providers.

The company is vital to streamlining the supply chain, thereby enhancing medication and product availability and improving patient care quality. Cardinal Health has a market capitalization of $47.04 billion, making it a “large-cap” stock.

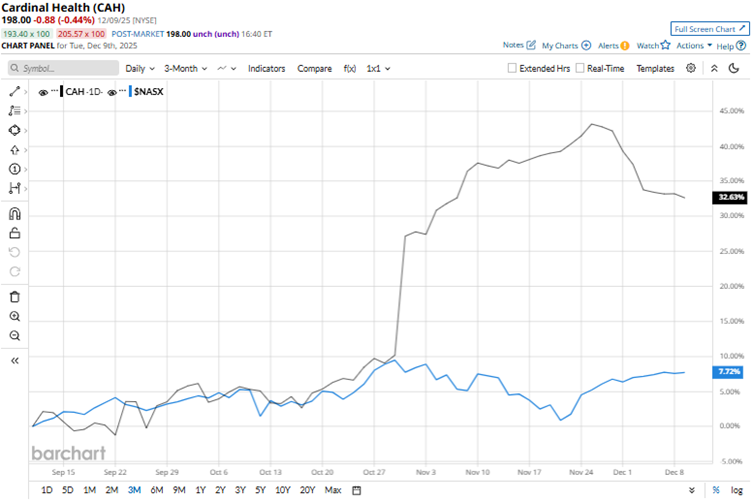

Cardinal Health’s shares reached a 52-week high of $214.93 on Nov. 26, but are down 7.9% from that level. Strong sentiment and solid earnings projections have led to a surge in the stock price. Over the past three months, the stock has been up 31.2%. On the other hand, the Nasdaq Composite ($NASX) index gained 7.8% over the same period.

Over a more extended period, this outperformance persists. Over the past 52 weeks, Cardinal Health’s stock has gained 62.9%, while it has been up 28.9% over the past six months. The Nasdaq Composite has gained 19.5% and 20.3% over the same periods, respectively. Cardinal Health’s shares have been consistently trading above its 200-day moving average over the past year, while it has been trading above its 50-day moving average since late September.

On Oct. 30, Cardinal Health reported its first-quarter results for fiscal 2026 (the quarter that ended Sept. 30). The company’s revenues increased 22% year-over-year (YOY) to $64.01 billion, which was higher than the $59.05 billion that Wall Street analysts had expected. Its non-GAAP EPS increased 36% YOY to $2.55, exceeding Street analysts' $2.21 estimate.

Cardinal Health also raised its fiscal 2026 non-GAAP EPS outlook from $9.30-$9.50 to $9.65-$9.85, indicating projected growth of 17%-20%. Based on these strong results and an updated outlook, the stock rose 15.4% intraday on Oct. 30. Last month, Cardinal Health completed the acquisition of urology MSO Solaris Health, adding more than 750 providers to the company’s multi-specialty MSO platform.

We compare Cardinal Health’s performance with that of another medical distribution firm, Cencora, Inc. (COR), which has gained 40.2% over the past 52 weeks and 18.8% over the past six months. Therefore, Cardinal Health has been the clear outperformer over these periods.

Wall Street analysts are strongly bullish on Cardinal Health’s stock. The stock has a consensus rating of “Strong Buy” from the 16 analysts covering it. The mean price target of $214.40 indicates an 8.3% upside compared to current levels. The Street-high price target of $232 indicates a 17.2% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart