Meta Platforms’ (META) AI glasses efforts in partnership with EssilorLuxottica (ESLOY) have brought the company a lot of success. The emergence of generative AI has meant that what was once a capital-intensive experiment is now a commercially viable business. This much was clear when, in May, Alphabet’s (GOOG) (GOOGL) Google committed $150 million to Warby Parker (WRBY), a popular eyewear company. Investors could foresee what the search engine giant was trying to do, and if anyone was in any doubt, the recent announcement should help remove that.

Earlier this week, Google announced that it was set to launch its first AI glasses next year. It is collaborating with Samsung (SMSN.L.EB) and Gentle Monster, in addition to Warby Parker, as already mentioned above.

Built using the company’s operating system for headsets, Android XR, the glasses will allow users to interact with Google’s Gemini AI assistant, though this interaction will only be audio-based, as per the company. Additionally, it will also launch glasses with an in-lens display, which will show users things like translations and directions. The company has not yet announced the exact date of the launch of these glasses.

About Alphabet Stock

Alphabet is an American multinational holding company, famous for its Google search engine, Waymo autonomous cars, Gemini Chatbot, Google Workspace, and many other things. It is one of the most valuable companies in the world and is headquartered in Mountain View, California.

GOOGL stock has had an incredible year, generating returns of over 70% in the last 12 months. In comparison, the S&P 500 Index ($SPX) has only returned 13.35% over the same period.

Alphabet, along with the other hyperscalers, is the very reason why many consider the ongoing rally an AI bubble. The company continues to invest in AI, with investors wondering whether the returns on investment will be as exciting as the infrastructure investments are. The stock price keeps climbing amid this backdrop, hence the AI bubble speculations.

GOOGL is clearly overvalued on various metrics. Its forward P/E ratio of 30x is 26.5% above its five-year historic forward P/E of 23.8x. It is trading at a price-to-sales ratio that is 62% above its five-year average. On a price-to-cash flow basis, the stock is trading at a multiple of 24.29x, and you guessed it right, this too is a massive 44% above its five-year average.

The stock is pricing in a lot of future growth, and it is for the investors to decide whether they think the premium is worth paying. After all, the AI demand is unprecedented, and if investors want to taste the fruit of GOOGL meeting this demand, they have to take the risk, which comes in this case in the form of overvaluation.

Alphabet Reports Strong Earnings

GOOGL announced its Q3 2025 earnings on Oct 29. For the first time ever, the company reported a revenue of over $100 billion for the quarter. It comfortably beat Wall Street expectations, reporting a revenue of $102.35 billion vs. an estimated $99.89 billion and an EPS of $3.10 vs. an estimated $2.33.

The demand for AI showed in the cloud segment, which reported a revenue of $15.15 billion against expectations of $14.75 billion. The company expects 2025 capex to land between $91 billion and $93 billion. However, these investments are likely to increase significantly in 2026, as per the management.

The momentum in the usage of AI Overviews and AI Mode continues to go strong. According to the management, users are now realizing that AI Overviews can answer most of their questions. This not only means they have a better user experience but is a huge positive for Google. If the company can satisfy user queries itself, it bodes well for the AI glasses, where users are more likely to get irritated if they don’t find the right info on the first attempt, unlike desktop users who are used to modifying their query if they don’t get the answer on the first attempt.

What Analysts Are Saying About GOOGL Stock

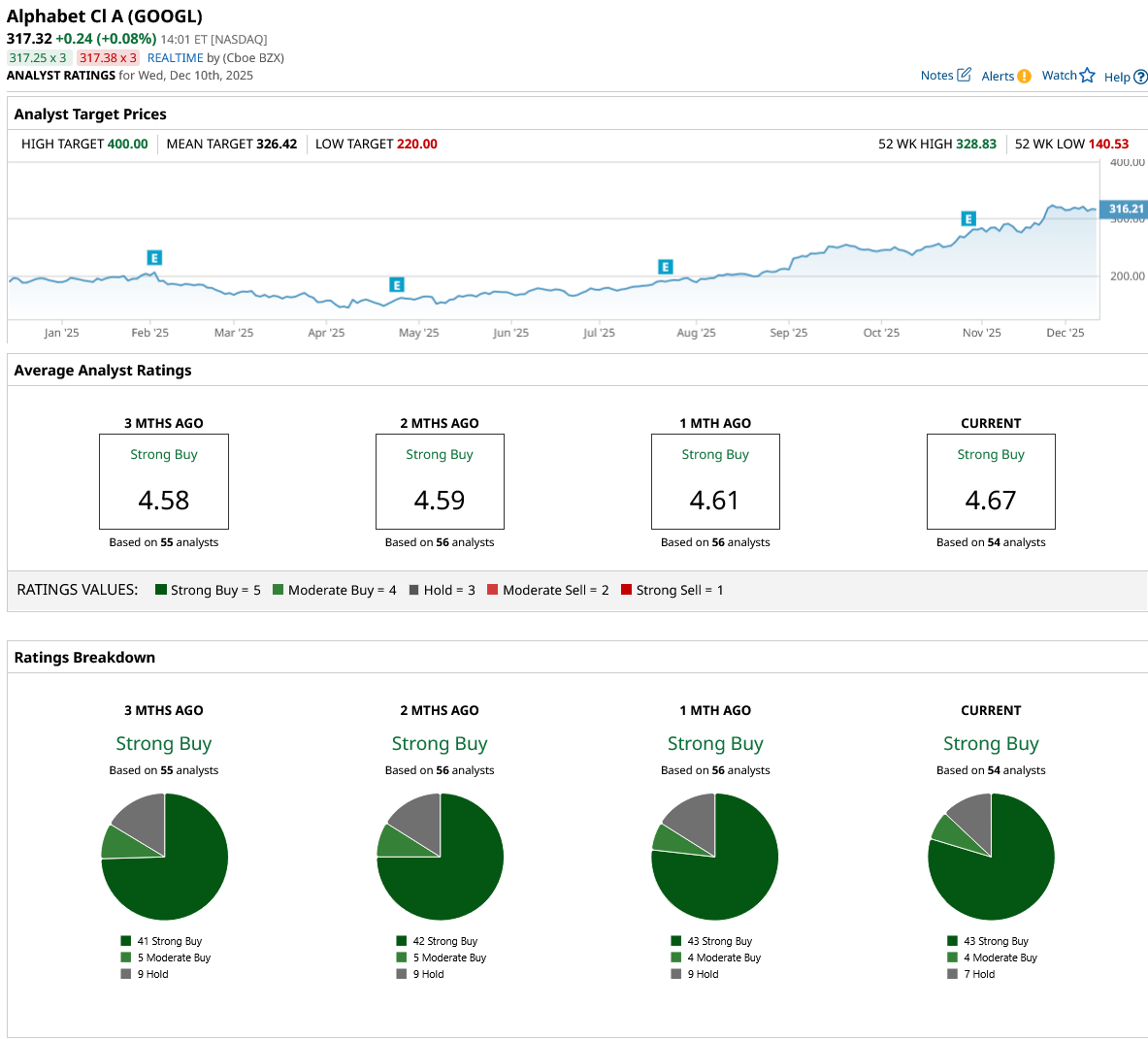

GOOGL enjoys a consensus “Strong Buy” rating, with 43 out of 54 analysts on Wall Street rating it a “Strong Buy.” No analyst has a “Sell” rating on the stock. The stock is trading quite close to its mean target price of $326. However, the highest target price of $400 still offers 26% upside from current levels.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Walmart Just Hit the Nasdaq Exchange. Should You Buy WMT Stock Here?

- Evercore Analysts Are Pounding the Table on Apple Stock Ahead of a ‘Sizable Catalyst’ Coming in 2026

- Dear Micron Stock Fans, Mark Your Calendars for December 17

- Google’s Gemini Just Scored a Major Military Win. Should You Buy GOOGL Stock Here?