Valued at a market cap of $20.3 billion, SBA Communications Corporation (SBAC) is a leading independent owner and operator of wireless communications infrastructure. The Boca Raton, Florida-based company primarily generates revenue by leasing antenna space on its extensive portfolio of cell towers, rooftops, small cells, and distributed antenna systems to major wireless carriers under long-term contracts, while also providing site development, construction, and maintenance services.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and SBAC fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the REIT - specialty industry. The company benefits from steady demand for mobile connectivity and network densification driven by 5G. Its business model of multi-tenant tower leasing provides stable, recurring cash flows and positions the company as a critical enabler of global wireless network expansion.

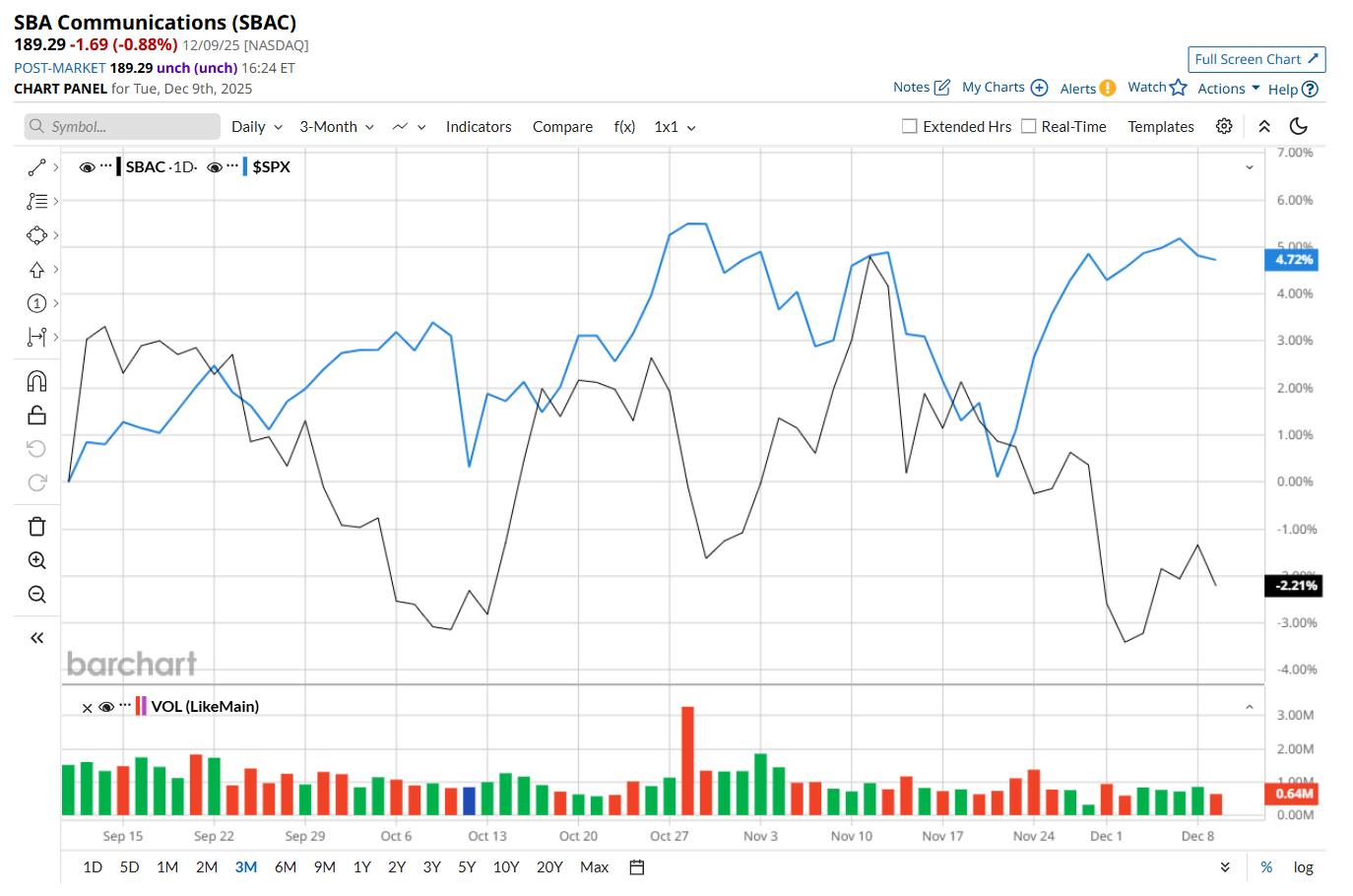

This specialty REIT has slipped 22.8% below its 52-week high of $245.16, reached on May 6. Shares of SBAC have declined 1.1% over the past three months, underperforming the S&P 500 Index’s ($SPX) 5% rise during the same time frame.

In the longer term, SBAC has fallen 15.2% over the past 52 weeks, lagging behind SPX’s 13% uptick over the same time frame. Moreover, on a YTD basis, shares of SBAC are down 7.1%, compared to SPX’s 16.3% return.

To confirm its bearish trend, SBAC has been trading below its 200-day moving average since late August and has remained below its 50-day moving average since late July, with slight fluctuations.

SBAC posted better-than-expected Q3 earnings results on Nov. 3, and its shares surged 1.4% in the following trading session. The company’s total revenue improved 9.7% year-over-year to $732.3 million, surpassing consensus estimates by 3.9%. Higher site leasing and site development revenues contributed to its topline rise. Moreover, while its AFFO per share declined marginally from the same period last year to $3.30, it handily topped analyst expectations of $3.19.

SBAC has also lagged behind its rival, American Tower Corporation (AMT), which declined 14.1% over the past 52 weeks and 2.1% on a YTD basis.

Despite SBAC’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 20 analysts covering it, and the mean price target of $224.78 suggests an 18.7% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- VICI Properties Hits a New 52-Week Low: Is It Time for Income Investors to Place a Bet?

- Salesforce Could Rebrand to Focus on Its AI Offerings. Should You Buy the Dip in CRM Stock Here?

- Creating a 39% “Dividend” on MRVL Stock Using Options

- Stock Index Futures Muted Amid Caution Ahead of Fed Rate Decision