Mentor, Ohio-based STERIS plc (STE) provides infection prevention products and services. Valued at $25.7 billion by market cap, the company offers sterilizers, washers, surgical tables, lights and equipment management systems, and endoscopy accessories.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and STE perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the medical devices industry. STE is a market leader in infection prevention, offering a unique mix of consumables and capital equipment. Its diverse portfolio makes it a one-stop solution for healthcare providers, driving revenue and customer retention.

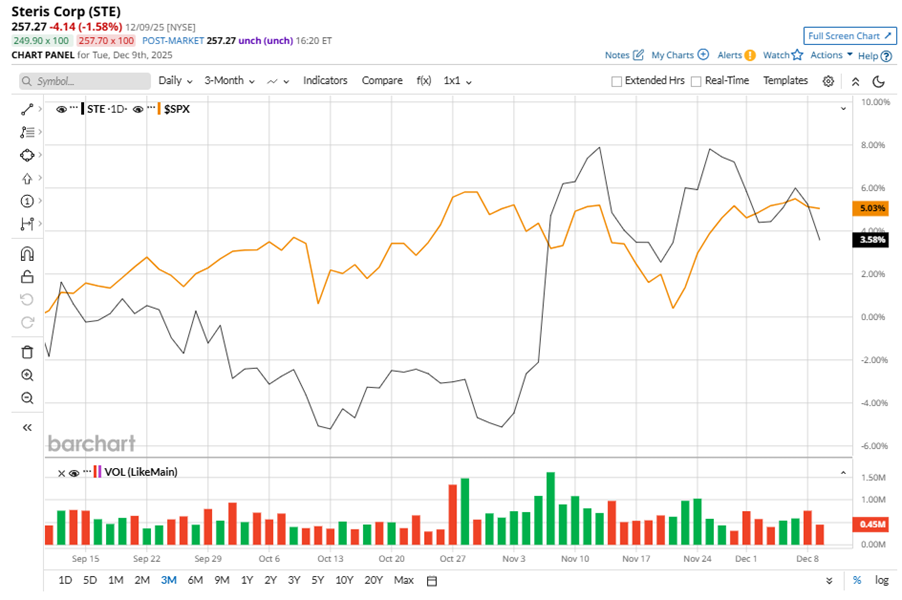

Despite its notable strength, STE slipped 4.2% from its 52-week high of $268.60, achieved on Nov. 25. Over the past three months, STE stock has gained 3.6%, underperforming the S&P 500 Index’s ($SPX) 5% gains during the same time frame.

In the longer term, shares of STE rose 6% on a six-month basis, underperforming SPX’s six-month gains of 13.9%. However, the stock climbed 19.3% over the past 52 weeks, outperforming SPX’s 13% returns over the last year.

To confirm the bullish trend, STE has been trading above its 200-day moving average since mid-May, with slight fluctuations. The stock has been trading above its 50-day moving average since early November.

On Nov. 5, STE reported its Q2 results, and its shares closed up by 6.9% in the following trading session. Its revenue was $1.5 billion, surpassing analyst estimates of $1.4 billion. The adjusted EPS of $2.47 exceeded analyst estimates by 5.1%.

STE’s rival, Stryker Corporation (SYK), has lagged behind the stock, plummeting 8.4% over the past 52 weeks and 8.7% on a six-month basis.

Wall Street analysts are reasonably bullish on STE’s prospects. The stock has a consensus “Moderate Buy” rating from the nine analysts covering it, and the mean price target of $288.86 suggests a potential upside of 12.3% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart