- BridgeBio Pharma (BBIO) has surged 145% over the past year, reaching an all-time high of $75.10.

- BBIO maintains a strong technical profile with a 100% “Buy” Barchart opinion.

- Revenue is projected to grow 123% this year and 79.63% next year, though earnings will dip 61.11% before rebounding 44.41%.

- Despite bullish analyst sentiment, BBIO’s 12.3% short interest and volatility warrant caution.

Today’s Featured Stock

Valued at $13.8 billion, BridgeBio Pharma (BBIO) discovers, develops and innovates drugs for genetic diseases. The company's product platform consists of Mendelian, oncology and gene therapies. Its product pipeline includes BBP-265, BBP-831, and BBP-454 which are in clinical and preclinical stages.

What I’m Watching

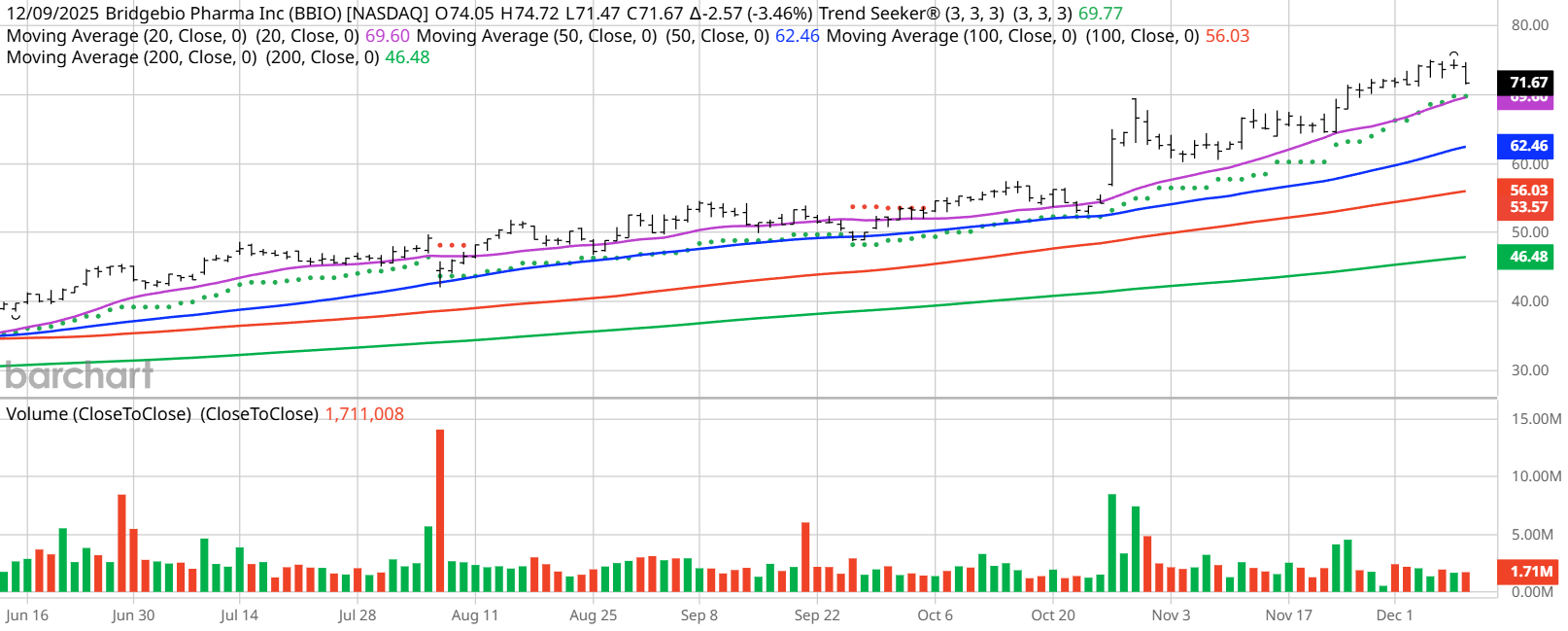

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. BBIO checks those boxes. Since the Trend Seeker signaled a new “Buy” on Oct. 6, the stock has gained 29.85%.

Barchart Technical Indicators for BridgeBio Pharma

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

BridgeBio hit an all-time high of $75.10 on Dec. 8.

- BBIO has a Weighted Alpha of +168.02.

- BridgeBio has a 100% “Buy” opinion from Barchart.

- The stock gained 144.46% over the past year.

- BBIO has its Trend Seeker “Buy” signal intact.

- The stock recently traded at $70.96 with a 50-day moving average of $62.84.

- BridgeBio made 12 new highs and gained 13.02% in the last month.

- Relative Strength Index (RSI) is at 58.32.

- There’s a technical support level around $70.52.

Don’t Forget the Fundamentals

- $13.8 billion market capitalization.

- Revenue is projected to grow 123.00% this year and another 79.63% next year.

- Earnings are estimated to decrease 61.11% this year but rebound again by 44.41% next year

Analyst and Investor Sentiment on BridgeBio Pharma

It looks like both Wall Street and individual investors are beginning to notice this stock.

- The Wall Street analysts tracked by Barchart have given 16 “Strong Buy,” 1 “Moderate Buy” and 1 “Hold” opinion on the stock with price targets between $66 and $110.

- Value Line rates it “Above Average.”

- CFRA’s MarketScope Advisor rates it a “Sell.”

- Morningstar thinks even with the stock’s recent runup, it’s fairly valued at $74.24.

- 54 investors following the stock on Motley Fool think the stock will beat the market while 29 think it won’t.

- 6,340 investors are monitoring the stock on Seeking Alpha, which rates it a “Buy.”

- Short interest is high at 12.3% of the float.

The Bottom Line on BridgeBio Pharma

It’s a positive sign that Wall Street has favorable opinions of BBIO, but I am cautious on any stock with over 10% short interest.

Today’s Chart of the Day was written by Jim Van Meerten. Read previous editions of the daily newsletter here.

Additional disclosure: The Barchart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Do We Have Permission to Buy Bitcoin Yet? Our Top Chart Strategist Maps Out the Path to $141,685

- Could Meta Stock Skyrocket in 2026 If Mark Zuckerberg Declares Another ‘Year of Efficiency’?

- Does IBM’s Major $11 Billion Deal for Confluent Make Its Stock a Buy, Sell, or Hold?

- This Hot Biotech Stock Just Set New All-Time Highs