Retail giant Walmart (WMT) moved its common stock and bonds to the tech-heavy Nasdaq. This move is based on several factors, the company’s focus on technology-driven innovation being a primary reason. Company CEO Doug McMillon stated that Walmart is increasingly becoming a tech-focused company, with artificial intelligence (AI) expected to invent new ways to shop.

This might also be the reason McMillon decided to hand over the reins of the company to John Furner, who has experience in Walmart’s digital, supply chain, and omnichannel units.

So should you consider investing in Walmart at this juncture?

About Walmart Stock

Walmart, headquartered in Bentonville, Arkansas and one of the largest retailers in the U.S., operates thousands of stores nationwide, offering a wide variety of products, including groceries, clothing, and electronics. Walmart focuses on low prices and convenience to serve millions of customers every day.

Walmart’s multiplatform approach seamlessly blends online and in-store shopping. Its e-commerce operations include a robust website and app that offer convenient services such as curbside pickup and home delivery, enhancing the customer experience and expanding reach beyond physical stores. The company has a market capitalization of $917.05 billion.

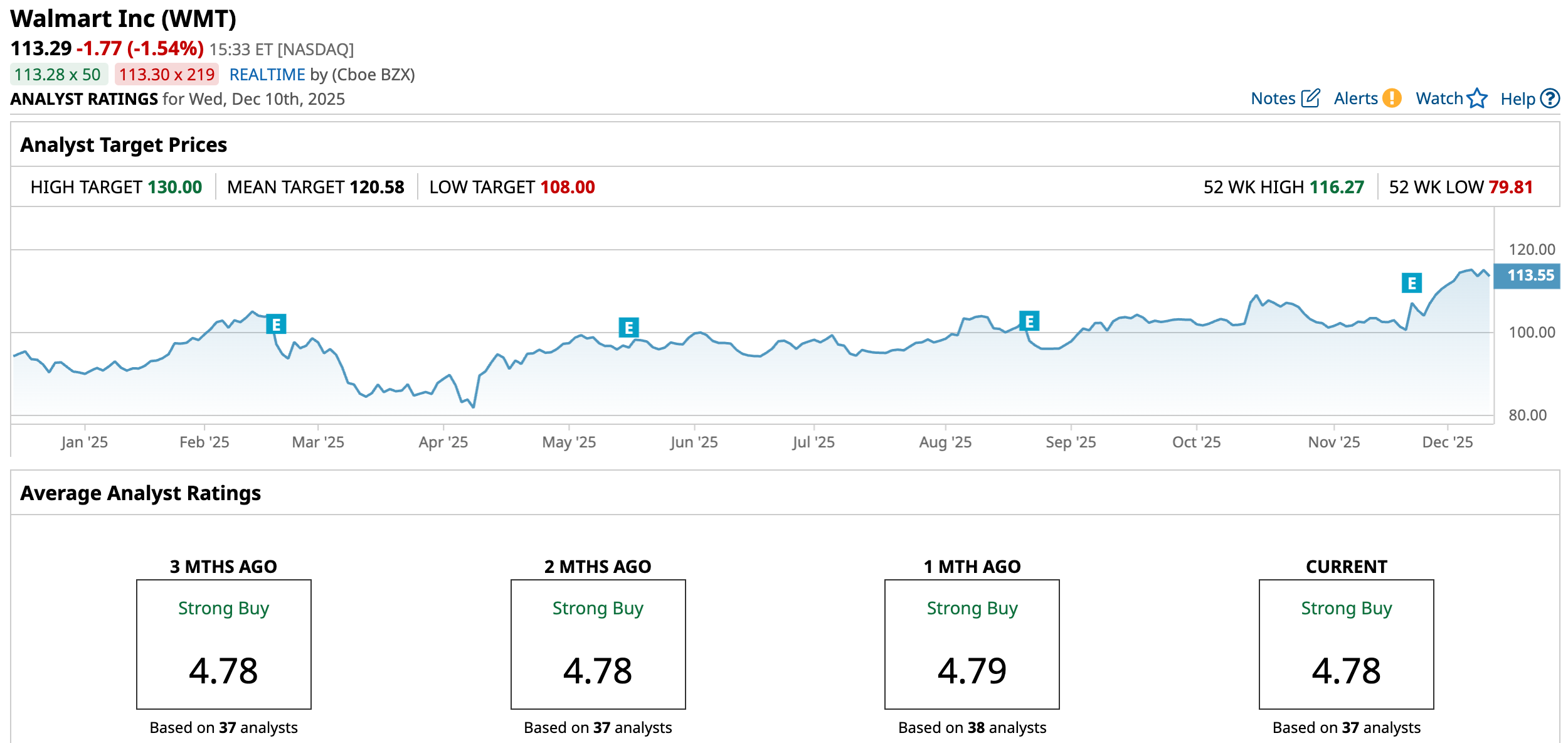

Walmart’s solid financial results and robust omnichannel strategy have lifted the stock. Over the past 52 weeks, the company’s stock has gained 20.21%, and over the past six months, it has risen 16.79%. Over the past month, Walmart’s shares have been up 10.97%. Reacting to strong results and low inflation in some categories, the stock reached a 52-week high of $116.27 on Dec. 5, but is down 2.34% from that level.

Walmart’s stock is trading at a stretched valuation. Its price sits at 43.64 times non-GAAP earnings, which is considerably higher than the industry average of 15.73 times.

Walmart Reported Strong Third-Quarter Results Due To E-Commerce Prowess

On Nov. 20, Walmart reported robust third-quarter results for fiscal 2026 (the quarter that ended on Oct. 31). The company’s revenue increased by 5.8% year-over-year (YOY) to $179.50 billion. This was higher than the $177.50 billion that Wall Street analysts had expected.

This growth can largely be attributed to Walmart’s increasing focus on its digital channels. For the third quarter, the company saw a 27% YOY jump in global e-commerce sales due to improvements in store-fulfilled pickups and delivery, as well as the marketplace. The company’s adjusted EPS increased by 6.9% from the year-ago value to $0.62, which was higher than the expected $0.60 figure.

Net sales in the Walmart U.S. segment grew 5.1% annually to $120.70 billion. Walmart U.S. segment’s e-commerce sales showed a 27% growth, driven by strength in store-fulfilled delivery, advertising, and marketplace. Also, the company noted that the segment’s sales through expedited store-fulfilled delivery channels grew by nearly 70%.

Walmart International segment’s top line increased 10.8% YOY to $33.50 billion, reporting strong growth from both stores and e-commerce businesses. In the Sam’s Club U.S. segment, e-commerce sales grew by 22%, noting continued growth in club-fulfilled pickup and delivery.

Walmart raised its outlook on the back of strong quarterly results. For fiscal 2026, the company raised its net sales growth outlook (at constant currency) from 3.8%-4.8% to 4.8%-5.1%. Adjusted EPS outlook was raised from $2.52-$2.62 to $2.58-$2.63.

Wall Street analysts are optimistic about Walmart’s future earnings. They expect the company’s EPS to increase by 9.1% YOY to $0.72 for the fiscal fourth quarter. For fiscal 2026, EPS is projected to surge 4.8% annually to $2.63, followed by an 11.8% growth to $2.94 in the next fiscal year.

What Do Analysts Think About Walmart Stock?

Wall Street analysts remain exceptionally bullish on this retail giant. This month, Evercore ISI Group, led by analyst Greg Melich, maintained an “Outperform” rating on the stock and raised its price target from $115 to $117, reflecting continued strong sentiments.

Analysts at Tigress Financial Partners also maintained a “Buy” rating on Walmart and gave a price target of $130. Tigress Financial analysts cited the company’s technology-driven scaling and its focus on accelerating AI as factors driving future growth.

Last month, analysts at BTIG raised Walmart’s price target from $120 to $125, while maintaining a “Buy” rating on the stock, citing strong projected growth and expressing optimism about the company’s new leadership.

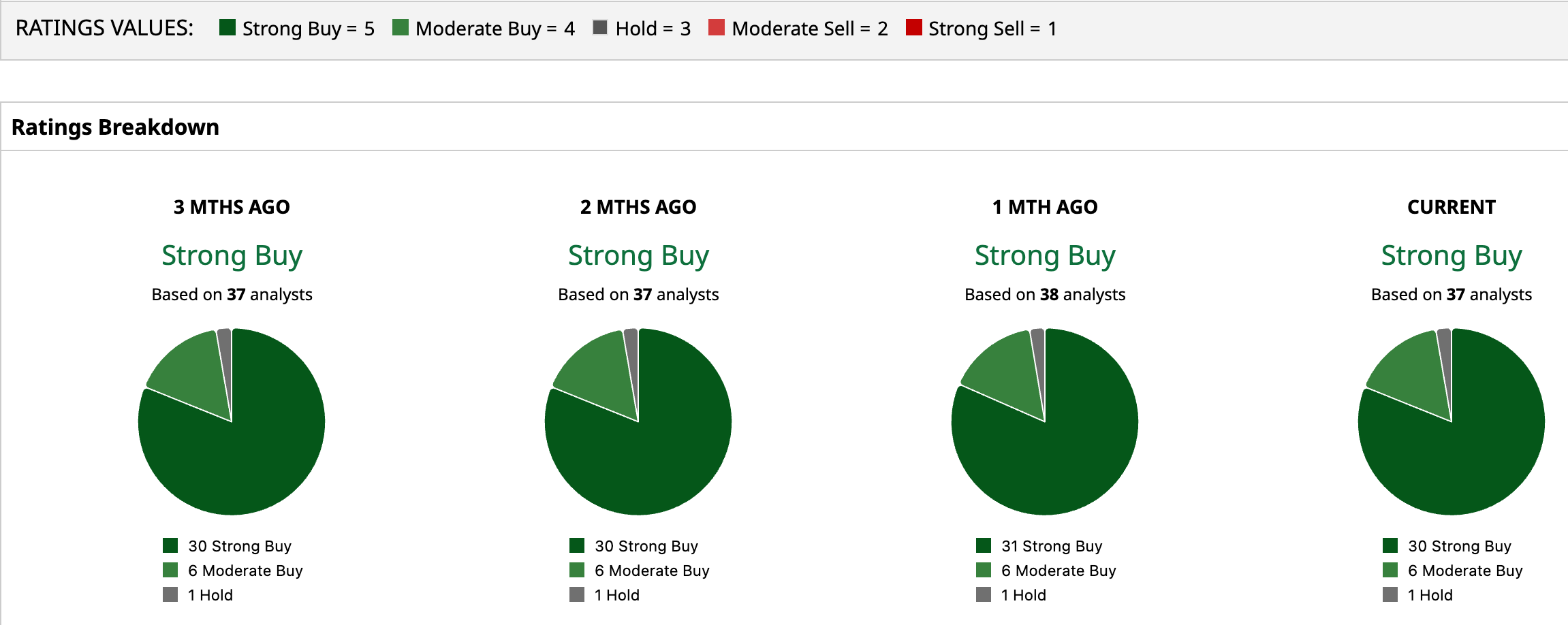

Walmart has long been a popular name on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 37 analysts rating the stock, a majority of 30 analysts have given it a “Strong Buy” rating, six analysts rated it “Moderate Buy,” while one analyst is taking the middle-of-the-road approach with a “Hold” rating. The consensus price target of $120.58 represents a 4.8% upside from current levels. The Street-high Tigress Financial-given price target of $130 indicates a 13% upside.

Key Takeaways

Walmart’s tech focus and multichannel approach are proving to be a successful strategy, as the company continues to grow its e-commerce sales. As analysts are optimistic about its prospects, the stock might be a solid buy following its move to the Nasdaq.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nearly 45% of Its Float Is Being Sold Short. Should You Bet on iRobot Stock Here?

- Eric Jackson Could Make Nextdoor the Next Big Meme Stock. Should You Chase the Rally Here?

- GE Vernova Showing No Signs of Slowing, Will GEV Stock Hit $1,000?

- An ‘EV Winter’ Is Coming for Tesla. Should You Sell TSLA Stock Now?