According to news reports, the likelihood of Fed Chairman Powell announcing a 25-basis point rate cut is 90% or more Wednesday morning.

The Fed fund futures forward curve has been indicating a December rate cut for months, with two more cuts projected in 2026.

Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily.The US president will name a new Fed chairman in due time, making additional rate cuts more likely.

Barring a surprise Wednesday afternoon, US Fed Chairman Powell will announce a 25-basis point rate cut at the conclusion of the December meeting of the Federal Open Market Committee. According to chatter on financial media, there is greater than a 90% chance of this happening. While any aspect of a market being that one-sided brings to mind the Poseidon Predicament[i], in this instance I’ll line up along the rail given what we’ve seen for months on the Fed fund futures forward curve.

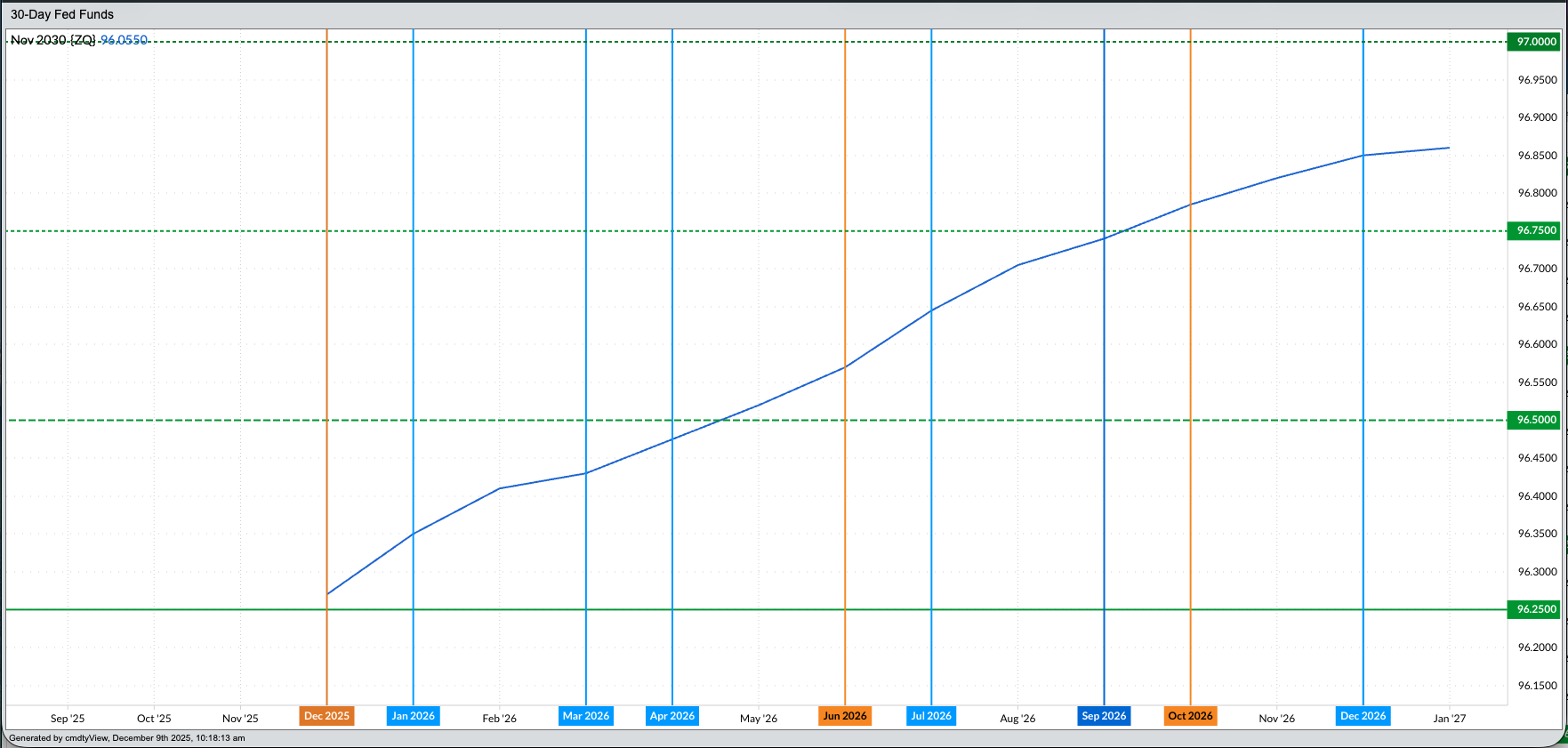

A look at that same forward curve early Wednesday morning shows the opinion of the market has not changed.

- The December futures contract ((ZQZ25) is priced near 96.2675, putting the expected Fed fund rate near 3.7325% (100% - 96.2675).

- Note this is just above the low end of the range of 3.75% ahead of Wednesday’s announcement

- This is marked by the solid green line at 96.25, the high end of the range for the futures price.

Once the 25-basis point rate cut is made Wednesday, the range will be lower to 3.5% to 3.75%. This is marked on the forward curve between the solid green line and the dashed green line at 96.5 (3.5%). In addition to all the talk about this month’s cut, most of the pundits being interviewed on financial television are talking about 2 more cuts coming in 2026. Does the futures market agree?

- Months with meetings are marked by vertical lines on the forward curve, with the schedule showing January (26-27), March (16-17), April (27-28), June (8-9), July (27-28), September (14-15), October (26-27), and December (7-8).

- Note futures from January through April are priced between 96.25 and 96.5, meaning as of this writing the Fed fund rate is expected to hold steady.

But things change after that. Recall Chairman Powell has fallen out of favor with the US President, shockingly enough, and Powell’s term as Fed chair comes to an end in May 2026. The US president has made a number of comments on the situation, including:

- As a candidate the second time around, he said as president he wanted to have final say on all interest rate decisions.

- More recently, he could name Chairman Powell’s replacement by the end of the year.

- The betting favorite has been Kevin Hassett, a candidate who fulfill the US president’s first wish as he would act as a mouthpiece for the president at subsequent FOMC meetings.

Looking at futures prices beyond April, with no meeting scheduled for May:

- The June futures contract (ZQM26) is priced near 96.57, putting the expected rate at 3.43%, well below the low end of what is expected today at 3.5%

- Indicating the new Chairman’s first meeting should conclude with a dictated rate cut of at least 25-basis points

- As for a second cut in 2026, based on the idea the range will drop to between 3.25% to 3.5% in June, the forward curve shows the October futures contract (ZQV26) priced near 96.785, putting the rate near 3.215% and the range from 3.25% to 3.0% (upper two dotted lines on forward curve chart)

What might the ripple effect be of a more dovish approach toward interest rate? Theoretically, based on the classic idea of a business cycle:

- Lower rates should lead to higher US stock markets. And higher stock markets are what the US president is after given he equates stock indexes to the economy.

- Lower rates would also be expected to weaken the US dollar, turning up the heat under inflation once again.

- Inflation would imply higher prices for US dollar-backed commodities, but that isn’t necessarily the case given global markets are driven as much, if not more, by politics than economics.

First things first, though, meaning let’s focus on what happens today when the rate cut is announced.

[i] When everyone is on the same side of the boat, the boat tends to roll over.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- What Does the Fed Fund Futures Market Tells Us About Wednesday and Beyond?

- This ETF Thrives on Rising Long-Term Rates. Why It’s 1 of the Best Ways to Profit Before Wednesday’s Fed Meeting.

- S&P Futures Muted Ahead of FOMC Meeting and U.S. JOLTs Report

- This Popular Wall Street Strategist Says It’s a ‘High-Risk Bull Market.’ He’s Right, with the Fed in Focus.