With a market cap of $25.4 billion, Cincinnati Financial Corporation (CINF) is a provider of property and casualty insurance products. The company operates through five key segments, offering a wide range of commercial, personal, excess and surplus, life insurance, and investment services.

Companies valued at more than $10 billion are generally considered "large-cap" stocks, and Cincinnati Financial fits this criterion perfectly. In addition to insurance solutions, it also provides commercial leasing, financing, and brokerage services.

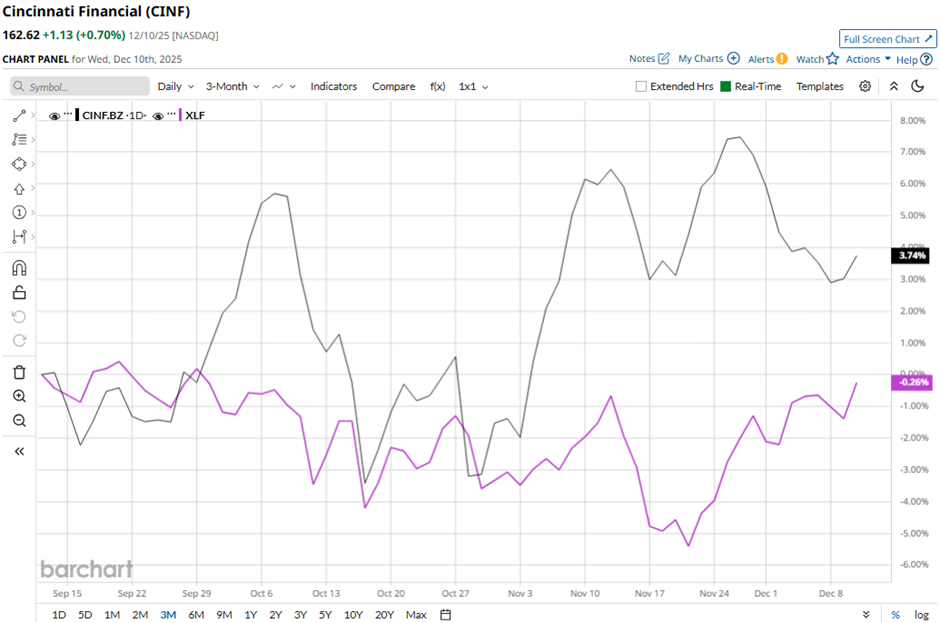

Despite this, shares of the Fairfield, Ohio-based company have declined 4.3% from its 52-week high of $169.86. CINF stock has increased 6.8% over the past three months, outpacing the Financial Select Sector SPDR Fund’s (XLF) marginal decrease over the same time frame.

In the longer term, CINF stock is up 13.2% on a YTD basis, outperforming XLF’s 11.5% gain. Moreover, shares of the Insurance firm have soared 8.5% over the past 52 weeks, compared to XLF’s 8.2% return over the same time frame.

The stock has been trading above its 200-day moving average since last year.

Cincinnati Financial delivered a stronger-than-expected Q3 2025 adjusted EPS of $2.85 on Oct. 27. Net income surged to $1.12 billion, boosted by a $675 million after-tax increase in the fair value of equity securities and a $152 million decrease in after-tax catastrophe losses. However, the stock fell 3.7% the next day.

In comparison, rival Loews Corporation (L) has outpaced CINF stock. Loews stock has soared 21.2% on a YTD basis and 22.2% over the past 52 weeks.

Despite the stock’s strong performance relative to the sector, analysts remain cautiously optimistic on CINF. The stock has a consensus rating of “Moderate Buy” from 10 analysts in coverage, and the mean price target of $172.67 is a premium of 6.2% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart