GameStop (GME) is back in the news with a surprise profitable third fiscal quarter. The company reported a surprise EPS of $0.24, which beat estimates by $0.04, and showed a dramatic improvement from a year ago when it incurred an operating loss to a surprise profit of $41.3 million. However, GameStop's stock dropped in after-market hours despite beating estimates, as it reported a revenue of $821 million, which missed estimates by a huge margin of 4.5% from a year ago.

The findings come as a welcome relief, though, in a situation where the overall retail industry also has budget cuts to make. GME stock, on the other hand, remains very volatile. This needs mention, since it currently trades far from the 52-week high of $35.81. The S&P 500 ($SPX), which remains near a record high, also raises questions about whether companies like GameStop can move beyond structural issues.

About GameStop Stock

GameStop, a gaming and entertainment retailer, operates from Grapevine, Texas. The company has long been recognized for its physical stores that offer video game retail. However, in recent years, it has been in a gradual transformation to optimize and improve profitability. The current market value for GameStop stands at approximately $10 billion. GameStop has long been among those most closely followed stocks.

Over the past 52 weeks, GME has ranged from $19.93 to $35.81, and it has fallen about 5% in the past five market days. To put this in perspective, the S&P 500 Index has shown marked improvement in 2025, up about 17% compared to GME's -30%, and it provides a bright backdrop for stocks that are performing relatively well.

In terms of valuation ratios, GameStop has a trailing P/E ratio of 24.07x and a price/sales ratio of 2.71x, which is significantly higher than that of most other conventional retailers. However, a ratio of 60.70 for price/cash flow indicates that there are clearly high expectations for this company.

There is no dividend being paid by GameStop, and no indication from management that it will reinstate it to continue working on their financial restructuring.

GameStop Beats on Earnings

GameStop's Q3 earnings are a reflection of improvement in profitability, despite a fall in sales figures. Although sales reached $821 million, marking a 4.5% fall from last year, which also dashed all expectations, GameStop's expenditure discipline stood out. Its SG&A expenses decreased from $282 million to $221.4 million, which turned around its operating performance. Operating income improved to $41.3 million from a loss of $33.4 million in the previous year.

Adjusted data showed an even clearer picture. Adjusted operating income stood at $52.1 million, with adjusted net income soaring to $139.3 million, an enormous increase from $26.2 million in the previous year. This year, it closed with $8.8 billion in cash and cash equivalents, as well as marketable securities, almost twice as much as it was a year ago. The value of the company's Bitcoin (BTCUSD) holdings stood at $519.4 million.

The company’s management has not offered forward revenue and EPS guidance, as has been seen in previous quarters, which has left investors to draw their own conclusion about the profitability improvement. This lack of revenue and EPS guidance might also be a reason for a tepid stock reaction following earnings.

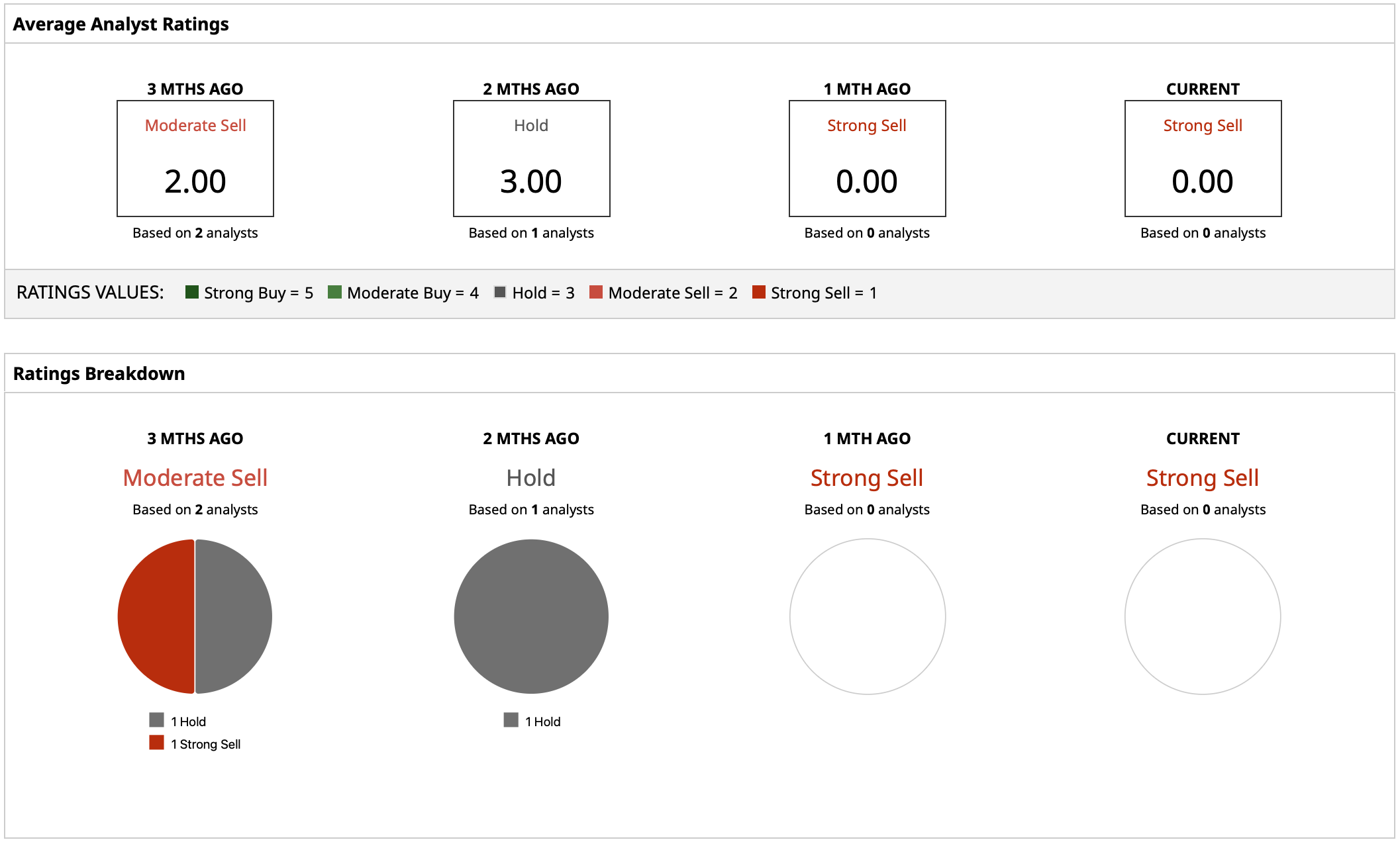

What Do Analysts Expect for GME Stock?

Analyst coverage of GME stock is severely lacking, and no professional analysts tracked by Barchart have an active rating on it. Perhaps a lack of guidance data or just GME's long history as the ultimate meme stock has analysts hesitant to initiate coverage. Either way, a turnaround is in the works, and it is still to be seen if it can improve GameStop's reputation on the Street.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- USA Rare Earth Just Revved up Its Commercial Timeline. Should You Buy USAR Stock Here?

- Robinhood Stock Gets Dragged Down by the Crypto Selloff. Should You Buy the Dip?

- Rivian’s Autonomy & AI Day Failed to Move the Needle for RIVN Stock. How Should You Play It Here?

- Intel Is Reportedly Buying SambaNova Systems. What Does That Mean for INTC Stock?