Hunt Valley, Maryland-based McCormick & Company, Incorporated (MKC) is a global leader in flavor, producing and distributing spices, seasonings, and condiments. With a market cap of $17 billion, it operates in over 150 countries through its Consumer and Flavor Solutions segments.

Categorized as a "large-cap stock," McCormick's valuation highlights its dominance in the flavor industry. Its innovative products and global reach underscore its position as a leader in the packaged food space.

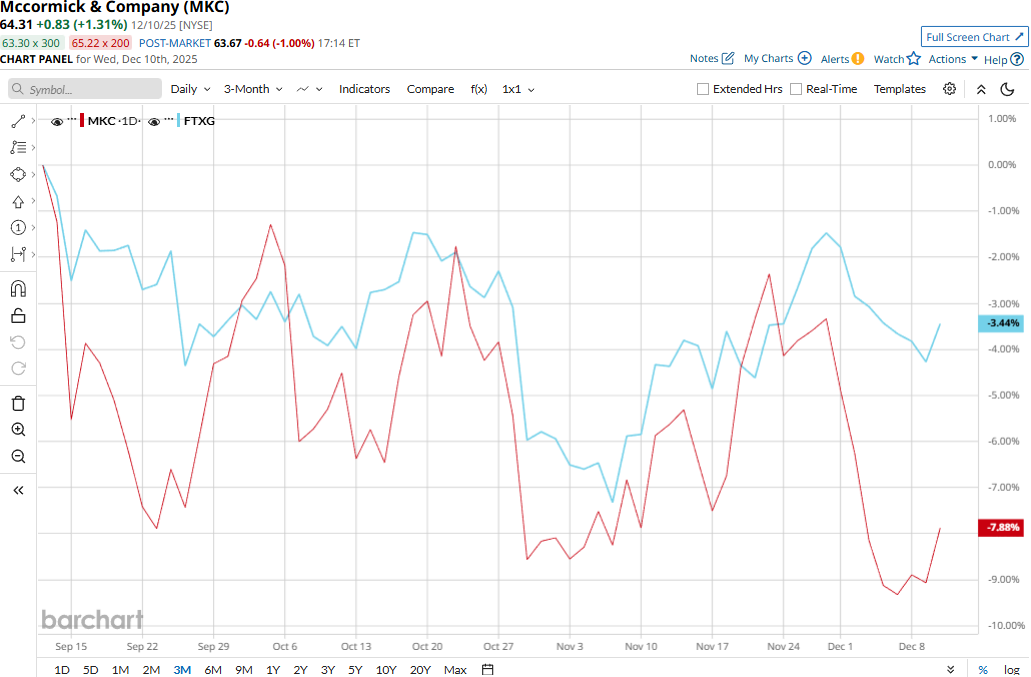

McCormick touched its two-year high of $86.24 on Mar. 10 and is currently trading 25.4% below that peak. Meanwhile, MKC stock prices have declined 6.2% over the past three months, lagging behind the First Trust Nasdaq Food & Beverage ETF’s (FTXG) 2.8% dip during the same time frame.

McCormick’s performance has remained grim over the longer term as well. MKC stock prices have dropped 15.7% on a YTD basis and 21.5% over the past 52 weeks, compared to FTXG’s 7% dip in 2025 and 11.9% decline over the past year.

MKC stock has traded consistently below its 200-day moving average and mostly below its 50-day moving average with some fluctuations since early April, underscoring its bearish movement.

Despite reporting better-than-expected financials, McCormick & Company’s stock prices declined 3.9% in the trading session following the release of its Q3 results on Oct. 7. Driven by 1.8% growth in organic revenues, the company’s overall topline grew 2.7% year-over-year to $1.7 billion, surpassing the consensus estimates by 60 bps. However, this was supported by a 90 bps favorable impact of currency movement.

Meanwhile, the company’s adjusted EPS inched up 2.4% year-over-year to $0.85, surpassing the consensus estimates by 4.8%. Following the initial dip, MKC stock prices maintained a positive momentum for three subsequent trading sessions.

Meanwhile, McCormick has notably outperformed compared to its peer Hormel Foods Corporation’s (HRL) 24.3% drop on a YTD basis and 29.2% plunge over the past year.

Among the 13 analysts covering the MKC stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $80.21 suggests a 24.7% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Jamie Dimon Has Long Been Sounding the Economic Alarm. After the Fed’s Latest Rate Cut, Can You Still Bank on JPMorgan Stock?

- Unlock Over 7% Income: Analysts Love These 2 High-Yield Dividend Stocks

- Nearly 45% of Its Float Is Being Sold Short. Should You Bet on iRobot Stock Here?

- Eric Jackson Could Make Nextdoor the Next Big Meme Stock. Should You Chase the Rally Here?