Based in Pasadena, California, Alexandria Real Estate Equities, Inc. (ARE) is a leading real estate investment trust (REIT) that develops and manages campuses in key innovation markets across the U.S. Specializing in the life sciences sector, the company creates collaborative workspaces designed to foster research and development.

Alexandria Real Estate’s properties support biotech and tech firms by providing advanced facilities that encourage scientific and technological progress within community-focused environments. The REIT has a market capitalization of $7.83 billion.

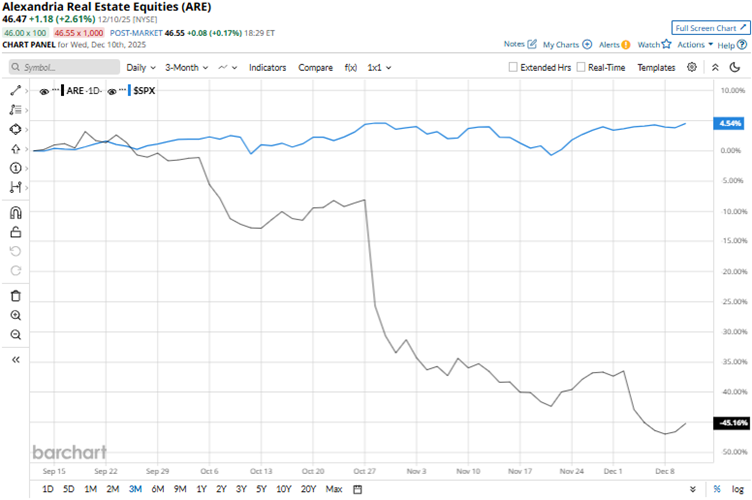

Alexandria Real Estate’s shares had reached a 52-week low of $44.10 on Dec. 8, but are up 5.4% from that level. Due to weak results and a significant dividend cut, the stock has come under considerable pressure. Over the past three months, the stock has dropped 44.7%. On the other hand, the broader S&P 500 Index ($SPX) has gained 5.4% over the same period.

Over a more extended period, this underperformance persists. Over the past 52 weeks, Alexandria Real Estate’s stock has declined by 55.5%, while it has been down 36.6% over the past six months. Contrarily, the S&P 500 index has gained 14.1% and 14% over the same periods, respectively. The stock has been trading below its 200-day moving average since late September and lower than its 50-day moving average since early October.

On Oct. 27, Alexandria Real Estate reported its third-quarter results for 2025. The company’s total revenues decreased 5% year-over-year (YOY) to $751.94 million, falling short of Wall Street analysts’ estimate of $756.20 million. Its adjusted funds from operations (FFO) declined 6.3% from the prior-year period to $2.22 per share, missing the $2.31 per share estimate from analysts. Based on subdued results, the REIT’s stock dropped 19.2% intraday on Oct. 28. Recently, Alexandria Real Estate also announced a 45% reduction in its Q4 dividend compared to Q3, as an effort to preserve liquidity. This led to the stock dropping 10.1% intraday on Dec. 3.

We compare Alexandria Real Estate’s performance with that of another office REIT, BXP, Inc. (BXP), which has declined 13.4% over the past 52 weeks and 3.5% over the past six months. Therefore, ARE has been the clear underperformer over these periods.

Wall Street analysts are tepid on ARE’s stock. The stock has a consensus rating of “Hold” from the 15 analysts covering it. The mean price target of $63.08 indicates a 35.7% upside compared to current levels. The Street-high price target of $91 indicates a 95.8% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart