Palantir Technologies (PLTR) recently landed one of its most significant defense contracts yet as the U.S. Navy tapped the software firm to overhaul submarine production through artificial intelligence. The deal authorizes up to $448 million to deploy Palantir's technology across America's entire Maritime Industrial Base under an initiative called ShipOS.

The Virginia-class and Columbia-class submarine programs are billions of dollars over budget and years behind schedule. The Columbia-class program carries a $130 billion price tag, with construction handled by General Dynamics (GD) and HII (HII).

Navy Secretary John Phelan framed the partnership as transformative, calling it a departure from decades of bureaucratic delays and cost overruns that have plagued military shipbuilding.

Early pilot programs at facilities like General Dynamics Electric Boat and Portsmouth Naval Shipyard produced striking results. For instance, tasks that previously required 160 hours of manual planning now take under 10 minutes. Further, material review processes that used to take weeks are now completed in less than an hour. These efficiency gains demonstrate how AI can reshape an industry that has traditionally been resistant to modernization.

Palantir's Foundry platform and AI tools will roll out across two major shipbuilders, three public shipyards, and 100 suppliers throughout the submarine industrial base. The software aims to connect fragmented data systems to production capacity and supply chain bottlenecks. Navy officials expect this data integration to identify problems earlier and improve coordination across contractors.

The expansion deepens Palantir's military presence beyond existing programs like the Army's TITAN intelligence platform and the Maven Smart System used across multiple service branches.

Palantir’s Ecosystem Continues to Widen

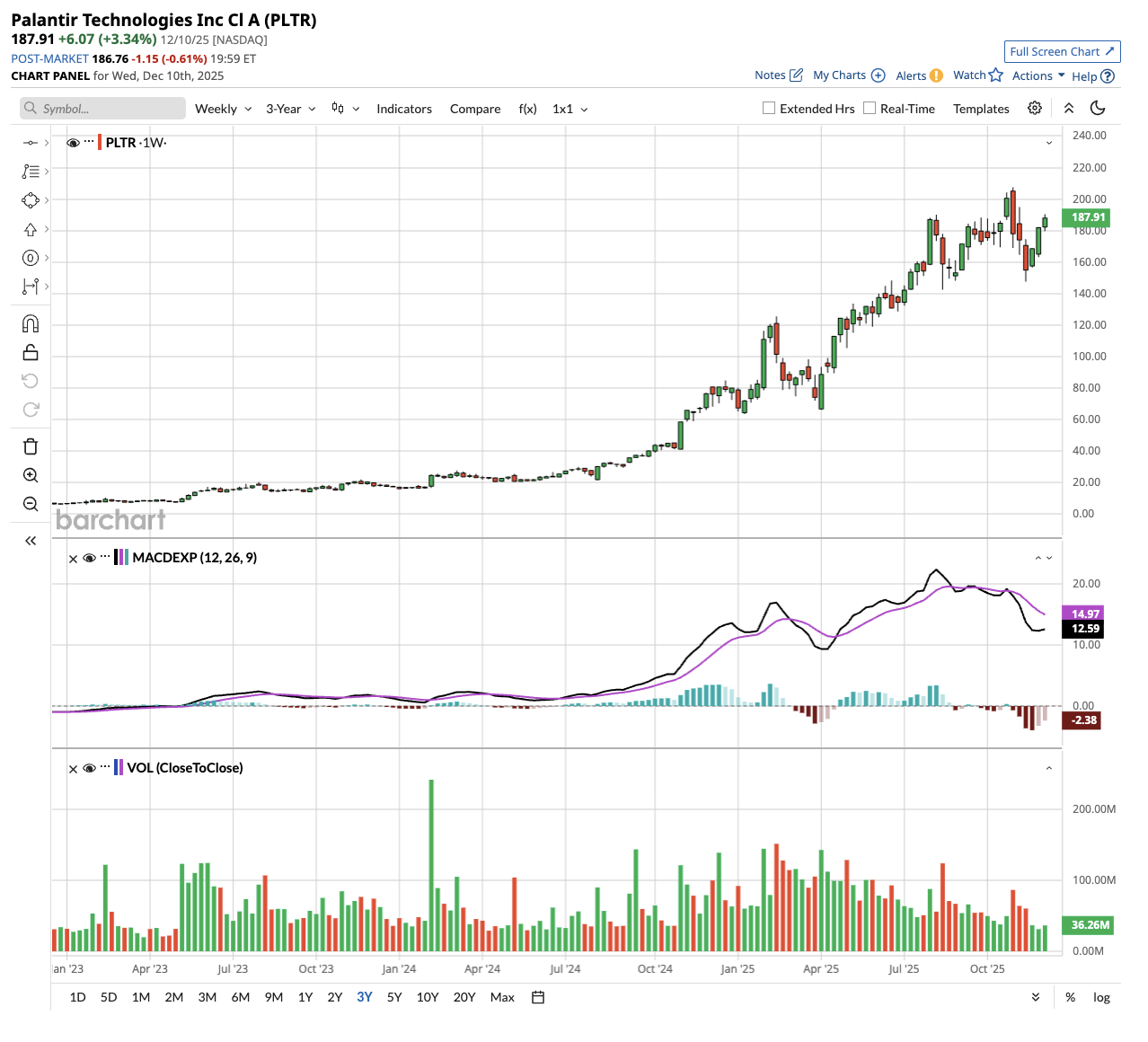

Valued at a market cap of almost $450 billion, PLTR stock has returned close to 2,500% to shareholders over the last three years. Palantir continues to gain significant traction in the AI segment, enabling it to increase revenue from $742 million in 2019 to $2.86 billion in 2024.

Palantir Technologies continued its aggressive push into commercial markets with a flurry of partnership announcements spanning energy infrastructure, aviation maintenance, rodeo analytics, and Australian government services. The deals demonstrate how the company is translating its defense expertise into diverse industries hungry for AI-powered operational improvements.

Palantir's new operating system, called Chain Reaction, is designed to accelerate the buildout of American AI infrastructure. Founding partners include CenterPoint Energy (CNP) and Nvidia (NVDA), which address critical bottlenecks in power generation and grid capacity needed to support massive data center expansion.

FTAI Aviation (FTAI) signed a multi-year deal to deploy Palantir's AI platform across its global aircraft engine maintenance network. The partnership aims to transform scheduling, inventory optimization, and supply chain management, with FTAI aiming to capture 25% of the industry market share.

Palantir also partnered with Teton Ridge to bring AI and computer vision to professional rodeo. The system analyzes rider and animal performance in real-time using Nvidia infrastructure, processing data locally at arena venues rather than pushing video feeds to cloud servers.

The technology aims to enhance fan engagement, improve athlete training, and create new sponsorship opportunities across Western sports. Moreover, Palantir achieved IRAP PROTECTED certification in Australia, which provides it with access for broader government and commercial adoption.

Is PLTR Stock Overvalued Right Now?

These deals and partnerships showcase Palantir's strategy of embedding its software across critical infrastructure and industrial operations. Each partnership expands the company's recurring revenue base while reducing dependence on large, lumpy government contracts that have historically made earnings difficult to predict quarter to quarter.

Analysts tracking PLTR stock forecast revenue to grow from $4.4 billion in 2025 to $15.6 billion in 2029. In this period, adjusted earnings are projected to expand from $0.72 per share to $2.43 per share.

Currently, Palantir stock trades at a forward price-to-earnings multiple of 205x, which is quite expensive. Even if the multiple normalizes to 75x, the stock will trade around $182 in December 2028, which is below the current trading price.

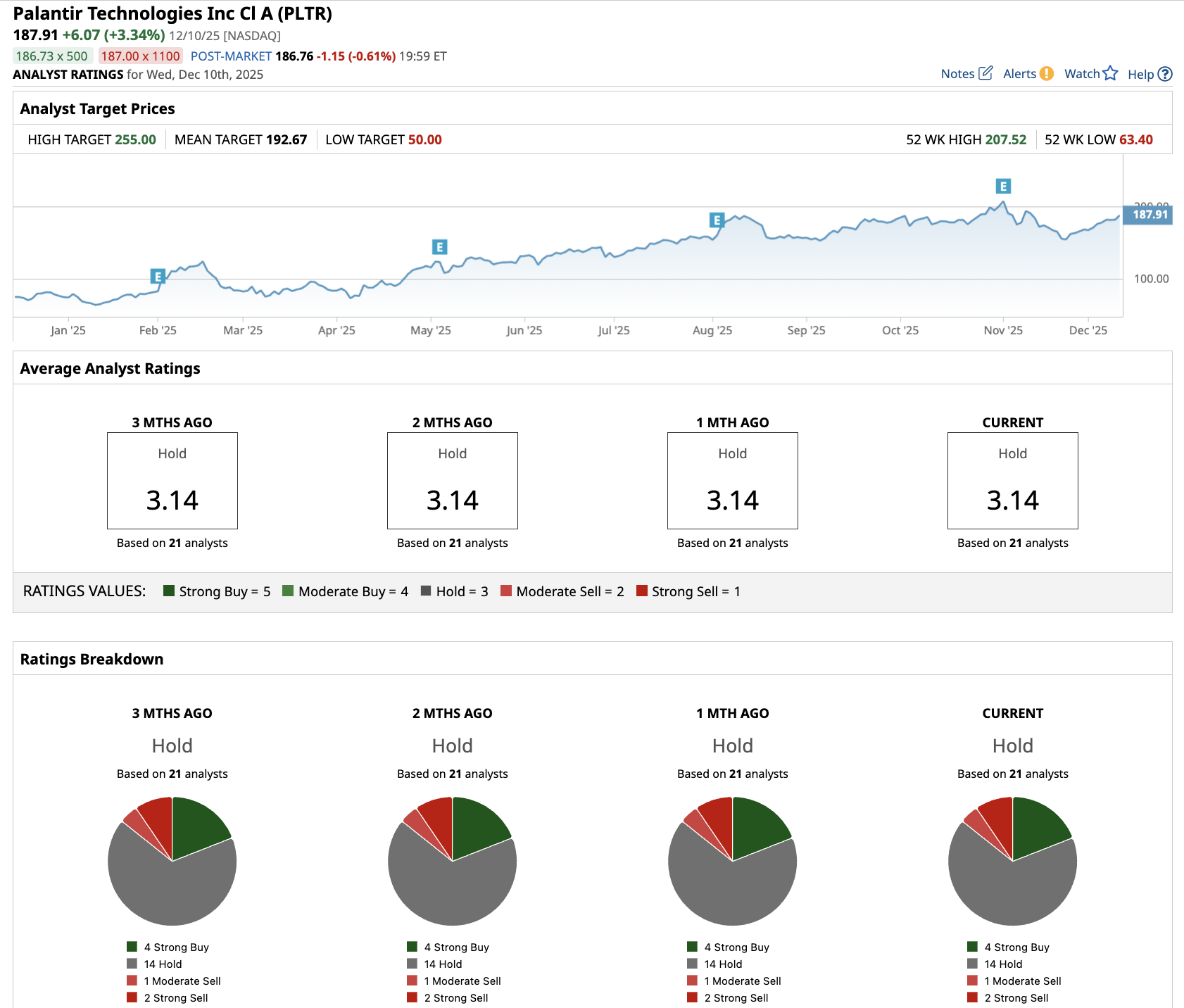

Out of the 21 analysts covering PLTR stock, four recommend “Strong Buy,” 14 recommend “Hold,” one recommends “Moderate Sell,” and two recommend “Strong Sell.” The average Palantir stock price target is $192.67, above the current price of $188.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart