The Federal Reserve made its move. A small move, an expected move, and an insignificant move over the long run. But don’t tell that to the stock market. With those ever-present forces of algorithmic trading programmed to react to every single word spoken on Fed day, the S&P 500 Index ($SPX) moved about 1% higher in the 2 hours between the announcement and the close. So ends another “event” day for stock traders and investors.

Now, on to the rest of our lives. And that means taking a look at the biggest S&P 500 ETF (SPY), with a different goal in mind. Not to trade it today or tomorrow. But to try to own it for a while, with iron-clad, reliable protection. At least for a period of time.

And while there are funds that play their own personal game of “Twister” to construct complex vehicles to cut some risk while trying to gain from the stock market’s positive performance, there’s a simple fact for many: You can do it yourself.

I’ve written here frequently about option collars, where we take some amount of a stock or ETF’s shares in multiples of 100, write covered calls on them, and simultaneously buy protective puts. The calls above the current price cap gains, and the puts below are more easily paid for by the cash flow the calls bring in for that upside sacrifice.

In this article, I’m going to ignore the covered call aspect of the collar, and instead focus on two seemingly competing, yet very collaborative concepts:

- Investing to profit from a stock market gain

- Investing to profit from a stock market loss

It seems like a strange and inconvenient marriage, no? Actually, it’s a match made in stock market heaven. It's actually referred to in Barchart.com’s extensive options data as a “Married Put.”

How to Marry a SPY ETF

First, in order to use put options to hedge SPY, since each option represents 100 shares of that ticker, 100 share lots would be owned. With SPY selling for nearly $700 a share, that’s close to a $70,000 position. In a future article, I’ll take this same concept and apply it to ETFs that are not exactly SPY, but highly correlated to it, and with much lower dollar prices. So those with smaller budgets can consider this approach.

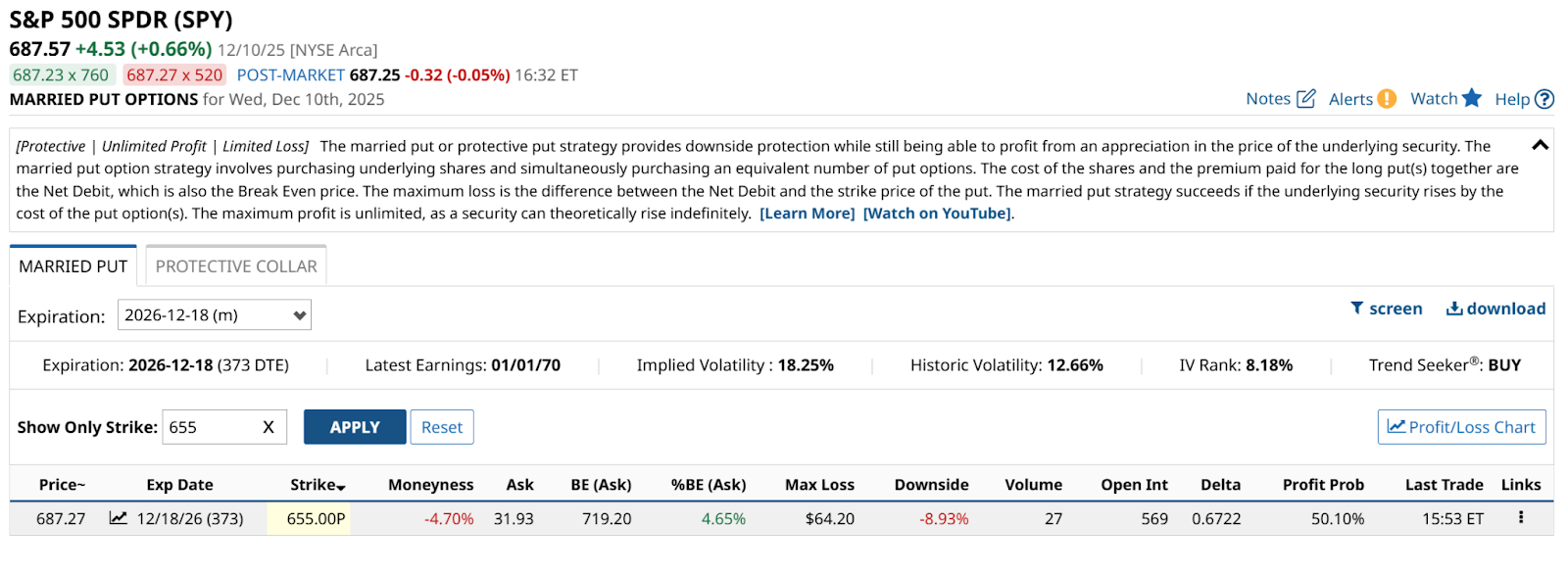

Here’s SPY as of late Wednesday, shortly after Fed Chair Jermone Powell left the stage. Let’s assume this is designed more as a “just in case” put hedge, in that we’ll go out several months, all the way until this time next year. Let’s also target a put option that is about 5% “out of the money,” which means we have the right (but not the obligation) to sell SPY if it falls by that much.

As we see above, a $655 put out to Dec. 18, 2026 is about 4.7% out of the money. Add to that the cost of the put, which is about $32 a share, and it nets to about a 9% downside risk.

If we were to try to pay for that put option with a covered call, that would reduce the cost, but cap the upside. That’s what my collar articles here are about.

Also, notice that SPY’s “IV Rank” is just 8.18%. Translation: SPY is trading with lower volatility than it has more than 90% of the time during the past 12 months. That means purchasing this type of protection is cheap right now. Sort of like an unanticipated holiday gift for the portfolio. Because the “insurance” versus major loss is relatively inexpensive, and the upside is NOT capped. There’s no covered call option here.

So that’s how to create a married put, and there are many examples in the option tables here to analyze a seemingly infinite number of possible levels of reward and risk, as well as time frames.

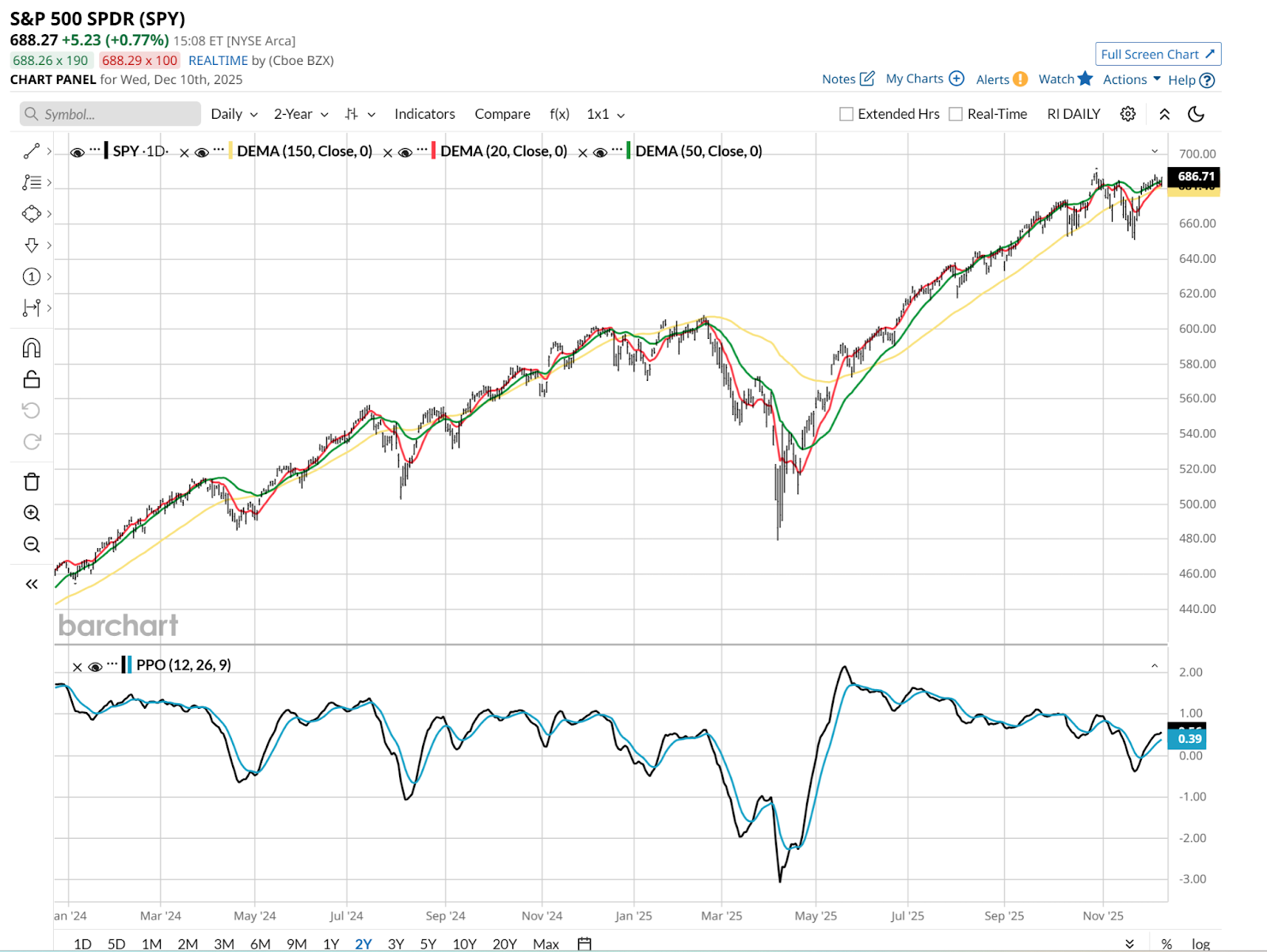

With SPY looking flattish for several weeks, the market is really trendless. But that is often when the sparks start to fly. Low volatility today often is supplanted by a shock to the system.

If that shock is downward, the puts will help. If it is upward, the gain potential in SPY is unimpeded. And in this case, we have a lot of time left before any resolution regarding the put option will be imminent.

I like collars as much as the next guy. But sometimes, rather than dating a collar, I’d rather marry a put.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, and at his ETF Yourself subscription service on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Post Fed Cut, This Popular S&P 500 ETF Is Not a Buy or Sell, But a ‘Married Put.’ How to Create One.

- Everyone Has a Role to Play with Risky ETFs. Yes, Even You.

- This ETF Thrives on Rising Long-Term Rates. Why It’s 1 of the Best Ways to Profit Before Wednesday’s Fed Meeting.

- Is a Global Margin Call Coming? How a Bank of Japan Rate Hike Could Trigger the Next Market Shock