USA Rare Earth (USAR) is more than a mining company, aiming to rebuild an entire U.S. supply chain from the ground up. The company’s mission is to create a fully integrated pipeline for rare earth elements and neodymium magnets that can feed America’s defense, automotive, and tech industries. And with demand for rare earth magnets soaring while geopolitical tremors make foreign dependence increasingly perilous, boosting domestic production is crucial.

This is the reason its latest announcement grabbed so much attention. USAR just fast-tracked the commercialization timeline for its Round Top heavy rare earth deposit in Texas, moving production up to late 2028 – a full two years ahead of schedule. Round Top is considered the richest-known U.S. deposit of heavy rare earths, gallium, and beryllium, and it anchors USAR’s mine-to-magnet strategy alongside its massive magnet plant in Oklahoma and its processing lab in Colorado.

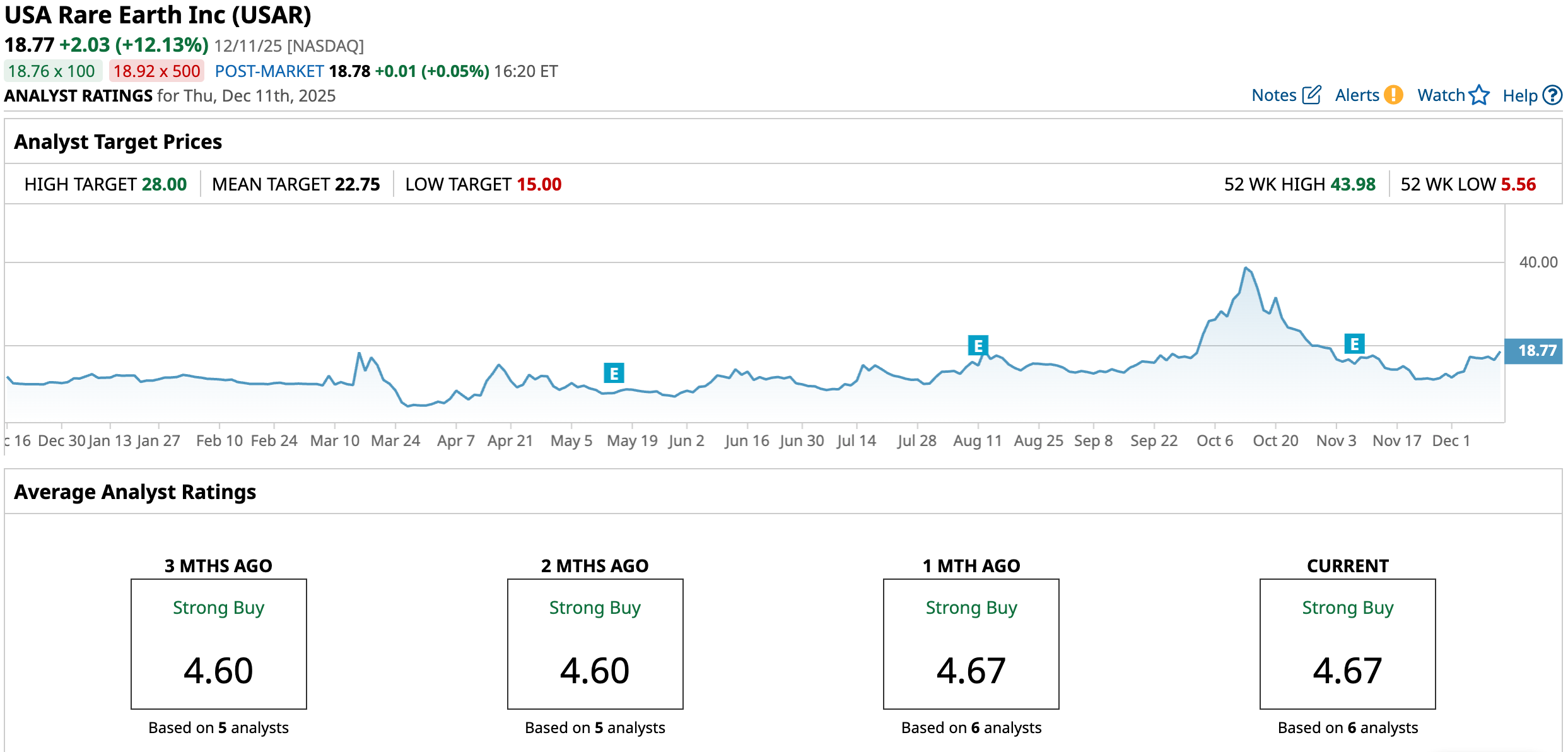

Despite being sliced in half since its October peak, USAR stock has clawed back by a sharp double-digit rebound over the past three months, gaining recently on an accelerated commercial production timeline news. Should investors be buying USAR stock right now?

About USA Rare Earth Stock

Headquartered in Stillwater, Oklahoma, USA Rare Earth is building a fully integrated U.S. supply chain for rare earths and critical minerals. Since 2019, it has been digging, processing, and supplying neodymium, dysprosium, terbium, gallium, beryllium, lithium, and more.

Its Round Top deposit in West Texas packs 15 of the 17 rare earth elements that power high-tech and green energy industries. The Stillwater facility is set up for commercial-scale magnet production and will collaborate with local research hubs to push magnet technology and industrial know-how. USAR has a market capitalization of $2.2 billion and is steadily carving its place in the U.S. rare earth scene.

USAR stock’s chart over the past year is full of sharp turns and unlikely comebacks. Over the past 52 weeks, the stock rose 47.94%, powered by the market’s growing hunger for rare-earth minerals that feed electric vehicle (EV) motors, wind turbines, and defense systems. Yet over the past month, shares bumped up only 2.81% likely due to the company’s Q3 numbers affecting sentiment. USAR stands further from its October high of $43.98, leaving the stock 57% below its peak.

But beneath that slide lies a stunning rebound story. From its March lows of $5.56, USAR has roared back almost 190%, proving that investor confidence in America’s rare-earth reboot has not evaporated.

December added fresh fuel with the news that its newly acquired Less Common Metals unit will supply high-quality rare-earth materials to Solvay and Arnold Magnetic Technologies. The details were scarce, no volumes, no revenue specifics, but the market loved the signal – USAR is already putting its $100 million acquisition to work.

Technically, the tone is shifting toward strength. The 14-day RSI has climbed to roughly 57.8, a mellow but meaningful uptick from last month’s oversold mood. The MACD oscillator is even more encouraging – the yellow MACD line has crossed above the blue signal line, and the histogram has flipped positive, hinting at recovering momentum and the possibility of a steady bullish phase building underneath.

A Quick Look at USAR’s Third-Quarter Update

USA Rare Earth’s third-quarter report for fiscal 2025, released on Nov. 6, was less like a routine update and more like a company steadily strengthening the foundations of its long-term plan. The quarter’s highlight was the operational progress around Round Top – USAR finally locked in a flow sheet for the development process, paving the way for its pre-feasibility study slated for completion in the back half of next year.

Meanwhile, its Stillwater magnet facility continues to move steadily toward first-quarter 2026 commissioning, reinforcing the company’s broader mine-to-magnet vision.

Strategic partnerships also took center stage. USAR signed an MOU with Enduro Pipeline Services to deliver U.S.-made neodymium magnets by early 2026, while a joint development agreement with ePropelled set the foundation for a long-term supply-and-purchase relationship for sintered neo magnets.

But the financial picture remains early-stage and heavy on investment. With no revenue yet, costs surged. Selling, general, and administrative expenses rose to $11.4 million from just $0.8 million a year earlier, driven by legal fees, consulting, expanded headcount, and onboarding costs. Research and development expenses rose to $4.45 million from $1.16 million for similar reasons. These elevated costs, only partially offset by higher interest income, widened the quarterly loss to $0.25 per share, far deeper than both last year’s $0.03 loss and Wall Street's expected $0.06 loss.

Operational cash burn rose 135.5% year-over-year (YOY) to $2.85 million. Yet USAR ended the quarter with a robust $257.6 million in cash, no significant debt, and an added $125 million equity investment lined up, a sizable war chest to fuel the next chapter of its rare earth ambitions.

Wall Street’s crystal ball is not offering any quick miracles for USAR. Analysts foresee the per-share loss doubling to -$0.06 in Q4, and widening by 100.1% annually to -$0.65 in fiscal 2025. But all is not gloomy, as forecasts suggest that the company could trim the losses by 36.9% annually to -$0.41 per share, signaling an early glow of stabilization.

What Do Analysts Expect for USAR Stock?

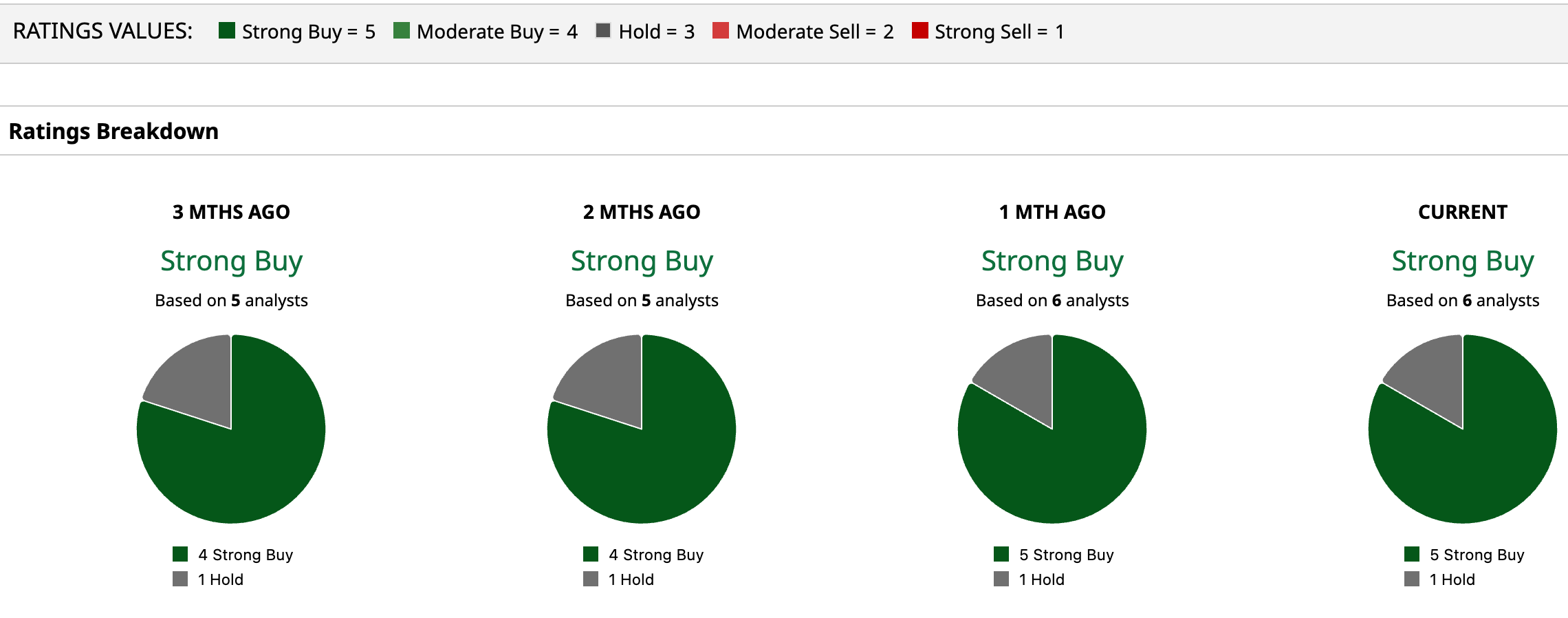

Wall Street analysts are bullish on USAR stock, and it has a consensus “Strong Buy” rating. Of the six covering the stock, a majority of five analysts recommend a “Strong Buy,” and only one is playing it safe with a “Hold” rating.

The consensus price target of $22.75 represents a 21% upside from current price levels. Moreover, the Street-high price target of $28 indicates a 49% upside.

Final Thoughts on USAR

USAR’s story is taking shape, and the opportunities ahead are unusually well aligned with the moment. The company is ahead of schedule, accelerating its commercial timeline by two years, and building a full mine-to-magnet chain that the U.S. urgently needs. With Round Top’s heavy rare earth potential, a near-launch magnet plant, and growing strategic alliances, USAR is positioning itself at the crossroads of national security, clean-tech expansion, and geopolitical urgency. The long-term blueprint feels purposeful, not accidental.

Meanwhile, rare earths power the modern battlefield and economy, including EV motors, wind turbines, drones, and missile systems. Yet the West still leans on China, which dominates both mining and processing. That imbalance has pushed U.S. policymakers to champion domestic supply chains, and in that reshoring race, USA Rare Earth stands out as a timely, mission-aligned contender.

But investors must also weigh the shadows – no revenues, widening losses, and a stock prone to sharp swings. Execution quality is improving, momentum is returning, yet the bet remains early-stage. USAR could become a pivotal U.S. rare-earth player, or a volatile ride for only the patient.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Archer Aviation Is Bringing Its Flying Cars to Saudi Arabia. Is ACHR Stock a Buy Here?

- USA Rare Earth Just Revved up Its Commercial Timeline. Should You Buy USAR Stock Here?

- Robinhood Stock Gets Dragged Down by the Crypto Selloff. Should You Buy the Dip?

- Rivian’s Autonomy & AI Day Failed to Move the Needle for RIVN Stock. How Should You Play It Here?