With a market cap of $9.4 billion, Baxter International Inc. (BAX) is a global medical technology company specializing in essential hospital products and therapies used in intensive care, kidney care, pharmaceuticals, and surgical settings. Headquartered in Deerfield, Illinois, its portfolio spans infusion systems, dialysis equipment, sterile IV solutions, and advanced patient monitoring technologies.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and BAX perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the medical instruments & supplies industry. The company’s market leadership is driven by demand trends in acute care and chronic therapies, ongoing cost-restructuring efforts, and strategic portfolio realignment following recent divestitures and spinoffs.

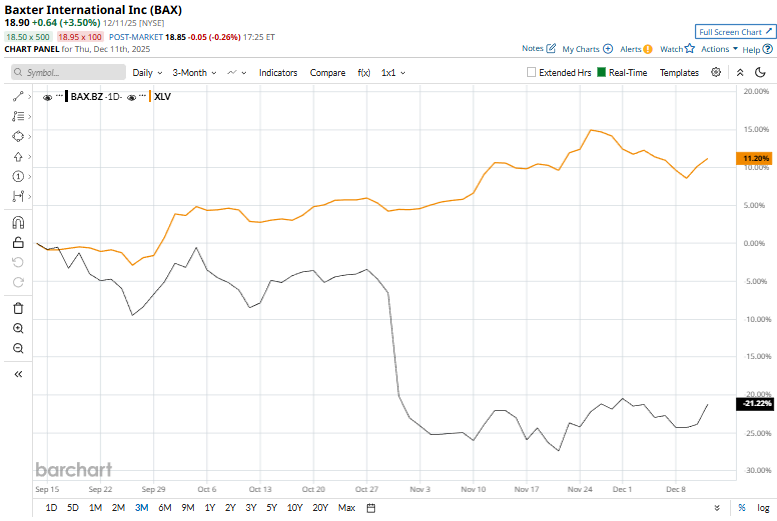

Despite its notable strength, BAX shares have slipped 49.9% from their 52-week high of $37.74, achieved on March 10. Over the past three months, BAX stock has declined 22.8%, underperforming the Health Care Select Sector SPDR Fund’s (XLV) 9.9% return during the same time frame.

In the longer term, shares of BAX dipped 35.2% on a YTD basis and fell 39% over the past 52 weeks, considerably falling behind XLV’s YTD gains of 11.6% and 8.1% returns over the last year.

To confirm the bearish trend, BAX has been trading below its 50-day and 200-day moving averages since early April and late March, respectively.

Baxter shares rose 2.8% after the company announced a quarterly cash dividend of 0.01 dollars per share, payable January 2, 2026 to shareholders of record on November 28, 2025. The declaration implies an annualized dividend rate of 0.04 dollars per share.

BAX’s rival, Becton, Dickinson and Company (BDX), has outpaced the stock, despite BDX’s shares plummeting 11.7% on a YTD basis and 9.3% over the past 52 weeks.

Wall Street analysts are cautious on BAX’s prospects. The stock has a consensus “Hold” rating from the 16 analysts covering it, and the mean price target of $22.29 suggests a potential upside of 17.9% from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Trump Takes a Stand Against Deere, How Should You Play the Blue-Chip Dividend Stock?

- Archer Aviation Is Bringing Its Flying Cars to Saudi Arabia. Is ACHR Stock a Buy Here?

- USA Rare Earth Just Revved up Its Commercial Timeline. Should You Buy USAR Stock Here?

- Robinhood Stock Gets Dragged Down by the Crypto Selloff. Should You Buy the Dip?