Cisco Systems (CSCO) briefly surpassed its dot-com-era peak for the first time in 25 years Wednesday, as shares climbed to $80.82, finally topping the $80.06 record set on March 27, 2000. That date marked the height of internet euphoria when Cisco briefly became the world's most valuable company by passing Microsoft (MSFT).

The networking equipment maker has spent a quarter century rebuilding investor confidence after losing 90% of its value when the tech bubble burst in 2002. This recovery comes as Cisco positions itself to capture AI infrastructure spending.

Valued at a market cap of $317 billion, Cisco is among the largest tech companies globally. CSCO stock is up 35% in the past year and 80% in the last five years. If we adjust for dividend reinvestments, cumulative returns for Cisco stock are closer to 110% since December 2020.

Is Cisco Stock Still a Good Buy?

Cisco Systems is capitalizing on artificial intelligence (AI) infrastructure spending with momentum that CFO Mark Patterson calls an inflection point for the networking giant after 25 years of searching for its next major growth catalyst.

The company pulled in $1.3 billion in AI infrastructure orders during its fiscal first quarter from hyperscale customers alone, driven by demand for both switching systems built on its Silicon One chips and coherent optics through the Acacia business acquired six years ago.

Patterson raised the full-year order target to at least $4 billion, double the prior year, while projecting AI-related revenue will triple to more than $3 billion, up from the $1 billion recognized in fiscal 2025.

Four different hyperscalers grew orders by more than 100% year-over-year (YoY) in the quarter, with Cisco securing four new design wins across various customers. It now serves five of the six largest cloud providers for AI infrastructure, positioning itself as the open alternative to Nvidia's (NVDA) proprietary stack. The order mix split evenly between optics and systems in the recent quarter, though the ratio fluctuates with customer deployment cycles.

Bill Gartner, who leads Cisco's optical business, said demand for scale-across networking has driven explosive growth beyond traditional data center interconnect applications. The technology allows hyperscalers to connect massive training clusters directly rather than routing traffic through constrained wide-area networks. Acacia Optics holds roughly 25% market share in hyperscale deployments and also sells to more than 400 service providers globally.

Beyond AI infrastructure, Cisco is in the early stages of a multiyear, multibillion-dollar campus networking refresh driven by aging equipment, security requirements, and preparation for bandwidth-intensive agentic AI applications.

Cisco faces component cost pressures from memory price increases and DRAM supply constraints but factored those into updated guidance. It is likely to maintain gross margins of around 68% while growing earnings at a faster pace than revenue.

Patterson emphasized that Cisco controls more of its destiny through Silicon One production than competitors that rely on merchant silicon, reducing exposure to chip shortages that plague the broader industry.

Federal government business stabilized with mid-to-high single-digit growth despite budget uncertainty, aided by heavy concentration in defense and intelligence spending rather than civilian agencies facing deeper cuts.

What Is the CSCO Stock Price Target?

Analysts tracking Cisco stock forecast revenue to increase from $56.65 billion in fiscal 2025 to $77 billion in fiscal 2030. In this period, adjusted earnings are forecast to expand from $3.81 per share to $6 per share.

CSCO stock currently trades at a forward price-to-earnings multiple of 19x, which is above the 10-year average of 14.4x. If Cisco is priced at 17x forward earnings, it should trade around $102 in mid-2029, indicating an upside potential of 26% from current levels. If we adjust for dividends, cumulative returns could be closer to 35%.

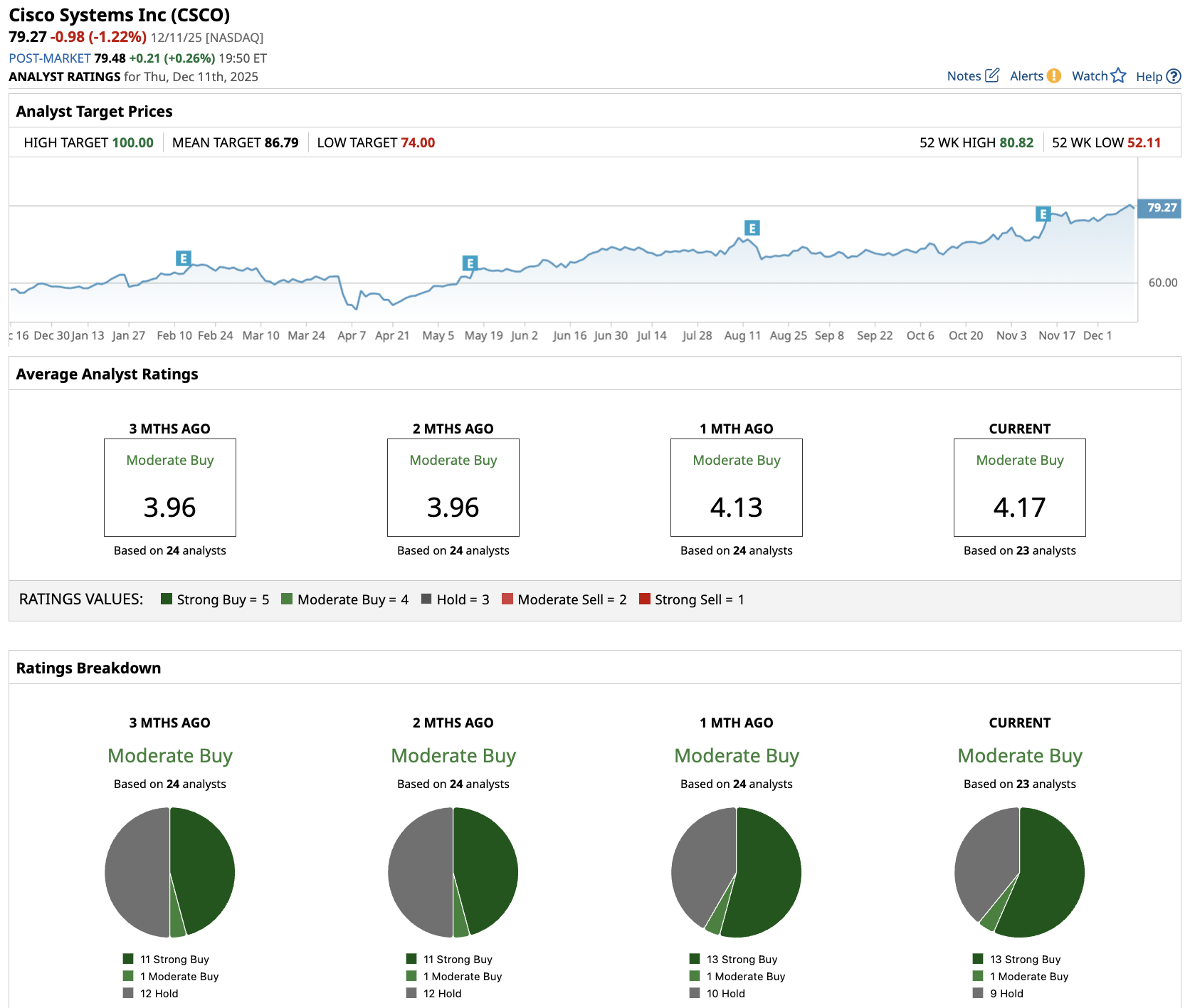

Out of the 23 analysts covering CSCO stock, 13 recommend “Strong Buy,” one recommends “Moderate Buy,” and nine recommend “Hold.” The average Cisco stock price target is $86.79, above the current price of about $79.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Gemini Space Station Is Launching a Prediction Markets Business. Should You Buy GEMI Stock Here?

- As Tesla Gets Ready to Remove Its Robotaxi Safety Drivers and Launch New FSD Model, Should You Buy TSLA Stock Here?

- Will Tesla Reclaim Its Top Growth Stock Crown in 2026?

- Forget Palantir, This ‘Strong Buy’ AI Stock Beats PLTR on Value