Miami, Florida-based Carnival Corporation & plc (CCL) is a cruise company that provides leisure travel services. Valued at $30.7 billion by market cap, the company offers cruise vacations specializing in ocean-based vacations, offering a mix of luxury, premium, and budget-friendly cruise experiences.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and CCL perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the travel services industry. Carnival's strength lies in its scale and diversified portfolio, enabling cost leadership and differentiation across multiple cruise brands. Its strong brand portfolio, including Carnival Cruise Line and Princess Cruises, drives customer loyalty and pricing power, leveraging core competencies across various market segments.

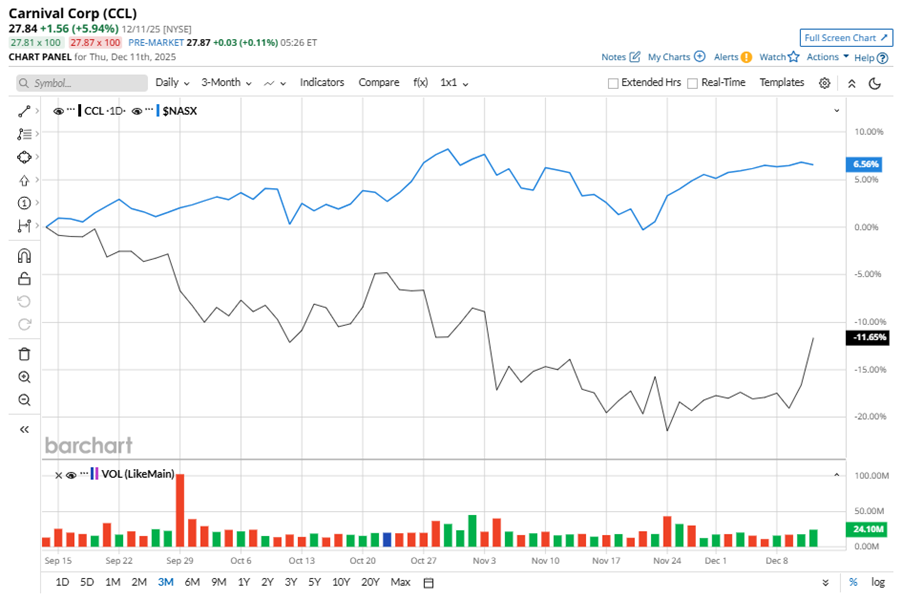

Despite its notable strength, CCL slipped 15.1% from its 52-week high of $32.80, achieved on Sep. 11. Over the past three months, CCL stock has declined 14.3%, underperforming the Nasdaq Composite’s ($NASX) 7% gains during the same time frame.

In the longer term, shares of CCL rose 16.6% on a six-month basis and climbed 4.6% over the past 52 weeks, underperforming NASX’s six-month gains of 20.3% and solid 17.8% returns over the last year.

To confirm the bullish trend, CCL has been trading above its 200-day moving average since mid-May, with slight fluctuations. The stock is trading above its 50-day moving average recently.

On Sep. 29, CCL shares closed down by 4% after reporting its Q3 results. Its adjusted EPS of $1.43 exceeded Wall Street expectations of $1.32. The company’s revenue was $8.2 billion, topping Wall Street forecasts of $8.1 billion.

CCL’s rival, Royal Caribbean Cruises Ltd. (RCL), has lagged behind the stock with 4.4% gains on a six-month basis, but outpaced the stock with a 13.9% uptick over the past 52 weeks.

Wall Street analysts are bullish on CCL’s prospects. The stock has a consensus “Strong Buy” rating from the 25 analysts covering it, and the mean price target of $35.22 suggests a potential upside of 26.5% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Is Souring on Netflix Stock Amid Warner Bros. Deal Drama. Is It Time to Ditch NFLX Now?

- Bob Iger Says ‘Creativity Is the New Productivity’ as Disney Bets $1 Billion on OpenAI and Entertainment Wars Heat Up

- This Little-Known Cloud Tech Stock Just Hit a New 52-Week High

- Can the Nasdaq Bull Keep Running? Here’s What Market Internals Are Telling Us Now.