With a market cap of $72.5 billion, Coinbase Global, Inc. (COIN) is a leading platform for crypto assets serving users in the United States and worldwide. It provides consumers with a primary financial account for the crypto economy and offers institutions a brokerage platform with deep liquidity.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Coinbase Global fits this criterion perfectly. The company also delivers a suite of developer tools for building onchain applications.

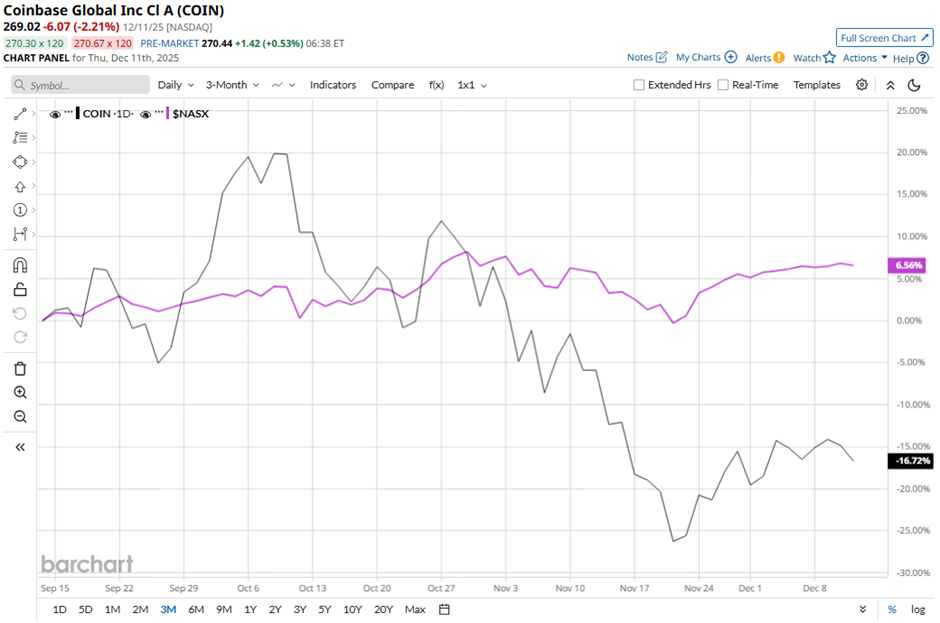

Shares of the New York-based company have declined 39.5% from its 52-week high of $444.64. COIN stock has dropped nearly 17% over the past three months, underperforming the Nasdaq Composite’s ($NASX) over 7% rise over the same time frame.

In the longer term, Coinbase Global stock is up 8.3% on a YTD basis, lagging behind NASX’s 22.2% increase. Moreover, shares of the company have decreased 14.3% over the past 52 weeks, compared to NASX’s 17.8% return over the same time frame.

Despite a few fluctuations, the stock has been trading mostly below its 50-day moving average since August. In addition, it has fallen below its 200-day moving average since mid-November.

Shares of Coinbase climbed 4.7% following its Q3 2025 results on Oct. 30, as the company reported net income of $1.50 per share, surpassing expectations. Transaction revenue nearly doubled to $1.05 billion amid heightened crypto volatility that boosted trading volumes. Investors were also encouraged by a 34.3% rise in subscription and services revenue to $746.7 million and the Deribit acquisition, which strengthened Coinbase’s foothold in the derivatives market.

In contrast, rival CME Group Inc. (CME) has outpaced COIN stock. Shares of CME Group have soared 17.3% on a YTD basis and 16.3% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic on Coinbase Global. COIN stock has a consensus rating of “Moderate Buy” from 32 analysts in coverage, and the mean price target of $389.57 is a premium of 44.8% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 2 ‘Strong Buy’ Biotech Stocks With 208% to 329% Upside Potential

- Nasdaq Futures Slip as Broadcom Results Fail to Ease AI Fears, Fed Speak on Tap

- As Trump Takes a Stand Against Deere, How Should You Play the Blue-Chip Dividend Stock?

- Archer Aviation Is Bringing Its Flying Cars to Saudi Arabia. Is ACHR Stock a Buy Here?