Headquartered in Ann Arbor, Domino's Pizza, Inc. (DPZ) commands the global pizza landscape as the world’s largest operator, and its nearly $14.2 billion market cap secures its place in the “large-cap” arena, a territory reserved for companies valued above $10 billion. This scale empowers it to manage more than 21,000 stores across over 90 international markets.

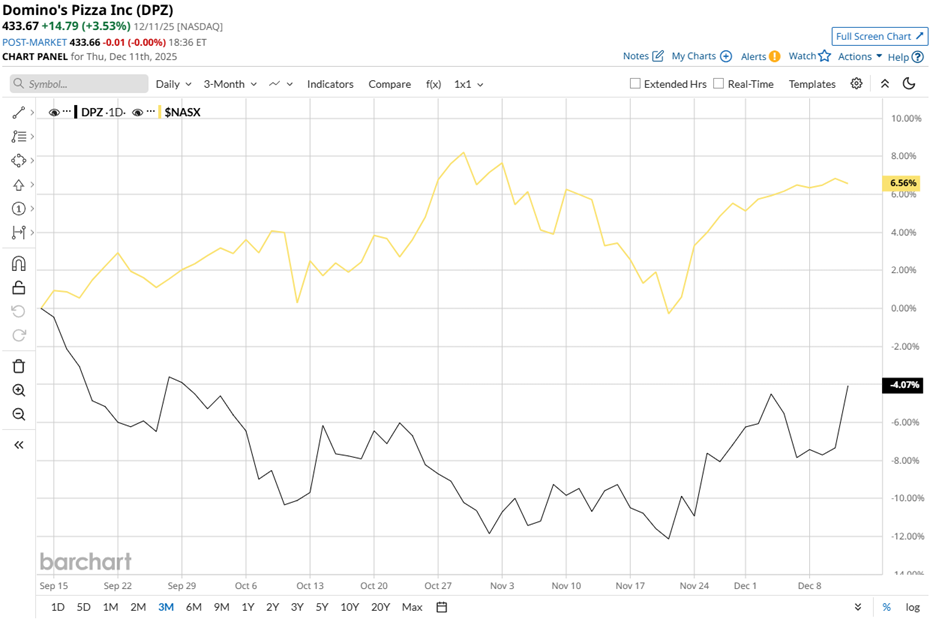

Despite this reach, DPZ’s stock narrates a choppier tale. It is currently trading 13.4% below its March high of $500.55 and has fallen almost 5% over the last three months. Meanwhile, the Nasdaq Composite ($NASX) has gained 7%.

Even long-term figures echo this softness. DPZ stock has plunged 5.2% over the past 52 weeks and gained only 3.3% year-to-date (YTD), trailing far behind the Nasdaq’s 17.8% and 22.2% respective gains.

Since mid-Sept, DPZ has traded below its 50-day moving average of $413.57 and its 200-day moving average of $449.34, signaling fading momentum. But since Dec, it has moved back above the 50-day level, though it still trails the 200-day average, reflecting an incomplete recovery.

Momentum improved after Q3 fiscal 2025 results, when shares jumped 3.9% on Oct 14. Revenues rose 6.2% year over year to $1.15 billion, beating the $1.14 billion analyst estimate. EPS reached $4.08, ahead of $3.97 forecasts, though down 2.6% from the prior year’s quarter as net income slipped 5.2% during the reported quarter’s operational cycle.

Operationally, Domino’s added 29 net U.S. stores, lifting its domestic system to 7,090 locations. Management expects more than 175 net U.S. additions for fiscal 2025 and international growth consistent with 2024, strengthening expansion visibility and signaling durable demand that can compound scale and franchise economics across diverse markets globally.

To put DPZ’s performance in perspective, its rival Arcos Dorados Holdings Inc. (ARCO) plunged 8.3% over 52 weeks but gained 1.9% YTD, underscoring mixed competitive conditions.

Even so, analysts remain optimistic. Among 30 analysts, the consensus rating stands at a “Moderate Buy,” and the average price target of $500.53 signals 15.4% potential upside from current levels, reinforcing confidence that Domino’s can convert its recent operational traction into sustained shareholder gains.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Trump Takes a Stand Against Deere, How Should You Play the Blue-Chip Dividend Stock?

- Archer Aviation Is Bringing Its Flying Cars to Saudi Arabia. Is ACHR Stock a Buy Here?

- USA Rare Earth Just Revved up Its Commercial Timeline. Should You Buy USAR Stock Here?

- Robinhood Stock Gets Dragged Down by the Crypto Selloff. Should You Buy the Dip?