Marlborough, Massachusetts-based Hologic, Inc. (HOLX) develops, manufactures, and supplies diagnostic products, imaging systems, and surgical products for women's health through early detection and treatment worldwide. With a market cap of $16.7 billion, Hologic operates through Diagnostics, Breast Health, GYN Surgical, and Skeletal Health segments.

Companies worth $10 billion or more are generally described as “large-cap stocks.” Hologic fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the medical instruments & supplies industry.

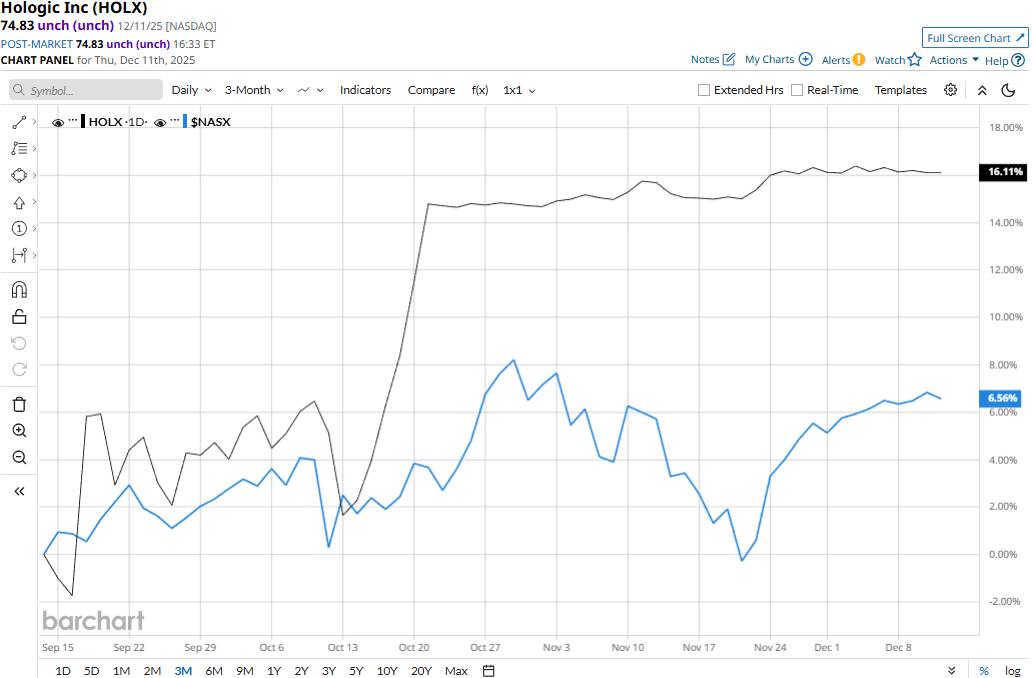

Hologic stock touched its 52-week high of $76.29 on Dec. 12, 2024, and is currently trading 1.9% below that peak. Meanwhile, HOLX stock soared 12.7% over the past three months, outpacing the Nasdaq Composite’s ($NASX) 7% gains during the same time frame.

Hologic’s performance has remained grim over the longer term. HOLX stock prices have gained 3.8% on a YTD basis and dipped 93 bps over the past 52 weeks, lagging behind the Nasdaq’s 22.2% surge in 2025 and 17.8% returns over the past year.

Hologic has traded mostly above its 50-day moving average since late May and above its 200-day moving average since early August, with some fluctuations, underscoring its bullish trend.

Hologic’s stock prices observed a marginal uptick in the trading session following the release of its better-than-expected Q3 results on Nov. 3. Driven by a 5.2% increase in US revenues and a 9.4% surge in international revenues, the company’s overall topline for the quarter grew 6.2% year-over-year to $1.1 billion, beating the Street’s expectations by 1.5%.

The company’s gross margins were negatively impacted due to product mix and an increase in tariff expenses. Nonetheless, driven by the impact of leverage from revenue growth, the company’s non-GAAP operating margins increased 120 bps year-over-year to 31.2%. Meanwhile, the company’s non-GAAP EPS soared 11.9% year-over-year to $1.13, beating the consensus estimates by 2.7%.

Further, Hologic has also outperformed its peer, Align Technology, Inc.’s (ALGN) 21.4% decline on a YTD basis and 31.6% plunge over the past 52 weeks.

Among the 18 analysts covering the HOLX stock, the consensus rating is a “Hold.” As of writing, its mean price target of $76.92 suggests a modest 2.8% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Trump Takes a Stand Against Deere, How Should You Play the Blue-Chip Dividend Stock?

- Archer Aviation Is Bringing Its Flying Cars to Saudi Arabia. Is ACHR Stock a Buy Here?

- USA Rare Earth Just Revved up Its Commercial Timeline. Should You Buy USAR Stock Here?

- Robinhood Stock Gets Dragged Down by the Crypto Selloff. Should You Buy the Dip?