Stanley Black & Decker, Inc. (SWK), based in New Britain, Connecticut, is a diversified global provider of hand tools, power tools and related accessories, mechanical access and electronic security solutions, healthcare solutions, engineered fastening systems, and more. Valued at $11.7 billion by market cap, the company offers onshore and offshore pipeline construction and inspection services.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and SWK perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the tools & accessories industry. SWK's strengths include its diversified portfolio, scale, and brand equity, enabling the company to leverage resources and drive growth. Its robust balance sheet, technological capabilities, and innovation ecosystem also position it for success, with a strong strategic fit for trends such as cordless power tools, thereby driving premium pricing and customer loyalty.

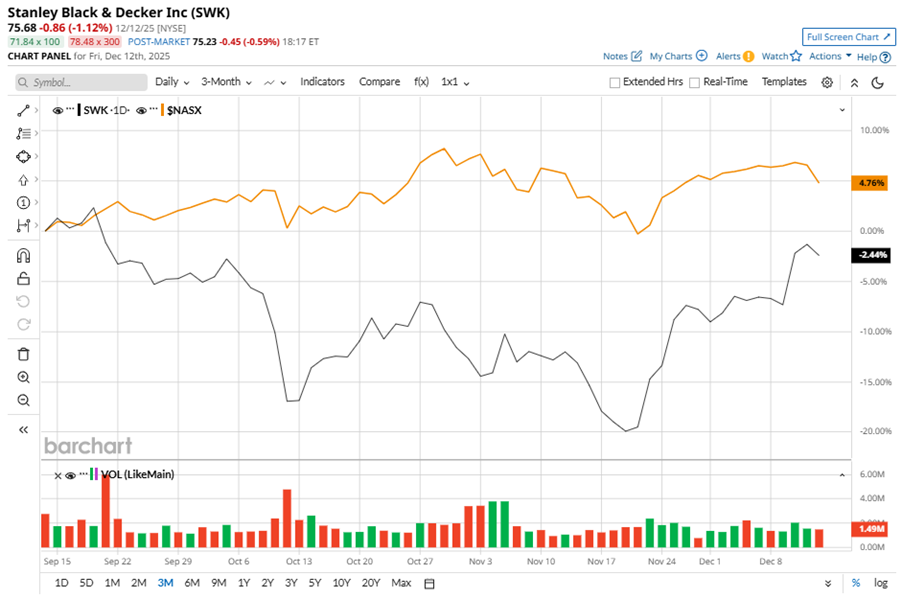

Despite its notable strength, SWK slipped 16.9% from its 52-week high of $91.06, achieved on Jan. 28. Over the past three months, SWK stock has declined 2.4%, underperforming the Nasdaq Composite’s ($NASX) 4.8% gains during the same time frame.

In the longer term, shares of SWK rose 12.3% on a six-month basis but dipped 8.5% over the past 52 weeks, underperforming NASX’s six-month gains of 18% and solid 16.5% returns over the last year.

To confirm the recent bullish trend, SWK has been trading above its 50-day and 200-day moving averages since late November, with minor fluctuations.

SWK’s weak performance stems from pressure from declining sales volumes.

On Nov. 4, SWK reported its Q3 results, and its shares closed up more than 4% in the following trading session. Its adjusted EPS of $1.43 exceeded Wall Street expectations of $1.19. The company’s revenue was $3.76 billion, falling short of Wall Street forecasts of $3.77 billion.

SWK’s rival, Snap-on Incorporated (SNA), has lagged behind the stock, with 9.9% gains on a six-month basis, but outpaced the stock with a 1.4% downtick over the past 52 weeks.

Wall Street analysts are reasonably bullish on SWK’s prospects. The stock has a consensus “Moderate Buy” rating from the 16 analysts covering it, and the mean price target of $81.33 suggests a potential upside of 7.5% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart