King of Prussia, Pennsylvania-based Universal Health Services, Inc. (UHS) is a healthcare company that owns and operates acute care hospitals, behavioral health facilities, and outpatient facilities. Valued at a market cap of $13.9 billion, the company provides a broad range of medical services, including emergency care, surgery, diagnostic services, and mental health treatment.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and UHS fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the medical care facilities industry. The company focuses on delivering essential healthcare across diverse communities, benefiting from scale, operational expertise, and steady demand driven by demographic and healthcare needs.

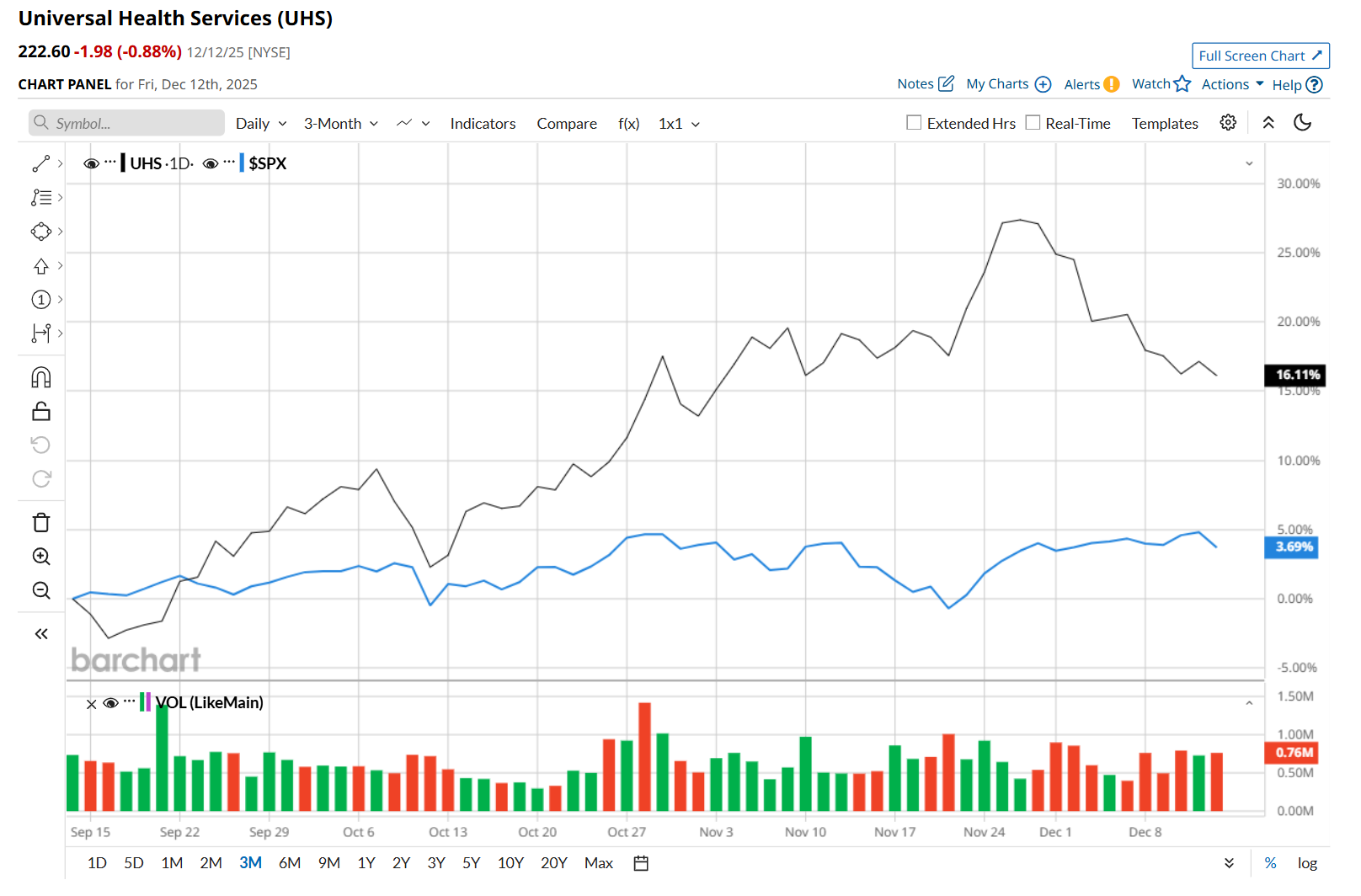

This healthcare company is currently trading 9.6% below its 52-week high of $246.33, reached on Nov. 26. Shares of UHS have gained 16.1% over the past three months, outperforming the S&P 500 Index’s ($SPX) 3.7% rise during the same time frame.

In the longer term, UHS has rallied 19.4% over the past 52 weeks, outpacing SPX’s 12.8% uptick over the same time frame. Moreover, on a YTD basis, shares of UHS are up 24.1%, compared to SPX’s 16.1% return.

To confirm its bullish trend, UHS has been trading above its 200-day moving average since early September, and has remained above its 50-day moving average since mid-August.

On Oct. 27, UHS delivered better-than-expected Q3 earnings results, driving its shares up 2.5% in the following trading session. The company’s overall revenue improved 13.4% year-over-year to $4.5 billion, surpassing consensus estimates by 4.4%. Moreover, its adjusted EPS increased by an even more impressive 53.4% from the year-ago quarter to $5.69, handily topping analyst expectations of $4.66. Additionally, UHS raised its fiscal 2025 revenue and earnings guidance, underscoring strong operating momentum and further boosting investor confidence.

UHS has lagged behind its rival, HCA Healthcare, Inc. (HCA), which soared 55.4% over the past 52 weeks and 61.5% on a YTD basis.

Looking at UHS’ recent outperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 20 analysts covering it, and the mean price target of $252.18, suggests a 23.2% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart