With a market cap of $37.5 billion, Fiserv, Inc. (FISV) is a global provider of payments and financial services technology solutions. The company operates through two segments: Merchant Solutions and Financial Solutions, offering services such as merchant acquiring, digital commerce, mobile payments, fraud protection, card processing, and digital banking solutions.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Fiserv fits this criterion perfectly. Fiserv serves a wide range of clients including businesses, banks, credit unions, fintechs, public sector entities, and software providers.

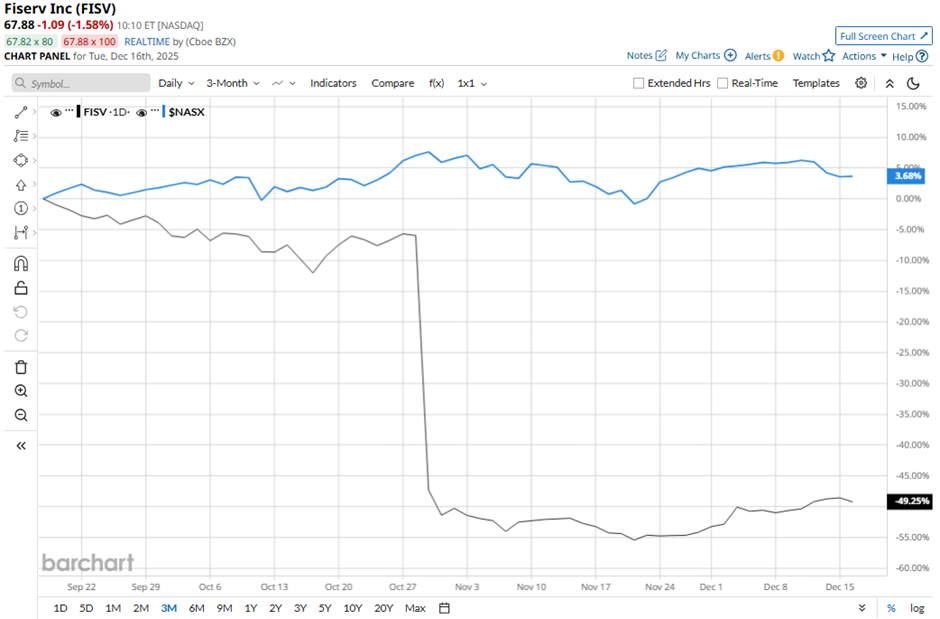

Despite this, shares of the Milwaukee, Wisconsin-based company have declined 71.3% from its 52-week high of $238.59. FISV stock has dropped 48.5% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 3.3% rise over the same time frame.

In the longer term, FISV stock is down 66.7% on a YTD basis, lagging behind NASX’s 19.5% gain. Moreover, shares of the company have decreased 66.4% over the past 52 weeks, compared to NASX’s 14.4% return over the same time frame.

The stock has been trading below its 50-day moving average since early March. Also, it has fallen below its 200-day moving average since late April.

Fiserv shares tumbled over 44% on Oct. 29 after the company reported weaker-than-expected Q3 2025, with adjusted EPS of $2.04 and revenue of $4.92 billion. The selloff deepened after Fiserv sharply cut its full-year outlook for a second straight quarter, slashing revenue growth expectations to 3.5% - 4% from 10% and lowering adjusted EPS guidance to $8.50 - $8.60.

In contrast, rival Accenture plc (ACN) has shown a less pronounced decline than FISV stock. ACN stock has dropped 22.6% on a YTD basis and 23.7% over the past 52 weeks.

Due to the stock’s weak performance, analysts remain cautious on Fiserv. FISV stock has a consensus rating of “Hold” from 34 analysts in coverage, and the mean price target of $82.10 is a premium of 21% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart