Buying call options sounds simple. If you’re bullish, you buy a call. Then, if the stock goes up, you make money… right?

In reality, many traders lose money on long calls – not necessarily because the stock didn’t move, but because it didn’t move aggressively enough or quickly enough. Time decay, poor strike selection, and chasing the wrong stocks can quietly drain accounts.

In this lesson, Barchart’s Senior Market Strategist John Rowland, CMT, explains how he actually finds long call opportunities where probability is stacked in his favor. That starts with a simple rule for strike selection — and perhaps even more importantly, a disciplined process for stock selection.

Why Strike Selection Matters More Than Most Traders Realize

John starts with a foundational reminder that trips up many beginners:

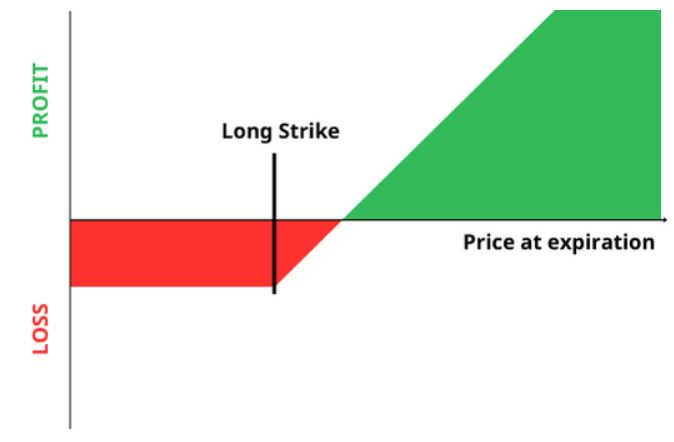

Out-of-the-money calls have no intrinsic value. Their entire premium consists of time and volatility. That means the stock must make a larger-than-expected move just to break even.

On the other hand, in-the-money calls move more like the underlying stock, which is reflected in their higher delta. By starting with higher-delta ITM options, traders can increase the odds of a winning call trade.

But the best call option trades don’t necessarily start with strike selection.

John emphasizes a simple but powerful rule: Profiting from long calls – and from OTM calls in particular – requires strong trends and real momentum, not just a bullish opinion.

That’s why finding the right stocks matters just as much as picking the strike.

Where to Start Looking for Long Call Candidates

Instead of scrolling charts randomly or chasing hype, John uses curated Barchart lists designed to surface stocks with momentum already working in their favor. These lists act as a filtering layer — narrowing the universe before a single option chain is opened.

Here are the three starting points he highlights.

#1. Uptrending Stocks

The Uptrending Stocks list focuses on large-cap stocks that already meet several technical conditions:

- Rising 20-, 50-, and 200-day moving averages

- Improving volume trends

- Trading at least 20% below their 52-week highs

That last point matters. It means the stock is trending higher but still has room to run, which is exactly what long calls need.

#2. Breakout & Reversal Candidates

Next, John looks for stocks emerging from volatility compression.

This list is built around Bollinger Bands, a volatility indicator that helps identify when price has been quiet for too long. Rising volatility after compression often precedes directional expansion, which is ideal for call buyers.

Volatility expansion + bullish bias is a powerful combination for long calls, especially when paired with proper strike selection.

#3. Stocks Making New Highs

Finally, John looks at stocks breaking into new highs.

The logic is simple: a stock cannot make a new high without clearing prior resistance. When resistance is removed, trends often persist longer than traders expect.

These candidates are not about “buying low” — they’re about buying into strength, which long calls require.

Why This Process Works

What makes John’s approach effective isn’t just the indicators; it’s the order of operations.

Instead of starting with the options chain, he starts with trend, momentum, and volatility. Only after narrowing the stock list does he move on to strike selection, delta, expected move, and time decay considerations.

That’s when long calls stop being lottery tickets and start becoming structured trades.

The Takeaway for Traders

Long calls can be one of the most capital-efficient bullish strategies — but only when paired with discipline.

In this clip, John shows how to:

- Avoid chasing cheap OTM calls with no edge

- Focus on stocks that can actually outrun time decay

- Use Barchart’s curated lists as part of a repeatable process

If you’ve ever wondered why your call option trades “almost work” but still lose, this breakdown connects the dots.

Watch this quick clip on Long Calls:

- Stream the full webinar with John Rowland

- Explore Barchart’s Uptrending Stocks, Breakout & Reversal, and New Highs lists

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Barchart Stock Screeners to Help You Find Better Call Option Trades

- Oracle's Unusual Put Options Activity - A Contrarian Signal - Should Investors Buy ORCL Stock?

- How to Buy CSCO for a 2.5% Discount, or Achieve a 19% Annual Return

- Buy the Dip, or Panic Sell? What This Powerful Chart Indicator is Telling Us About the Stock Market Now.