New York-based Fox Corporation (FOX) operates as one of the world’s top news, sports, and entertainment companies. With a market cap of over $28.1 billion, Fox operates through Cable Network Programming, Television, Credible, and The FOX Studio Lot segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." Fox fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the media industry.

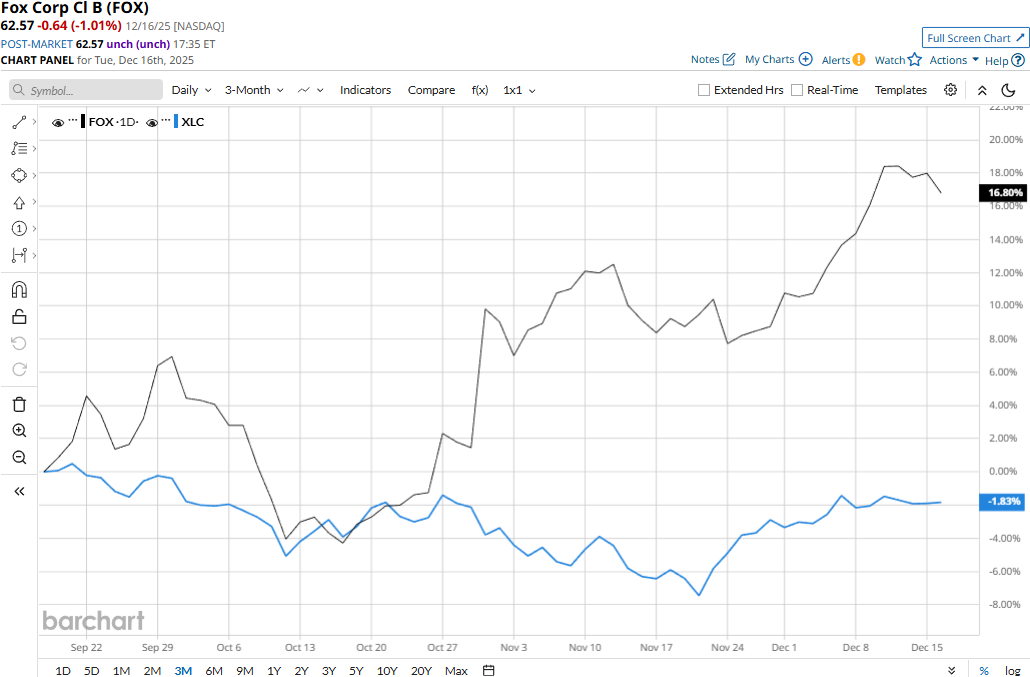

Fox touched its all-time high of $64.22 on Dec. 11 and is currently trading 2.6% below that peak. Meanwhile, Fox’s stock prices have soared 20.3% over the past three months, notably underperforming the Communications Services Select Sector SPDR Fund’s (XLC) 1.6% dip during the same time frame.

Fox’s performance has remained impressive over the longer term as well. Fox stock has soared 36.8% on a YTD basis and 40.1% over the past 52 weeks, outpacing XLC’s 20.5% gains in 2025 and 15.1% returns over the past year.

Fox has traded consistently above its 200-day moving average over the past year and above its 50-day moving average since late October, underscoring its bullish trend.

Fox’s stock prices soared 8.2% in the trading session following the release of its better-than-expected Q1 results on Oct. 30. Driven by growth in the cable network programming segment and television segment, the company’s distribution revenues increased 2.5% compared to the year-ago quarter. Meanwhile, driven by digital growth led by Tubi AVOD service, stronger news pricing, and higher sports prices, Fox’s advertising revenues increased by a notable 6.2%. Further, the company registered a solid 12% growth in content and other revenues, which was supported by growth in entertainment content.

Overall, Fox’s topline grew 4.9% year-over-year to $3.7 billion, surpassing the Street’s expectations by 4.7%. Meanwhile, its adjusted EPS grew 4.1% compared to the year-ago quarter to $1.51, beating the consensus estimates by a staggering 42.5%.

Further, Fox has notably outperformed its peer News Corporation’s (NWSA) 6% decline in 2025 and 9.6% plunge over the past 52 weeks.

Among the 14 analysts covering the Fox stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $65.42 suggests a modest 4.6% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This High-Yield Dividend Stock Trades at a Third of Its Record Highs: Is It a Buy for 2026?

- Elon Musk Warns He Wants to ‘Slow Down AI and Robotics’ But Says It’s Impossible and ‘Advancing at a Very Rapid Pace’

- Buy the Dip, or Panic Sell? What This Powerful Chart Indicator is Telling Us About the Stock Market Now.

- Should You Buy the Dip in Alibaba Stock?