CrowdStrike Holdings, Inc. (CRWD) is a leading U.S. cybersecurity technology company headquartered in Austin, Texas. Valued at a market cap of $123.2 billion, it specializes in cloud‑native security solutions designed to prevent breaches and protect enterprise IT infrastructure globally. Its core offering is the Falcon platform, a software‑as‑a‑service (SaaS) suite that provides comprehensive protection across endpoints, cloud workloads, identity, and data by combining real-time threat detection, automated response, vulnerability management, and AI-powered threat intelligence into a unified, scalable system.

Companies worth over $10 billion are typically classified as “large-cap stocks,” and CRWD fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the software infrastructure industry.

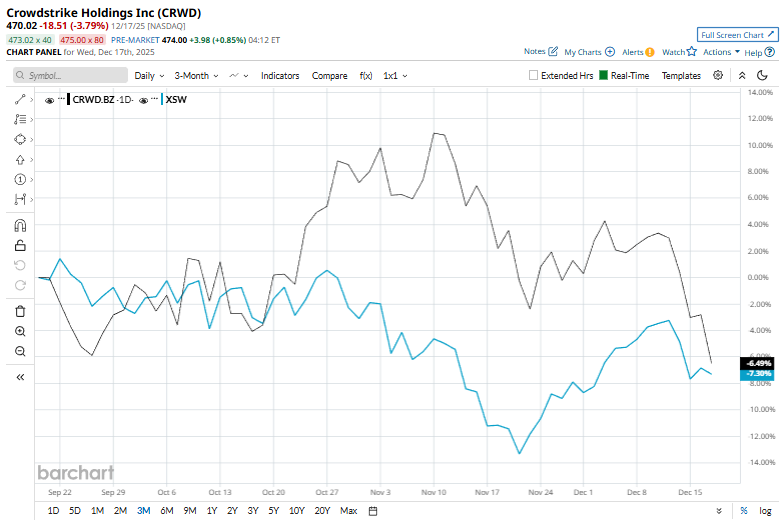

This cybersecurity leader has slipped 17.1% from its 52-week high of $566.90, reached on Nov. 12. Shares of CRWD have surged 5.5% over the past three months, slightly underperforming the SPDR S&P Software & Services ETF’s (XSW) 5.7% dropduring the same time frame.

Over the longer term, however, CRWD has surged 24.9% in the past year, far outpacing XSW’s marginal decline. The stock is up 37.4% year-to-date compared to XSW’s 7.2% fall.

The stock has remained mostly above its 200-day moving average throughout the past year. However, it recently slipped below its 50-day average, suggesting a short-term consolidation amid an otherwise strong upward trend.

On Dec. 2, CrowdStrike released its third-quarter results, causing shares to rise 2.5%. Total revenue reached approximately $1.23 billion, up 22% year over year, driven by sustained demand for its cloud-native Falcon security platform and a 21% increase in subscription revenue. Annual Recurring Revenue (ARR) rose 23% to $4.92 billion, including a record net new ARR addition of $264.6 million. While the company reported a GAAP net loss of $34 million due to ongoing investments, non-GAAP operating income hit a record $264.6 million, with non-GAAP EPS of $0.96, exceeding expectations.

CRWD has considerably outpaced its rival, Palo Alto Networks, Inc. (PANW), which dipped 8.9% over the past 52 weeks and surged marginally on a YTD basis.

The stock has a consensus rating of "Moderate Buy” from the 47 analysts covering it, and the mean price target of $559.05 suggests an 18.9% premium to its current price levels

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart