With a market cap of $11.4 billion, Hasbro, Inc. (HAS) is a global toy and game company that operates across the United States, Europe, Canada, Latin America, Australia, China, and Hong Kong. The company offers a wide range of products, including action figures, dolls, preschool toys, trading cards, games, and licensed consumer goods such as apparel and home products.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Hasbro fits this criterion perfectly. Hasbro also expands its brands through digital gaming, role-playing experiences, and entertainment content spanning film, television, and digital media.

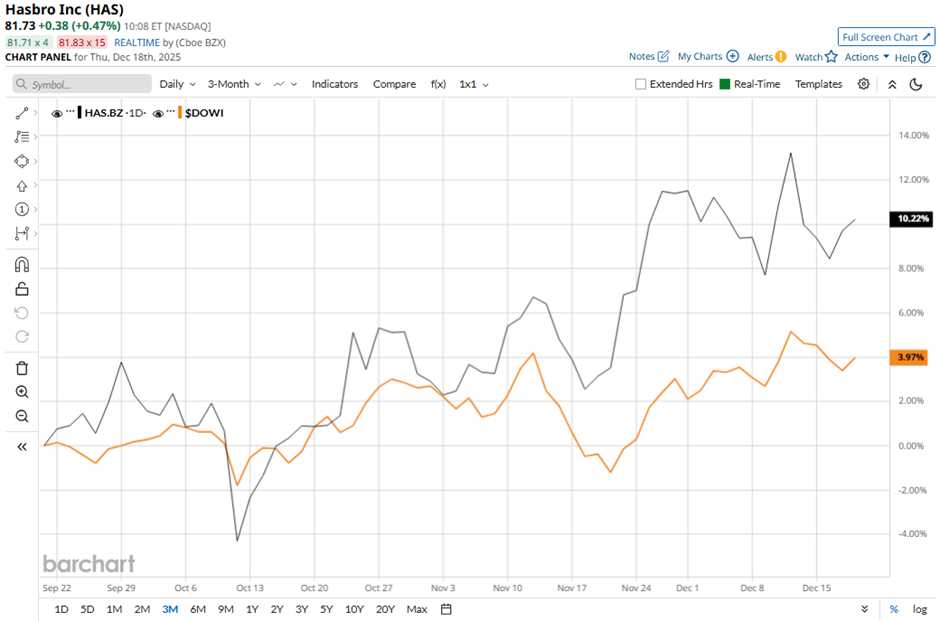

Shares of the toy and game maker have slipped 3.8% from its 52-week high of $85.14. HAS stock has gained 9.4% over the past three months, outpacing the broader Dow Jones Industrials Average's ($DOWI) 4.4% rise over the same time frame.

Longer term, HAS stock is up 46.5% on a YTD basis, exceeding DOWI's 13.2% gain. Moreover, shares of Hasbro have surged nearly 41% over the past 52 weeks, compared to DOWI's 13.8% return over the same time frame.

The stock has shown a bullish trend, consistently trading above its 200-day moving average since early May.

Shares of Hasbro rose 3.7% on Oct. 23 after the company reported strong Q3 2025 results, with revenue up 8% year over year and operating profit increasing 13% to $341 million, driven by a 42% revenue surge in the Wizards of the Coast and Digital Gaming segment. Investor sentiment was further boosted by MAGIC: THE GATHERING revenue jumping 55%, adjusted EPS of $1.68, and a high 44% operating margin in the Wizards segment, highlighting strong profitability and operating leverage.

Additionally, Hasbro raised its full-year outlook, projecting high-single-digit revenue growth, adjusted operating margins of 22% - 23%, and adjusted EBITDA of $1.24 billion - $1.26 billion.

In comparison, rival Mattel, Inc. (MAT) has lagged behind HAS stock. MAT has risen nearly 16% on a YTD basis and 13.3% over the past 52 weeks.

Due to the stock's strong performance, analysts are bullish about its prospects. HAS stock has a consensus “Strong Buy” rating overall from the 13 analysts covering the stock, and the mean price target of $92.50 represents a premium of 13% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Disney Made a Bold Move By Partnering with OpenAI: Will It Help DIS Stock Recover?

- ‘We’ll Be in These Stocks 10, 20 Years’: Warren Buffett’s $30 Billion Bet Gets a Big Boost as Bank of Japan Raises Rates to 30-Year High

- Forget Nvidia and Broadcom. This Forgotten Retail Stock Is a Top Performer in 2025.

- Silver Prices Are Spiking. Here’s Why It Could Be a Buying Opportunity for Gold.