On Dec. 11, Broadcom (AVGO) declared a $0.65 dividend for the quarter, a 10.2% increase from the previous quarter’s $0.59. The chipmaker continues to reward long-term investors as a rare dividend payer in the semiconductor industry. The fact that the company can not only keep up with but also increase the dividend payout speaks volumes about its strong cash flows.

The world is seeing increasing investment in IT infrastructure upgrades since the emergence of generative AI in 2022. As an AI chipmaker, AVGO is expected to continue reaping the benefits of this AI boom, which, according to analysts, is likely only at the halfway stage in terms of infrastructure spending.

Bank of America’s analysts believe volatility is set to dominate chip stocks, mainly because the question of ROI on AI investments is going to become increasingly important. However, for companies like Broadcom, the chip demand should stay strong. In 2026, semiconductor sales are likely to hit the $1 trillion mark for the first time. AVGO will take a good chunk of this pie.

About Broadcom Stock

Broadcom is a global tech giant that designs semiconductor equipment, along with software and networking equipment. The company plays a pivotal role in meeting the demand of the AI industry through its custom chip designs, built specifically to run AI workloads. It is led by CEO Hock Tan and headquartered in San Jose, California.

Despite a 22% drop in the last five trading sessions, the stock is up 35% in the last year, comfortably outpacing the Nasdaq Composite Index’s ($NASX) 13.2% gains.

Broadcom’s forward P/E of 44.68x has finally fallen below its five-year average forward P/E of 47.36x. This isn’t any significant discount, especially when seen in the context of its peers. Both Nvidia (NVDA) and Marvell Technologies (MRVL) trade at a forward P/E below AVGO at 38.38x and 28.06x, respectively. Even with a 22% dip in a matter of five days, the stock is trading at a premium to its peers. Its long-term debt-to-total capital ratio of 42.33% is also significantly higher than NVDA's 7.31% and MRVL’s 22.43%. It is quite possible that this high valuation is what has caused such a strong negative reaction post-earnings, coupled with the obvious margin pressure the company is facing going forward.

AVGO now boasts a 0.77% forward dividend yield, giving enough dividend security to investors who like to cash in quarterly dividends while betting on the growth of the semiconductor industry.

Broadcom Stock Reports Strong Earnings

AVGO announced its Q4 2025 earnings on Dec. 12. It reported an EPS of $1.95 vs. $1.86 expected on a strong revenue of $18.02 billion vs. $17.49 billion expected. Going forward, the first fiscal quarter’s revenue is likely to come in at $19.1 billion, a healthy 28% year-over-year (YoY) growth.

Management clarified on the earnings call that the $10 billion customer announced during the quarter was Anthropic. Investors were presented with another surprise, as the company announced a fifth large customer as well. Broadcom also signed a deal with OpenAI recently and carries a $73 billion backlog, which it is likely to deliver over the next 18 months. This aids Broadcom's ambitious revenue targets, as per analysts.

What Analysts Are Saying About AVGO Stock

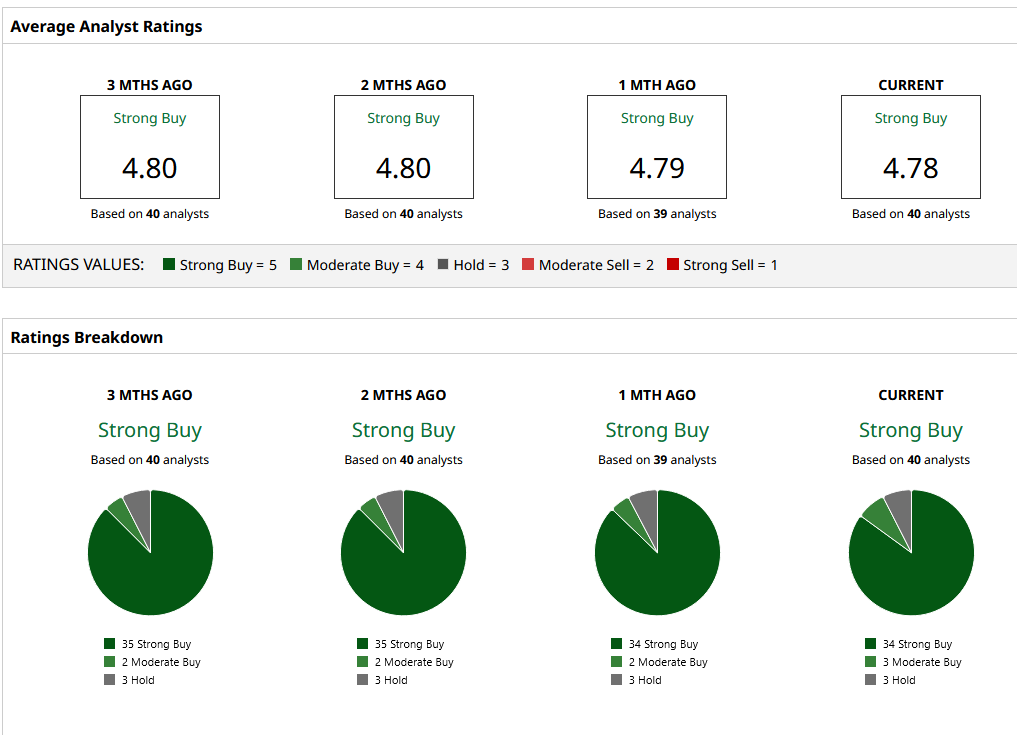

AVGO is a top pick among analysts, with 34 out of 40 Wall Street analysts rating it a “Strong Buy.” Earlier in the week, UBS raised AVGO’s price target from $472 to $475, implying a further 45% upside. Due to the ongoing dip in the stock price, the highest price target of $535 offers 64% upside from here on.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart