It has been a long time since I covered uranium stocks and the Sprott Uranium Miners ETF (URNM) on Barchart. In an August 16, 2024, article on the topic, I concluded with the following:

Given the rising demand from energy and nuclear applications, uranium is a hot commodity with great upside potential. Uranium mining ETFs could be the optimal path for exposure over the coming months and years.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

Cameco’s spot uranium price was $84.25, with the long-term price at $79.50 at the end of July 2024. The URNM was trading at $41.22 per share. While uranium prices have not moved much, the URNM ETF soared before its latest correction.

Marginal changes in Cameco uranium prices

The chart shows that while Cameco’s long-term uranium price has risen since mid-August 2024, the spot price has moved lower.

At the end of November 2025, Cameco’s spot price was lower at $75.80, with the long-term price higher at $86.00. The five-year chart highlights the mostly bullish trend in uranium prices.

Geopolitical and technological issues have supported uranium mining stocks

The following factors have supported investments in uranium mining companies in 2025:

- The bifurcation of the world’s nuclear powers has led to increased weapons production, driving up uranium demand.

- Climate change initiatives have increased the demand for alternative energy sources. Increasing nuclear power demand has driven up uranium demand.

- Artificial intelligence requires a substantial increase in power demand. Nuclear-powered electricity could turbocharge uranium demand over the coming years.

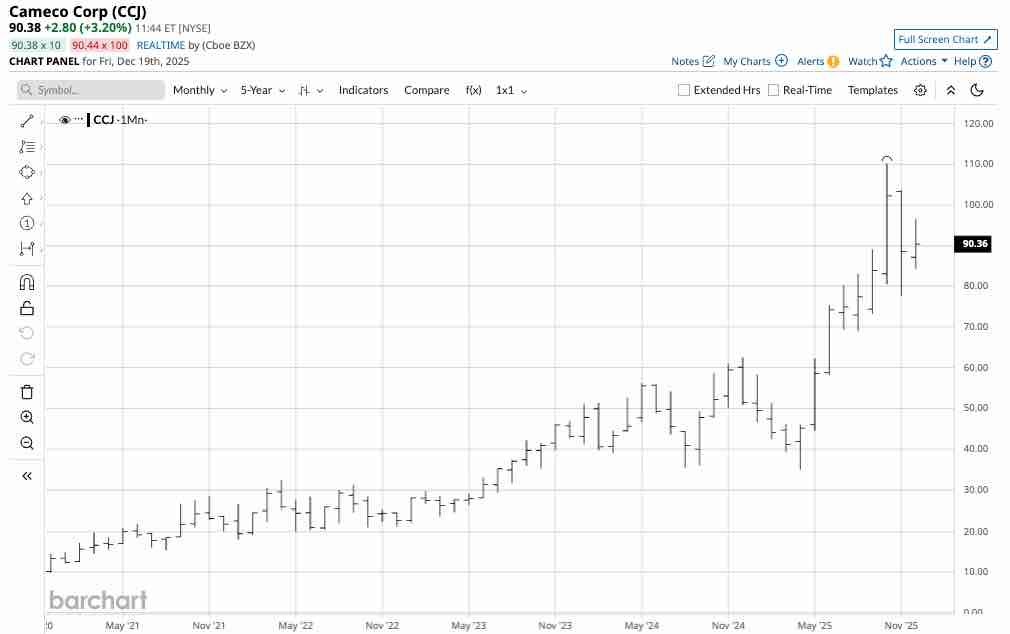

Uranium mining companies’ shares have exploded higher in 2025. Cameco Corp. (CCJ) is a leading Canadian uranium mining company.

The five-year chart highlights CCJ’s bullish trend. In 2025, CCJ rose 114.4% from $51.39 at the end of 2024 to a high of $110.16 per share in October 2025. At over $90 per share, CCJ shares remain not far below the October peak.

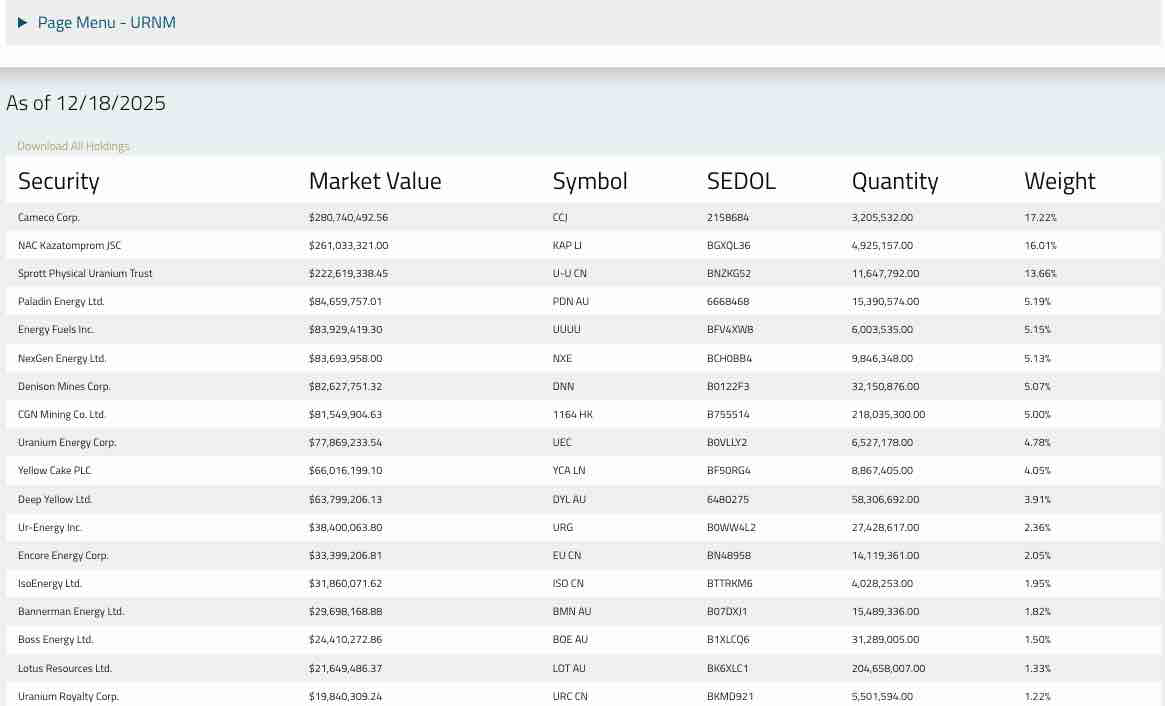

URNM holds the leading uranium mining companies’ shares

The top holdings of the Sprott Uranium Miners ETF (URNM) include:

Kazakhstan is the world’s leading uranium producer, so the URNM allocates over 17% of its assets to the state uranium-producing company, NAC Kazatomprom JSC. URNM’s second-leading holding is CCJ with a 16.01% allocation.

A liquid ETF that has a reasonable yield

At $56.31 per share, URNM had over $1.70 billion in assets under management. URNM trades an average of over 500,000 shares daily and charges a 0.85% management fee. The $1.28 annual dividend yields 2.27%.

URNM provides exposure to a diversified portfolio of uranium mining companies, with over 33% invested in the top two uranium producers. Meanwhile, URNM also has a 13.66% exposure to the Sprott Physical Uranium Trust, which invests “substantially all of its assets” in physical uranium, totaling over $7.46 billion. Therefore, URNM not only has exposure to uranium mining companies, but also to the physical commodity.

An explosive rally, a correction, and a long-term bullish trend- Buying URNM on the dip

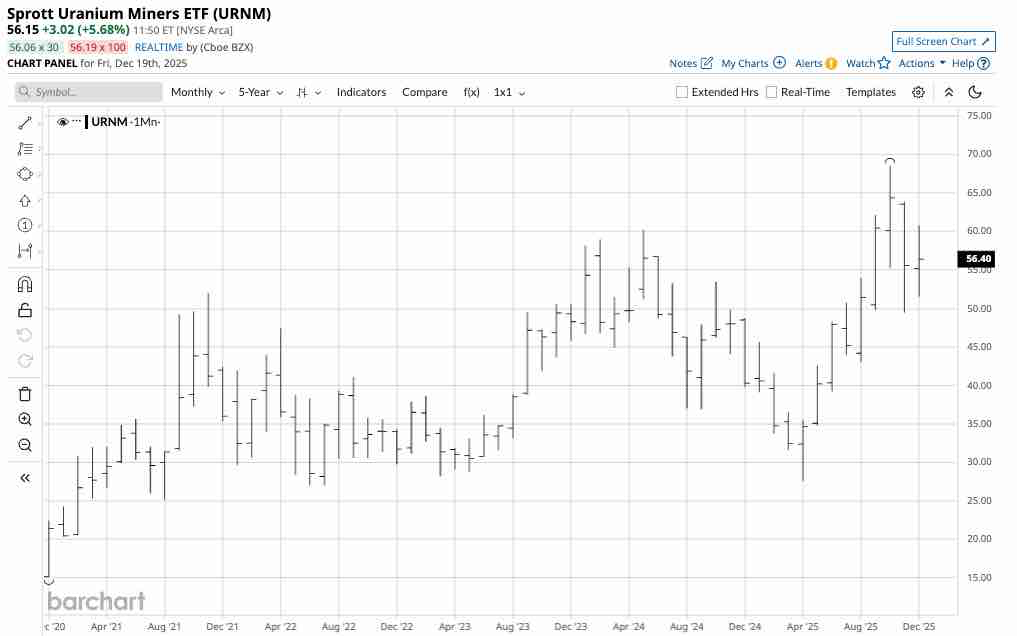

The URNM ETF has rallied in 2025.

The monthly chart highlights URNM’s over 70% 2025 gain, moving from $40.31 at the end of 2024 to the October 2025 high of $68.55 per share. At above $56 in mid-December, URNM is above the midpoint of the 2025 trading range.

Geopolitics, climate change initiatives, and rising energy demand from technological advances in AI are driving higher uranium demand. URNM is a diversified, liquid uranium ETF that provides exposure to the primary ingredient in nuclear energy and weaponry.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart