CoreWeave (CRWV) is once again in focus, as Wedbush’s Dan Ives reinstated this AI cloud service provider as a member of the IVES AI 30 list, citing that this player will begin the new year as one of the top picks going into 2026. Indeed, this is well-timed, as the CRWV stocks do appear to be taking off once again, even though the AI investment landscape seems increasingly discerning.

However, industry-level catalysts remain on the uptick as well. Wall Street is anticipating a robust year for AI investment, with Ives predicting a technology-led bounce as the adoption of AI solutions in the enterprise gathers pace. CoreWeave is right at the heart of this phenomenon, providing high-density GPU infrastructure solutions for AI labs, cloud, and enterprises worldwide. Meanwhile, investor sentiment remains mixed on whether the AI phenomenon has reached a fever pitch, with CoreWeave’s recent earnings further proving that interest in compute resources remains strong.

About CoreWeave Stock

CoreWeave is a purposeful AI cloud service provider with origins in New Jersey, focusing on high-performance GPU computing designed for model training, inference, and next-gen applications. Currently, with a mid-cap valuation approaching, the firm has established its position as one of the most rapidly growing independent AI cloud platforms, thanks to its strong tie-ups with Nvidia (NVDA), as well as some leading-edge AI developers.

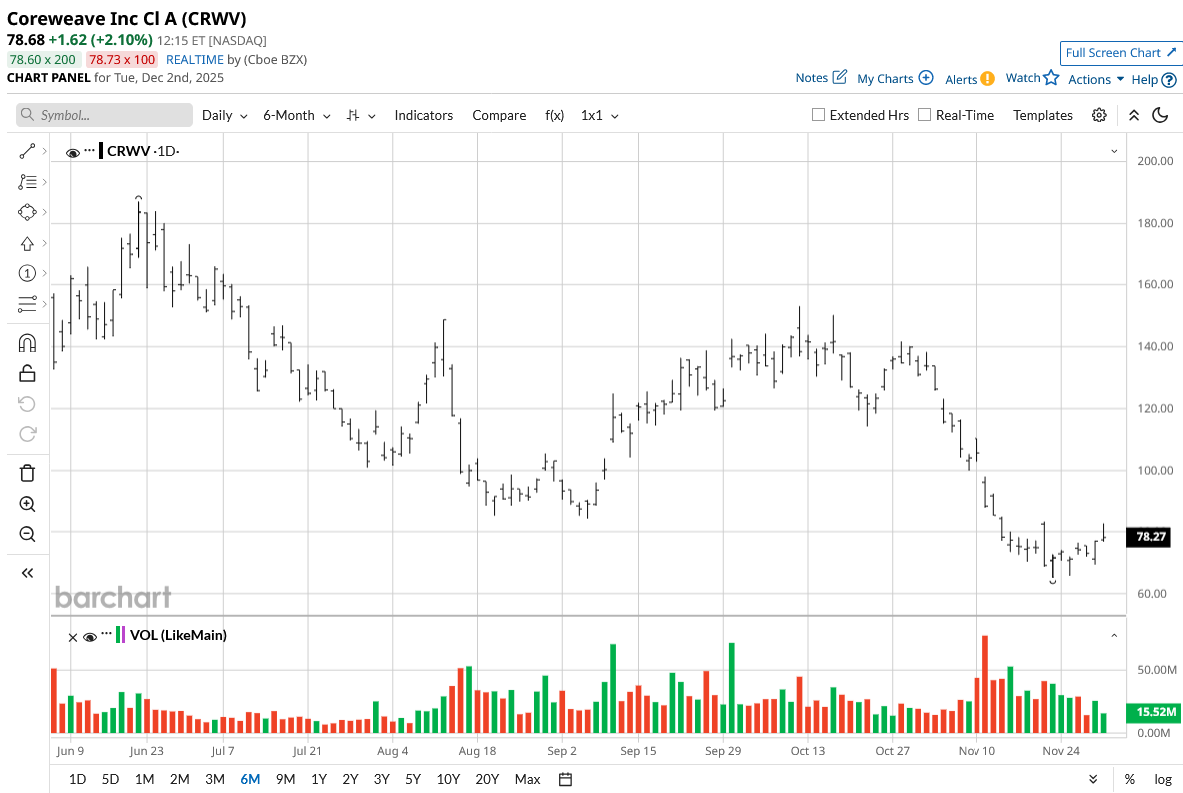

Over the previous 52 weeks, CRWV has ranged from a low of $33.51 to a high of $187.00, showing the extreme volatility CRWV experiences as the market reprices the economy that underpins AI infrastructure. Recently, the stock experienced corrections, which, however, marked a remarkable turnaround with more than a 7% increase over the last five trading days, as the stock recovered from a multichart low. Although the S&P 500 ($SPX) rose modestly this year, CRWV’s long-term course reflects the evolving demand for AI-exposed stocks with strong revenue.

In terms of valuation, CRWV’s current price/sales multiple of 8.9x is rich compared with the rest of the technology space, although this is not unusual for a high-growth infrastructure provider scaling its operations. Currently, this firm is not reporting material GAAP earnings, thanks largely to its infrastructure development costs, so its price/earnings multiple is undefined. The fact that its debt/equity ratio of 3.62x reflects its capital-intensive infrastructure development effort, although its recent borrowing restructuring did limit its costs, suggests that this firm’s investment cycle is shorter term, with its associated fast-growth nature.

CoreWeave does not offer a dividend.

CoreWeave Beats on Earnings

CoreWeave reported its second successive record quarter in Q3 2025, with revenue of $1.36 billion, a strong increase from last year’s $583.9 million. Although GAAP operating income was down, with increased addition costs and interest, the fact remains that CoreWeave reported strong adjusted EBITDA of $838.1 million, with its associated margin of a robust 61% truly remarkable, especially given its rapid scale.

Backlog was noted as having nearly doubled to $55.6 billion, driven by key multi-year contracts with Meta (up to $14.2 billion), OpenAI (expanded from $3.0 billion to a total of $22.4 billion), and its sixth relationship with a global hyperscaler.

We highlighted the acceleration of demand for its GB300 AI server solution, as well as the adoption of Blackwell-based cluster solutions, as strong factors driving its second-quarter revenue.

The report also pointed out some of the key execution wins, which include CoreWeave increasing its active power capacity in the quarter by 120 MW, its contracted capacity reaching 2.9 GW, and its launch of Nvidia GB300 NVL72 systems, being the first cloud provider. Other acquisitions, such as OpenPipe, reflect the firm’s efforts to pursue AI soft services as well as its fleet of purpose-built facilities.

The firm did not provide any forward-looking revenue or EPS guidance, but the company indicated that 2026 will comprise many scale-up moments in terms of capacity, infrastructure, and customer scale.

What Analysts Expect for CRWV Stock

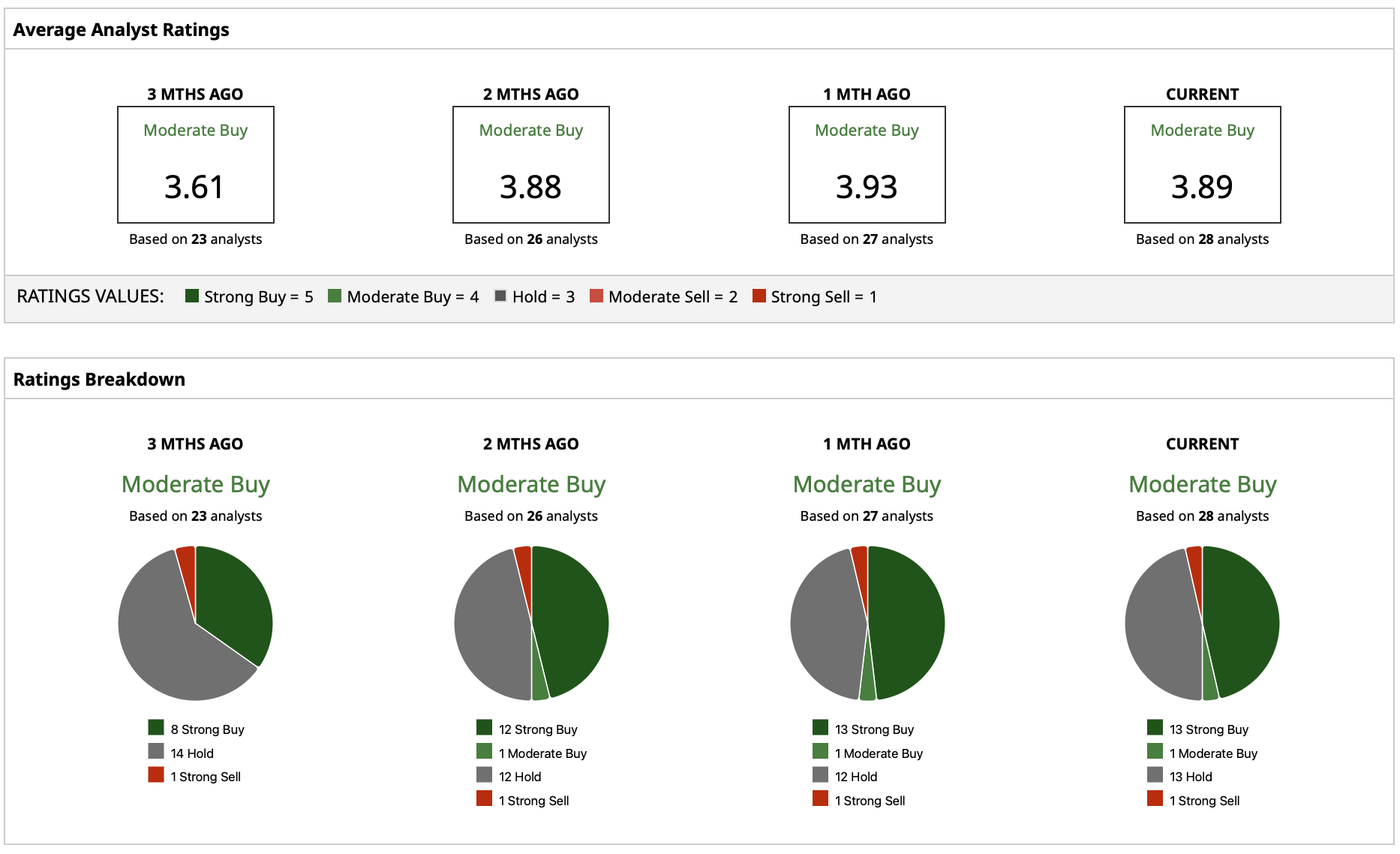

CoreWeave retains a "Strong Buy" consensus rating, driven by its increasingly robust backlog, partnerships, and widened infrastructure reach. Analysts regard the firm as one of the most obvious picks as a beneficiary within the multi-trillion-dollar AI infrastructure cycle identified by Dan Ives of Wedbush.

The mean target of $131.23 captures upside of approximately 70% from current levels of around $78, although the Street-high target of $200 captures more than a double. This reflects a range of views on execution and capital intensity but nonetheless reflects faith in CoreWeave’s positioning as a cloud AI leader.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Applied Calculus Says Nutanix (NTNX) Is Mispriced—And the Math Is Hard to Ignore

- Should You Go on Cathie Wood’s ARK ETF Diet?

- Dan Ives Is Betting Big on CoreWeave Stock as an AI Winner. Should You Buy CRWV Too?

- Analysts Say AWS Will Drive ‘Significant Upside’ for Amazon. Should You Buy AMZN Stock Now?