The soft red winter wheat (ZWH26), soybean (ZSF26), meal (ZMF26), and soybean oil (ZLF26) markets at present look very heavy and susceptible to more price downside in the near term. However, corn (ZCH26) and hard red winter wheat (KEH26) late last week showed some price strength.

Corn may be the most important grain market to watch in the near term. My grain-market-reporting days on the floor of the Chicago Board of Trade nearly 40 years ago remind me that veteran grain traders would tell me, “Corn is king.” The corn market’s resilience late last week, in the face of solid selling pressure in the soybean complex and SRW wheat markets, is one potential bright spot in which King Corn may be attempting to pull the other grains out of their price slumps.

Corn Showing Resilience

March corn futures last week gained 3 cents, so it was not a bad trading week for the bulls. As the calendar year winds down, look for low-volume trade around the holidays and ahead of the USDA’s January crop production report.

Corn and soybean traders will continue to closely monitor growing conditions for South American crops. In Brazil, a late-planted soybean crop will bring a particular focus on safrinha (second-crop) corn plantings. Weather forecasters say Brazil and Paraguay will see rains through the next two weeks, with enough rain in much of the region to support crop development. In Argentina, a wetter weather pattern will continue in the coming days and benefit crops.

Export demand for U.S. corn has been good over the past few months. While corn futures prices have languished the past few weeks, the hefty U.S. corn sales abroad should keep a floor under futures prices.

Soybeans Struggling Despite Stepped-Up China Purchases of U.S. Beans

January soybean futures last Friday hit a seven-week low and for the week were down 27 1/2 cents. January soybeans, meal and bean oil futures saw technically bearish weekly low closes on Friday as prices are trapped in downtrends on the daily bar charts. This suggests more chart-based selling pressure in the soy complex from the speculators early this week.

Soy complex bulls on Friday got no help from the USDA reporting daily U.S. soybean export sales of 134,000 metric tons of soybeans to China during the 2025-26 marketing year. U.S. trade relations with China will continue to be near the front burner of the soy complex futures markets. China is so far meeting its pledge to the U.S. regarding the amount of U.S. soybeans purchased. However, new and big U.S. arms sales to Taiwan announced last week did not please China, as the negative rhetoric between the two largest economies in the world seems to be rising a bit.

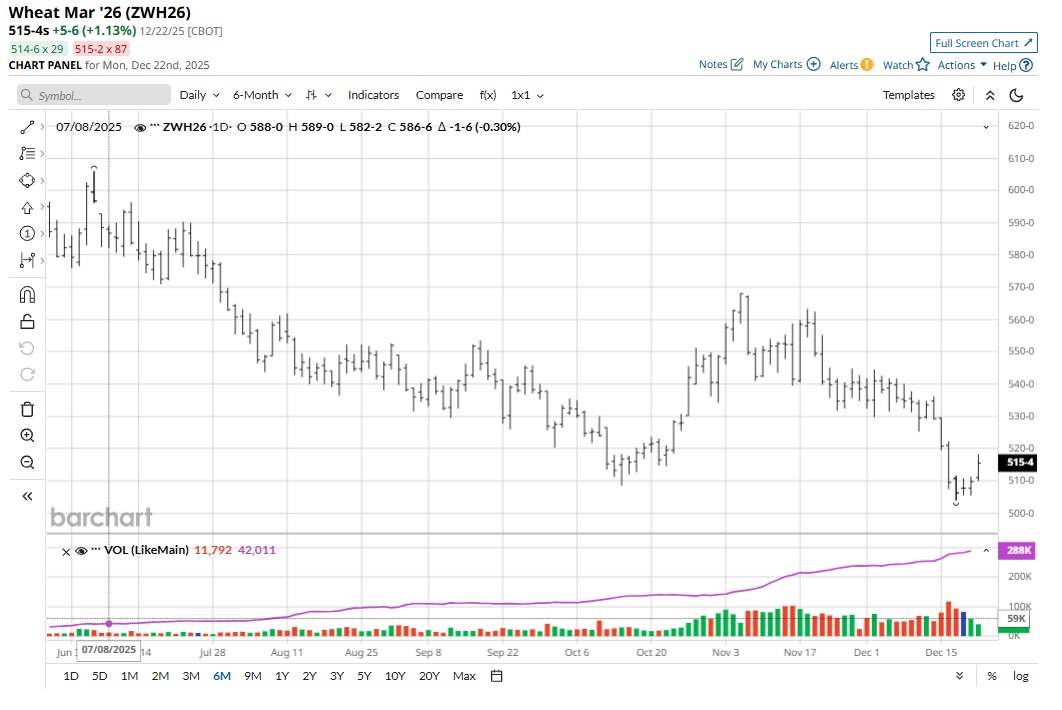

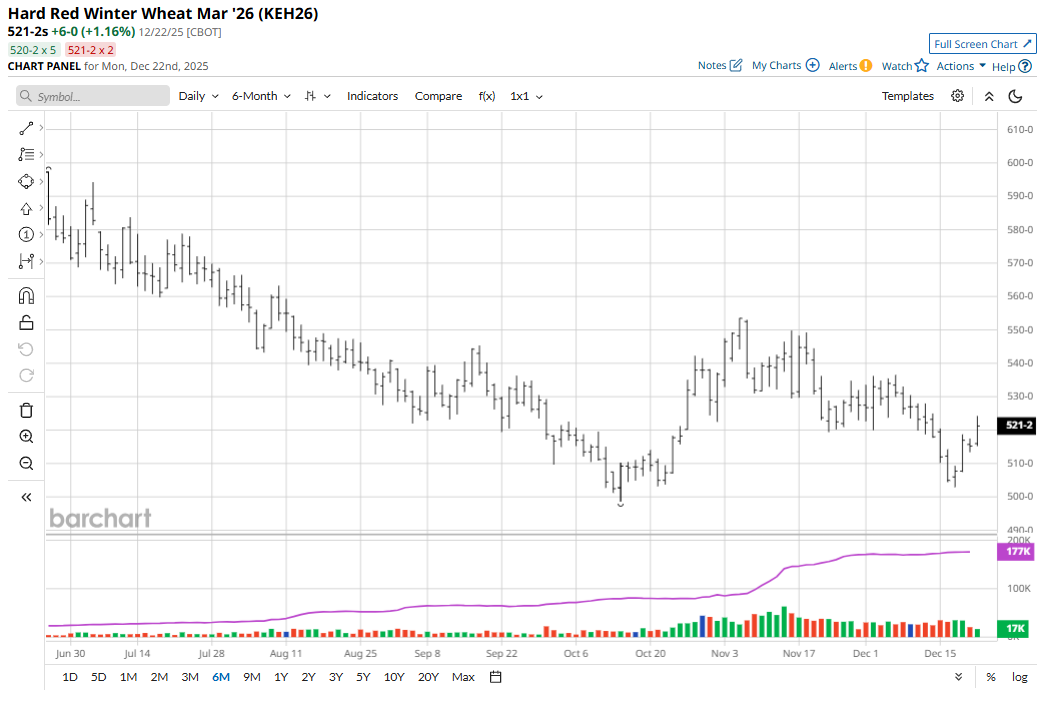

Wheat Futures Market Bears in Firm Control

March soft red winter wheat futures prices last week lost 19 1/2 cents. March hard red winter wheat fared better, losing only 2 3/4 cents for the week. The winter wheat futures markets remain trapped in price downtrends on the daily bar charts. That may keep the speculative bears wanting to play on the short sides in the near term. However, the stable corn market last week, in the face of selloffs in soybeans and wheat futures markets, gives the wheat bulls some hope there may not be much more downside in winter wheat futures.

Hefty global supplies and mostly favorable weather conditions around the globe have kept wheat futures buyers at bay. However, there is lingering uncertainty over U.S. planted acres and whether it will be harvested or grazed. The all-important late-March USDA planting intentions report will provide grain traders with more definitive crop acres numbers.

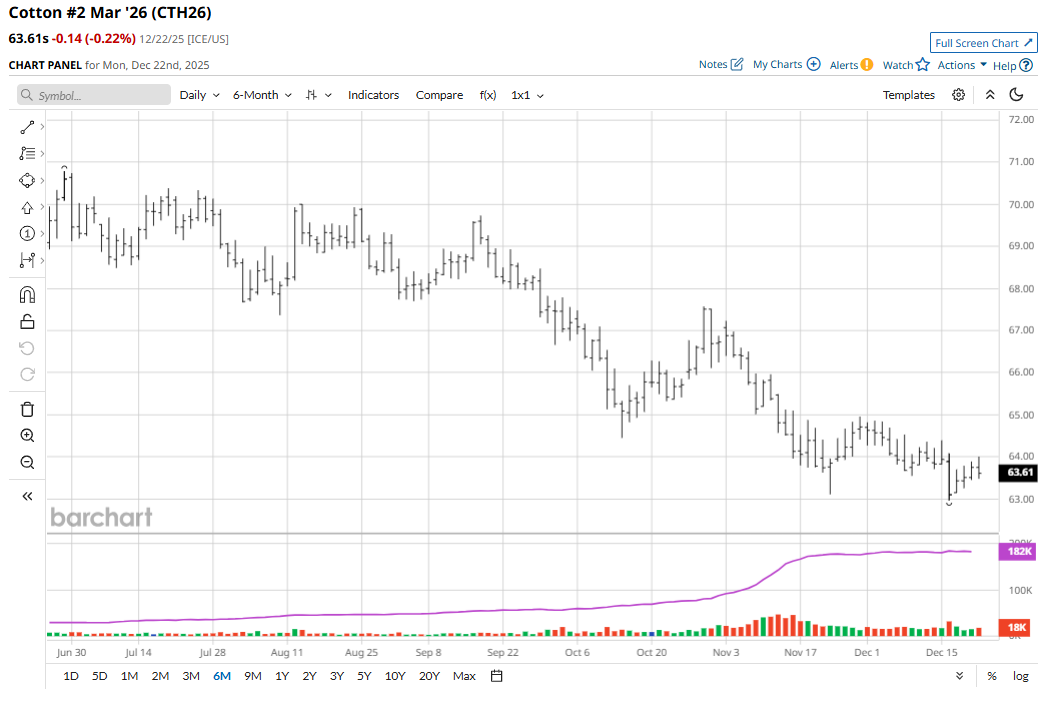

Cotton Bears Keeping a Firm Grip

Cotton (CTH26) continues to languish at lower price levels and March futures last week hit a contract low. The market late last week saw some tepid short covering. However, the still-bearish near-term technical posture continues to limit buying interest from the speculators. Cotton traders will continue to look to the grain futures markets for their own daily price direction next week. The Christmas holiday Thursday will likely make for a quieter, lower-volume trading week in cotton futures, as well as the grain markets.

A surprisingly tame U.S. consumer price index last week likely provided a further boost to U.S. consumer confidence, following the Federal Reserve interest rate cut in early December. That should be good news for the cotton market and prompt some better demand for apparel. However, consumer apparel trends in recent years have moved more toward synthetic fibers, which has been an underlying worry for the cotton market bulls for some time now.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart