Valued at a market cap of $86 billion, Saint Paul, Minnesota-based 3M Company (MMM) is a diversified global technology company that delivers a wide range of products and solutions across the Safety and Industrial, Transportation and Electronics, and Consumer segments. It serves customers worldwide through e-commerce, distributors, retailers, and direct sales channels.

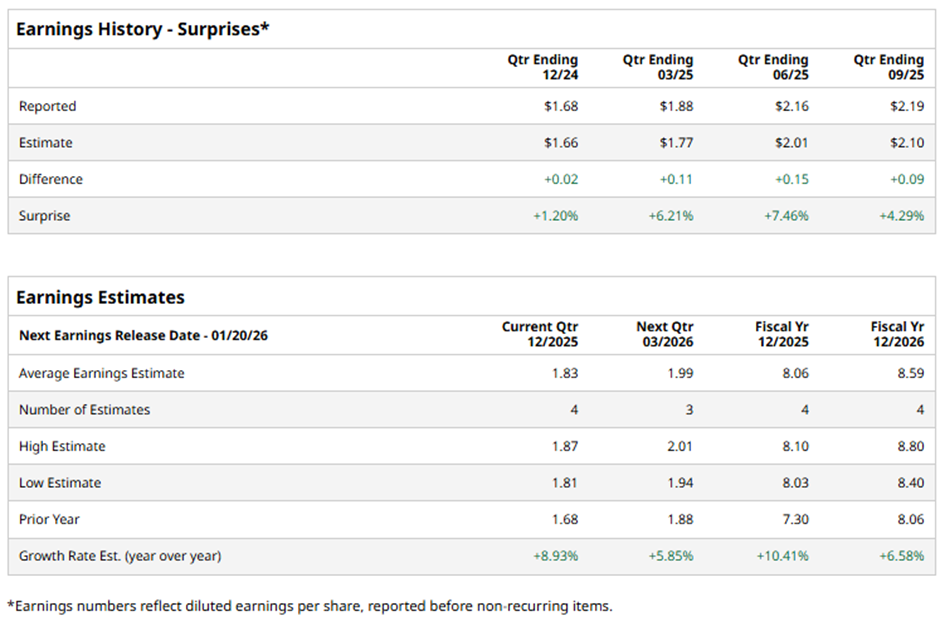

3M is expected to unveil its fiscal Q4 2025 results soon. Prior to the event, analysts anticipated the industrial giant to post an adjusted EPS of $1.83, up 8.9% from $1.68 in the same quarter last year. It has surpassed Wall Street's earnings projections over the last four quarters.

For fiscal 2025, analysts predict MMM to report adjusted EPS of $8.06, a 10.4% increase from $7.30 in fiscal 2024.

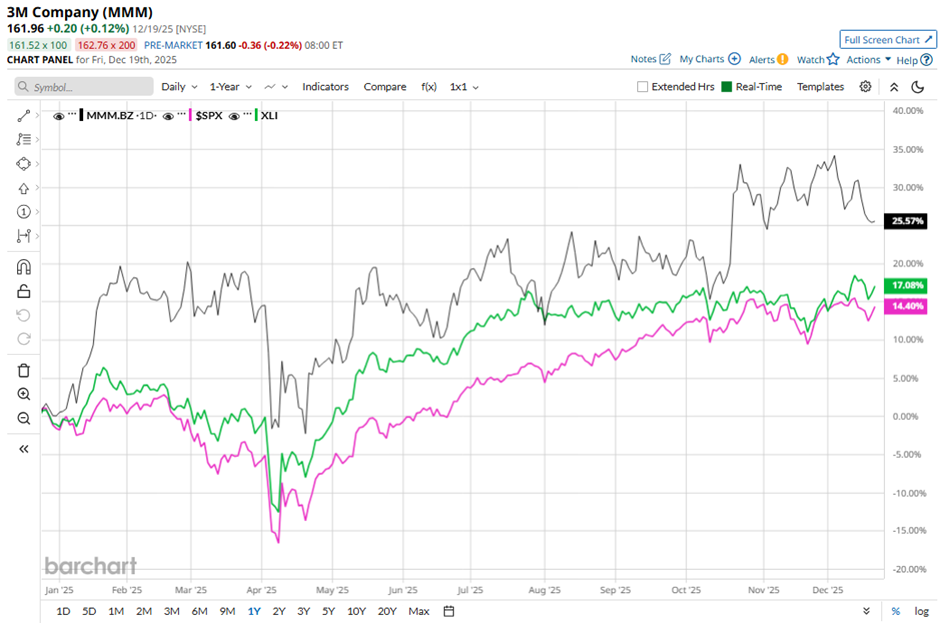

MMM's shares have climbed 27.4% over the past 52 weeks, outpacing the broader S&P 500 Index's ($SPX) 16.5% gain and the Industrial Select Sector SPDR Fund's (XLI) 17.8% increase over the same period.

Shares of 3M surged 7.7% on Oct. 21 after the company raised its 2025 adjusted EPS forecast to $7.95 - $8.05, driven by a shift toward higher-margin products and tighter cost controls. The company reported Q3 2025 adjusted EPS of $2.19 and revenue of $6.32 billion, surpassing expectations. Investors were also encouraged by product innovation under the management, including 70 new product launches in Q3 and expectations to reach 250 by year-end, alongside a 22.8% drop in selling, general, and administrative expenses.

Analysts' consensus rating on MMM stock is cautiously optimistic, with a "Moderate Buy" rating overall. Out of 16 analysts covering the stock, opinions include nine "Strong Buys," six "Holds," and one "Strong Sell." This configuration is slightly less bullish than three months ago, with 10 “Strong Buy” ratings on the stock.

The average analyst price target for 3M Company is $177.40, indicating a 9.5% potential upside from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart