Greenwich, Connecticut-based Interactive Brokers Group, Inc. (IBKR) operates as an automated electronic broker. Valued at $109 billion by market cap, the company specializes in executing and clearing trades in stocks, options, futures, foreign exchange, bonds, mutual funds, and exchange-traded funds. It also offers custody, prime brokerage, securities, and margin lending services. The leader in the digital brokerage space is expected to announce its fiscal fourth-quarter earnings for 2025 in the near term.

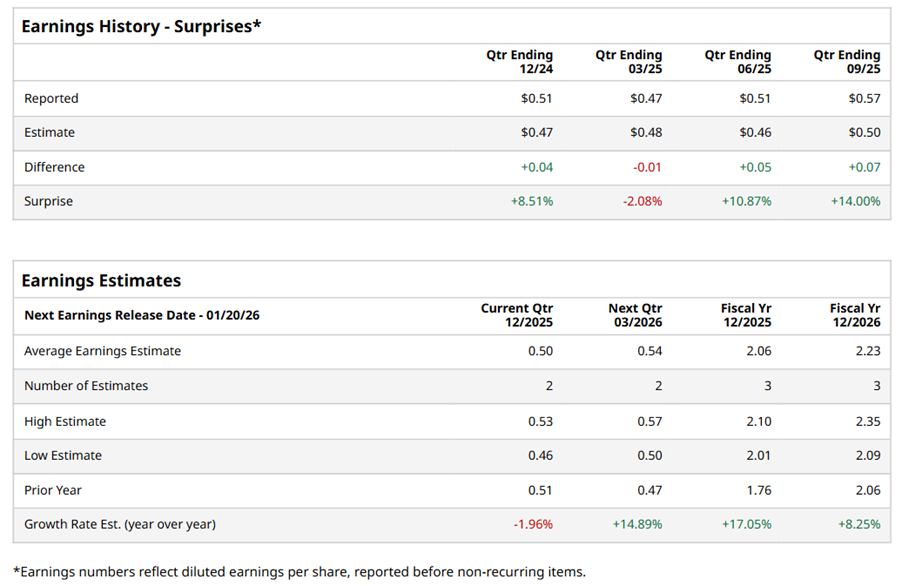

Ahead of the event, analysts expect IBKR to report a profit of $0.50 per share on a diluted basis, down 2% from $0.51 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect IBKR to report EPS of $2.06, up 17.1% from $1.76 in fiscal 2024. Its EPS is expected to rise 8.3% year over year to $2.23 in fiscal 2026.

IBKR stock has outperformed the S&P 500 Index’s ($SPX) 16.5% gains over the past 52 weeks, with shares up 47.9% during this period. Similarly, it outperformed the Financial Select Sector SPDR Fund’s (XLF) 14.7% returns over the same time frame.

IBKR is outperforming due to strong net new account growth, increased trading activity, and robust gains in commission revenue and net interest income. The company surpassed four million customers and $750 billion in client equity, driven by international client growth and product innovations such as crypto trading and futures contracts. Management is focused on sustaining growth through innovation and global expansion, but cautions that declining benchmark interest rates could pressure net interest income.

On Oct. 16, IBKR reported its Q3 results, and its shares closed down more than 3% in the following trading session. Its revenue was $1.7 billion, surpassing analyst estimates of $1.5 billion. The company’s adjusted EPS of $0.57 beat analyst estimates by 6.1%.

Analysts’ consensus opinion on IBKR stock is bullish, with a “Strong Buy” rating overall. Out of nine analysts covering the stock, eight advise a “Strong Buy” rating, and one gives a “Hold.” IBKR’s average analyst price target is $80.12, indicating a potential upside of 24.7% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart