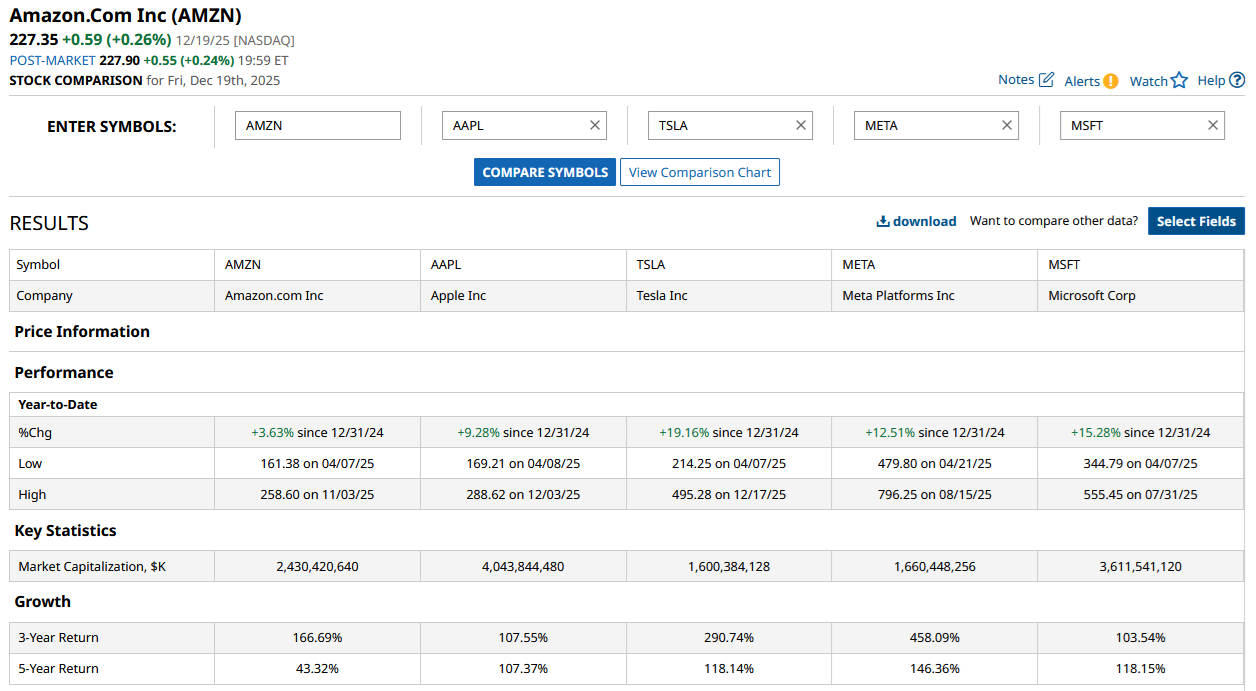

With year-to-date (YTD) gains of a mere 3.6%, Amazon (AMZN) is set to underperform the S&P 500 Index ($SPX), which is on track to deliver double-digit returns for the third consecutive year. Unless we see something dramatic over the next week, Amazon will end up as the worst-performing “Magnificent 7” constituent this year.

While the coveted group did not have a roaring year with Apple (AAPL), Microsoft (MSFT), and Meta Platforms (META) underperforming the S&P 500 Index and Tesla (TSLA) only slightly nudging ahead following the recent rally, Amazon’s underperformance stands out.

Amazon entered 2025 as a “top pick” for many brokerages—a distinction it had held for the previous couple of years. However, the stock failed to live up to expectations and is on track to underperform the broader markets by a wide margin. Notably, while Amazon shares outperformed in the preceding two years, riding the artificial intelligence (AI) mania, they underperformed in 2021 and 2022.

In fact, over the last five years, AMZN is up just 43%, which is just about half of what the average S&P 500 Index constituent has delivered. Meanwhile, brokerages are quite bullish on the stock’s prospects, and BMO, TD Cowen, Wedbush, Truist, J.P. Morgan, and Evercore ISI have named Amazon as a “top idea” or equivalent for 2026.

Why Did Amazon's Stock Underperform in 2025?

Barring brief periods, particularly following the Q3 2025 earnings release, Amazon stock underperformed peers this year. There’s a lot that’s making markets apprehensive, which is reflected in the stock’s price action. Here’s a brief overview:

- Rising Competition: Amazon is facing competitive pressure from legacy brick-and-mortar stores like Walmart (WMT), as well as Temu and Shein, which have become popular with their ultra-low-cost merchandise.

- Market Share Losses in AWS: While Amazon Web Services’ (AWS) growth has rebounded, it continues to lose market share to Microsoft and Alphabet (GOOG) (GOOGL), which are growing at a much faster rate.

- Capex Taking a Toll on Cash Flows: The Amazon story was never about GAAP earnings, but the stellar cash flows that it generated. However, the burgeoning capex, particularly towards building the artificial intelligence (AI) infrastructure, is taking a toll on the company’s free cash flows. Amazon’s trailing 12-month free cash flows plunged to $14.8 billion at the end of Q3 2025, while the corresponding numbers in 2024 and 2023 were $47.7 billion and $21.4 billion, respectively. While AI could drive Amazon’s growth and help the company lower costs, intermittent concerns over tech companies’ ability to monetize their AI investments have put pressure on their stock prices.

- Impact of AI: While AI would positively impact nearly all aspects of Amazon’s business, there are concerns that the rise of third-party AI shopping agents is a threat to Amazon’s lucrative and fast-growing digital advertising business.

AMZN Stock 2026 Forecast

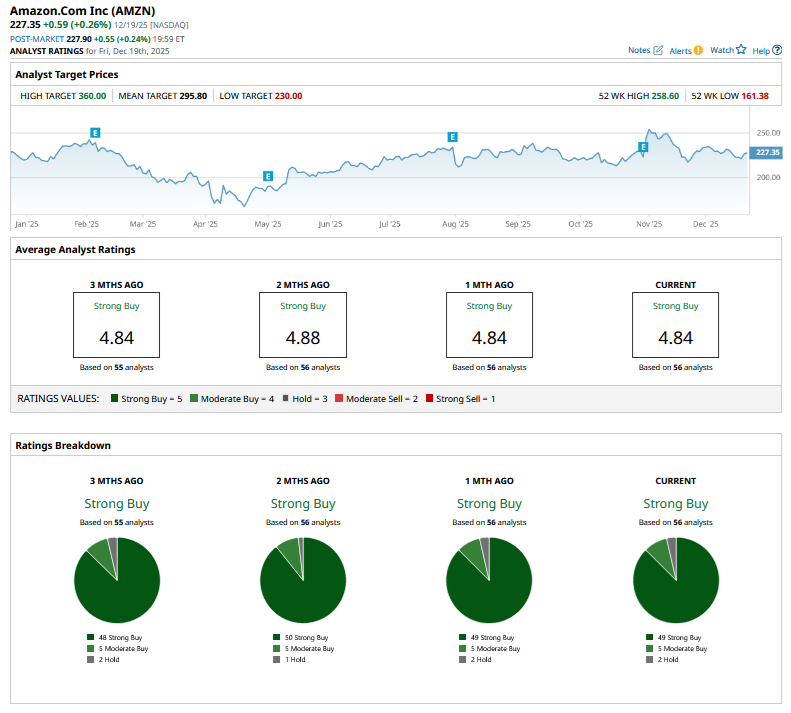

Brokerages are upbeat on Amazon’s forecast, and it has a consensus rating of “Strong Buy” from the 56 analysts covering the stock. AMZN’s mean target price of $295.80 is 30% higher than the current price levels. The stock trades even below the most pessimistic target price of $230, while the Street-high target price of $360 represents a potential upside of 58%.

Should You Buy Amazon Stock?

While Amazon’s e-commerce growth in developed markets might have plateaued, the company should be able to bolster its growth. Amazon is doubling down on groceries and has even launched a private food brand, which would help it increase its total addressable market. Haul, which is Amazon’s platform to take on the likes of Temu and Shein, should also help the company earn additional revenues. Amazon's business-to-business (B2B) platform, Amazon Business, is another potential growth driver to watch, and it is already running at a multi-billion-dollar gross revenue run rate.

Prime should also help drive Amazon’s growth next year, and we might even see the company hike prices. The company has started cracking down on Prime password sharing and should ramp up ads in 2026, which would help it increase its digital ad business.

AMZN stock trades at a forward price-to-earnings (P/E) multiple of 31.7x, which looks quite tempting to me even as earnings growth might be tepid over the next couple of years on higher depreciation expenses emanating from the AI capex.

I find Amazon among the best structural growth stories, as the company is a play on several high-potential sectors like e-commerce, cloud, streaming, digital advertising, and now even AI. I have been bullish on Amazon stock for quite some time, and while I did book some profits earlier this year, I have used the recent dip to add more shares.

On the date of publication, Mohit Oberoi had a position in: AMZN , META , AAPL , TSLA , MSFT , GOOG . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Palo Alto Networks Stock Is Down But Not Out - Worth Buying PANW Here?

- Valero (VLO) Stock Just Triggered a Rare Quant Signal the Options Market Is Missing

- Morgan Stanley Sees a Sweet Turnaround Play in This 1 Stock. Should You Buy Shares Here?

- As Nvidia Acquires SchedMD, Should You Buy, Sell, or Hold NVDA Stock?