With a market cap of $58.4 billion, Freeport-McMoRan Inc. (FCX) is an Arizona-based mining and metals company. Freeport’s core business is exploration, mining, and production of mineral resources, with a strategic emphasis on copper, a critical industrial metal used in electrical infrastructure, renewable energy, and electrification. The leading international metals company is expected to announce its fiscal fourth-quarter earnings soon.

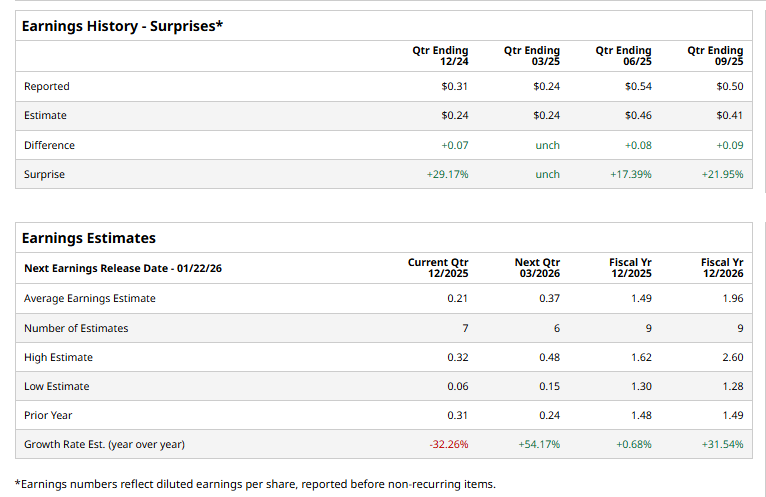

Ahead of the event, analysts expect FCX to report a profit of $0.21 per share on a diluted basis, down 32.3% from $0.31 per share in the year-ago quarter. The company beat or met consensus estimates in all four quarters over the past year.

For the current year, analysts expect FCX to report EPS of $1.49, up marginally from $1.48 in fiscal 2024. Its EPS is expected to rise 31.5% year over year to $1.96 in fiscal 2026.

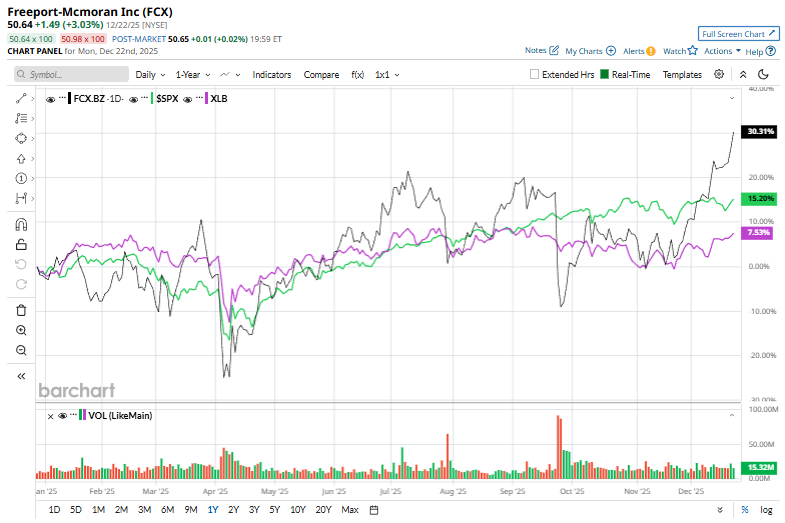

FCX stock has climbed 30.3% over the past year, outpacing the S&P 500 Index’s ($SPX) 16% gains and the Materials Select Sector SPDR Fund’s (XLB) 6.7% rally over the same time frame.

Freeport-McMoRan has outperformed the broader market over the past year largely on the back of strength in copper prices, its primary earnings driver, supported by tightening global supply and rising demand from electrification, renewable energy, and data-center infrastructure. The company has also benefited from favorable pricing dynamics in the U.S. market, which helped support margins despite operational variability.

On Dec. 15, shares of Freeport-McMoRan climbed more than 1% as a broad rally in mining stocks lifted the sector, driven by substantial gains in copper prices of over 1% and a supportive upswing across precious metals.

Analysts’ consensus opinion on FCX stock is highly bullish, with a “Strong Buy” rating overall. Out of 20 analysts covering the stock, 14 advise a “Strong Buy” rating, three suggest a “Moderate Buy,” and three give a “Hold.” FCX’s average analyst price target is $50.95, indicating a marginal potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart