With a market cap of $57.3 billion, SLB N.V. (SLB) is a global provider of technology and services for the energy industry, supporting field development, hydrocarbon production, carbon management, and integrated energy systems. The company operates through four divisions: Digital & Integration; Reservoir Performance; Well Construction; and Production Systems, offering solutions that span subsurface evaluation, drilling, well construction, and production optimization.

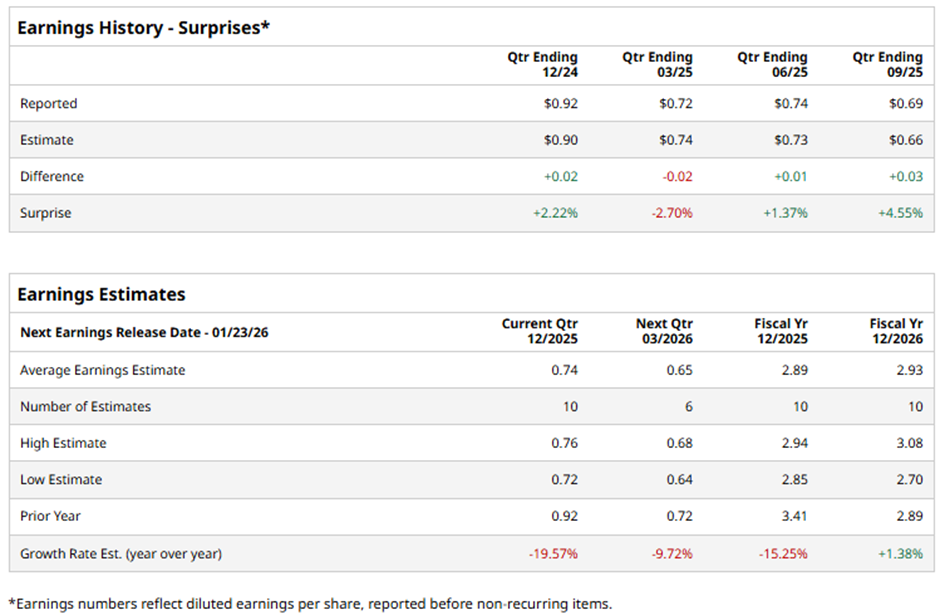

The Houston, Texas-based company is expected to announce its fiscal Q4 2025 results on Friday, Jan. 23. Ahead of this event, analysts predict SLB to report an adjusted EPS of $0.74, down 19.6% from the previous year's $0.92. It has surpassed Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts forecast SLB to post an adjusted EPS of $2.89, a decrease of 15.3% from $3.41 in fiscal 2024. However, the company’s adjusted EPS is projected to rise 1.4% year-over-year to $2.93 in fiscal 2026.

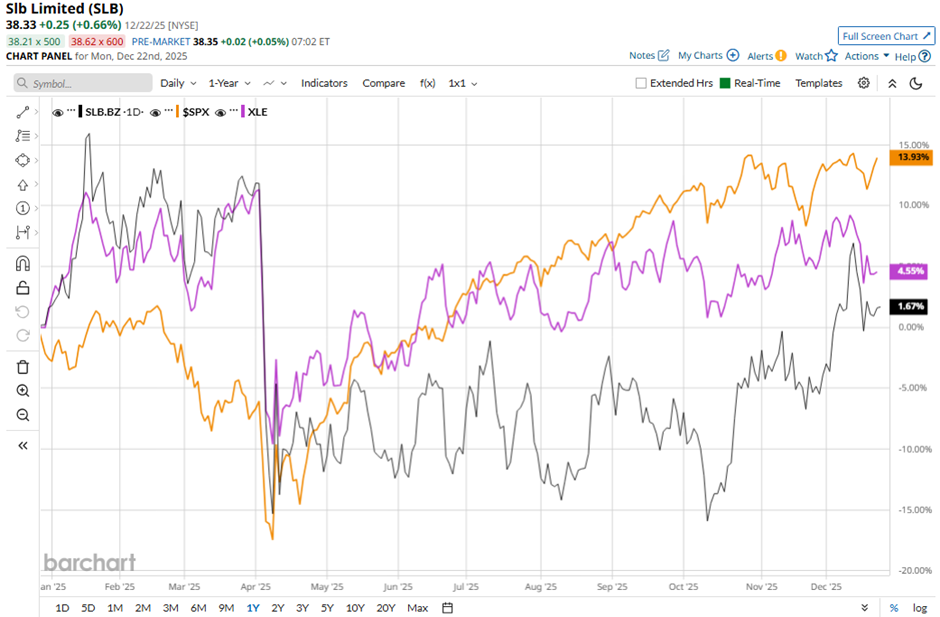

SLB stock has risen 4.1% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) nearly 16% gain and the Energy Select Sector SPDR Fund's (XLE) 5.1% return over the same period.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $0.69, SLB’s shares fell marginally on Oct. 17 as the management signaled no significant pickup in North American drilling activity, citing high production costs in some shale basins and an oversupplied oil market. Investors also reacted to operational softness, including a 7% drop in international revenue to $6.92 billion, disruptions in Ecuador, and a 9% global revenue decline when excluding the ChampionX acquisition.

Analysts' consensus view on SLB stock is bullish, with a "Strong Buy" rating. Out of 23 analysts covering the stock, 16 give a "Strong Buy," four have a "Moderate Buy," and three give a "Hold" rating. This configuration is slightly more bullish than three months ago, with 15 “Strong Buy” ratings on the stock.

The average analyst price target for SLB is $47.17, indicating a potential upside of 23.1% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart