With a market cap of $59.2 billion, PACCAR Inc. (PCAR) is a global leader in the design, manufacture, and distribution of high-quality commercial trucks, with a strong presence in the heavy- and medium-duty vehicle markets. Headquartered in Bellevue, Washington, the company operates through well-known truck brands including Peterbilt, Kenworth, and DAF, which are recognized for their premium quality, performance, and reliability.

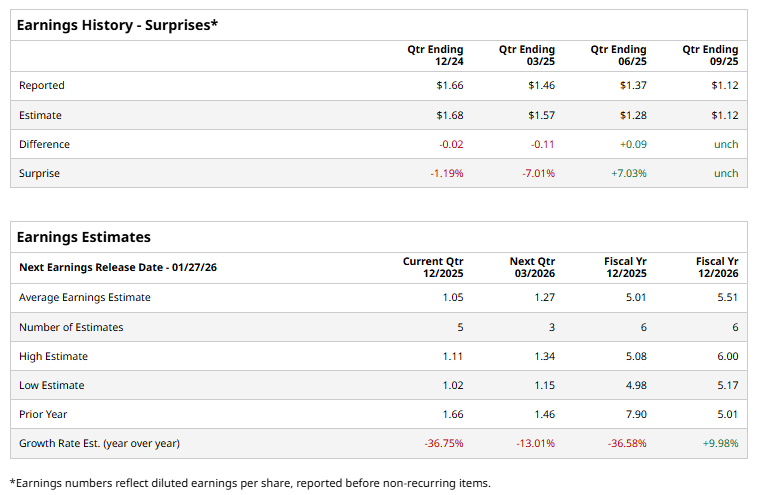

The industrial giant is set to announce its Q4 results shortly. Ahead of the event, analysts expect PACCAR to report a profit of $1.05 per share, down 36.8% from $1.66 per share reported in the year-ago quarter. The company has surpassed Wall Street’s bottom-line projections twice over the past four quarters while missing on two other occasions.

For fiscal 2025, PCAR is expected to deliver an EPS of $5.01, down 36.6% from $7.90 in 2024. However, in fiscal 2026, its earnings are expected to grow nearly 10% year over year to $5.51 per share.

PCAR shares have increased 6.7% over the past 52 weeks, underperforming the S&P 500 Index’s ($SPX) 15.7% returns and the Industrial Select Sector SPDR Fund’s (XLI) 17.9% gains during the same time frame.

On Dec 9, PACCAR’s Board declared a regular quarterly cash dividend of $0.33 per share, payable on March 4, 2026, to shareholders of record as of February 11, 2026, along with an extra cash dividend of $1.40 per share, payable on January 7, 2026, to shareholders of record as of December 19, 2025. Following the announcement, PACCAR shares rose 4.2% in the next trading session.

Analysts remain cautiously optimistic about the stock’s prospects. PCAR has a consensus “Moderate Buy” rating overall. Of the 18 analysts covering the stock, opinions include seven “Strong Buys,” and 11 “Holds.” It currently trades above the mean price target of $111.70

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 2 Dividend Kings Quietly Beating the Market This Year

- If You Were Gifted $10,000 of Nvidia Stock Last Christmas, Here’s How Much It Would Be Worth Today

- Virgin Galactic Stock Is Challenging This Key Resistance Level as Trump Goes All In on Space

- Should You Buy FJET Stock After the Starfighters Space IPO?