With a market cap of $111.7 billion, Lockheed Martin Corporation (LMT) is a leading aerospace and defense company that provides advanced technology systems and services worldwide. It operates through four segments - Aeronautics; Missiles and Fire Control (MFC); Rotary and Mission Systems (RMS); and Space, offering solutions in military aircraft, missile defense, helicopters, space systems, and cyber security.

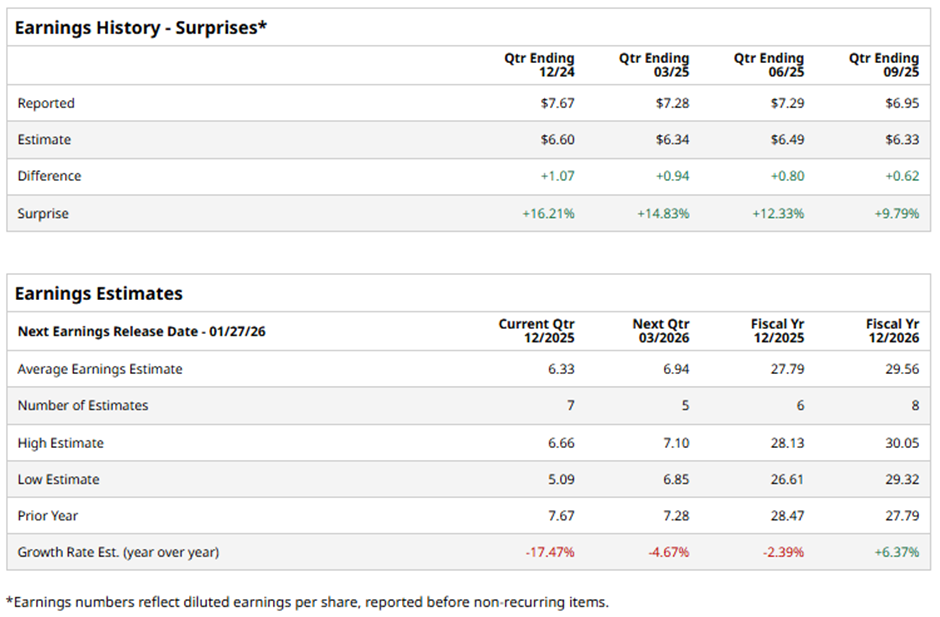

The Bethesda, Maryland-based company is expected to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts forecast LMT to report a profit of $6.33 per share, down 17.5% from $7.67 per share in the year-ago quarter. However, it has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts predict the world’s largest defense contractor to report an EPS of $27.79, down 2.4% from $28.47 in fiscal 2024. However, EPS is anticipated to grow 6.4% year-over-year to $29.56 in fiscal 2026.

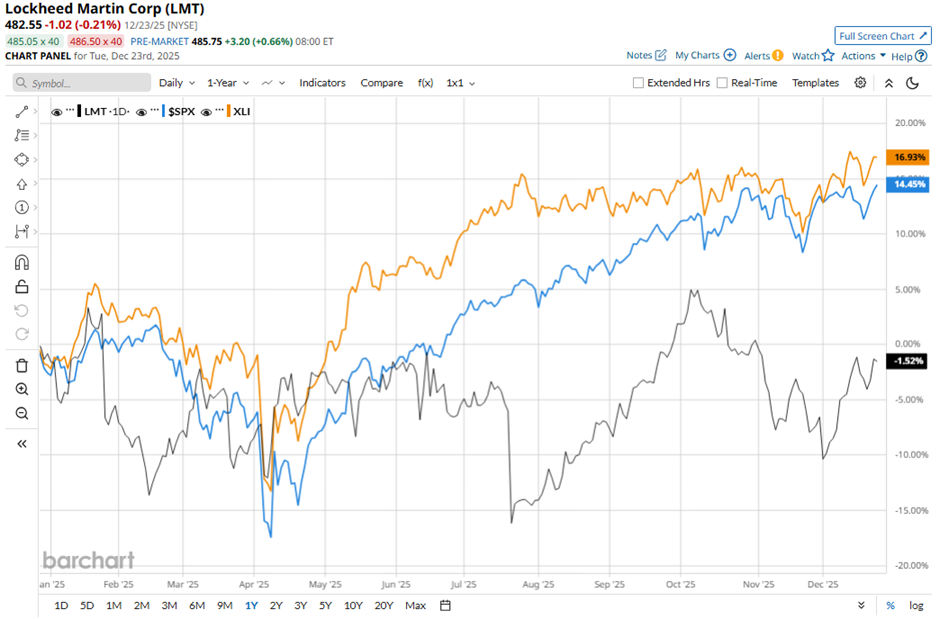

Shares of LMT have declined marginally over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 15.7% gain and the State Street Industrial Select Sector SPDR ETF’s (XLI) 17.9% increase over the same period.

Lockheed Martin reported stronger-than-expected Q3 2025 EPS of $6.95 and revenue of $18.61 billion on Oct. 21. The company also raised its 2025 outlook, increasing its EPS forecast to $22.15 - $22.35 and lifting the lower end of its revenue guidance to $74.25 billion. Nevertheless, the stock fell 3.2% on that day.

Analysts' consensus view on Lockheed Martin’s stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 23 analysts covering the stock, seven recommend "Strong Buy," 15 suggest "Hold," and one advises "Strong Sell." The average analyst price target for LMT is $524.05, suggesting a potential upside of 8.6% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart