Valued at $35.6 billion by market cap, Sysco Corporation (SYY) is a leading American multinational food-service distribution company and a core participant in the consumer staples sector. Headquartered in Houston, Texas, Sysco primarily markets and distributes a broad range of food and related products, including fresh, frozen, and prepared foods, meat, seafood, produce, dairy, beverages, and imported specialties, as well as non-food items such as disposable paper products, tableware, kitchen equipment, and cleaning supplies to restaurants, healthcare facilities, educational institutions, hotels, and other food-service operators worldwide.

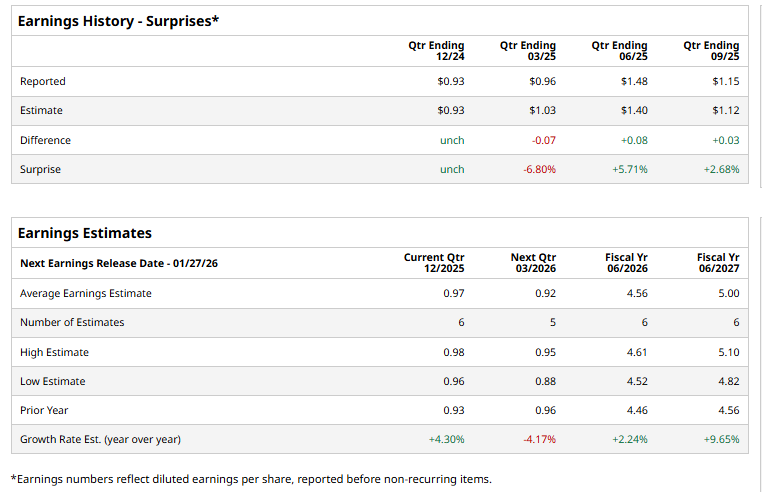

The food service giant is expected to announce its fiscal second-quarter earnings soon. Ahead of the event, analysts expect SYY to report a profit of $0.97 per share on a diluted basis, up 4.3% from $0.93 per share in the year-ago quarter. The company beat or matched the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect SYY to report EPS of $4.56, up 2.2% from $4.46 in fiscal 2025. Its EPS is expected to rise 9.7% year over year to $5 in fiscal 2027.

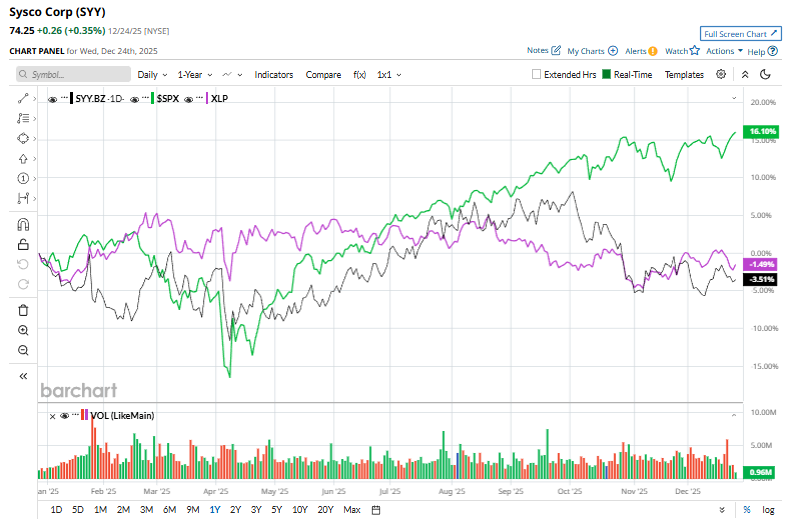

SYY stock has plummeted 4.2% over the past year, trailing the S&P 500 Index’s ($SPX) 14.8% gains and the Consumer Staples Select Sector SPDR Fund’s (XLP) 1.7% losses over the same time frame.

Sysco’s stock has trailed the broader market over the past year primarily due to slower growth and margin pressures rather than company-specific structural issues. Softer traffic at restaurants, particularly among independent operators, has weighed on volume growth, while persistent food, labor, and logistics cost inflation has pressured margins despite price pass-through efforts.

Analysts’ consensus opinion on SYY stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 16 analysts covering the stock, 10 advise a “Strong Buy” rating, and six give a “Hold.” SYY’s average analyst price target is $87.64, indicating a potential upside of 18% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Dividend Giant Yielding 4.5% Is Wall Street’s Top Telecom Pick for 2026

- Have a MERRY Christmas With These 9 Unusually Active Options

- Sydney Sweeney Made American Eagle Stock a Star in 2025. Should You Keep Buying AEO in 2026?

- CEO Satya Nadella Is Doubling Down on AI at Microsoft. Does That Make MSFT Stock a Buy Here?