Micron Technology (MU) stock was a bearish candidate that came up on one of my screeners for being 96% above its 200-day moving average.

Today, we’re going to look at a Bear Put spread trade that assumes Micron will experience a pullback from these overbought levels.

A Bear Put spread is a bearish trade that also benefits from a rise in implied volatility.

The maximum risk for a Bear Put spread is limited to the premium paid while the maximum potential profit is also capped.

The maximum profit is equal to the width between the strikes less the premium paid.

MICRON TECHNOLOGY BEAR CALL SPREAD

To create a Bear Put spread, we buy an out-of-the-money put and then sell another put further out-of-the-money.

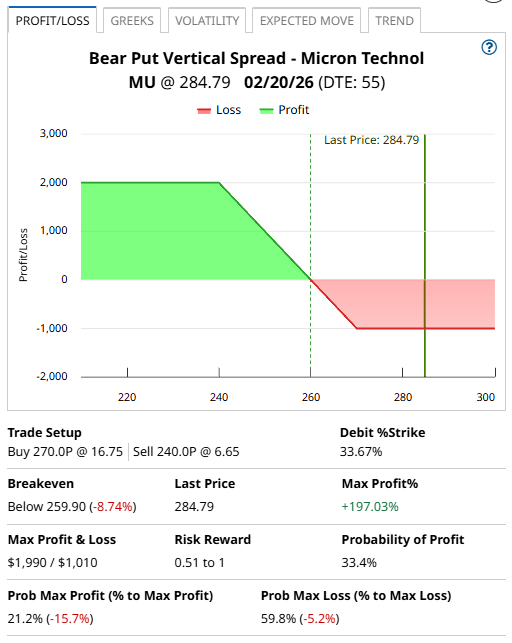

Buying the February 20th put with a strike price of $270 and selling the $240 put would create a Bear Put spread.

This spread was trading for around $10.10 on Friday. That means a trader buying this spread would pay $1,010 in option premium and would have a maximum profit of $1,990.

That represents a 197.03% return on risk between now and February 20th if MU stock falls below $240.

If Micron stock closes above $270 on the expiration date the trade loses the full $1,010.

The breakeven point for the Bear Put spread is $259.90 which is calculated as $270 minus the $10.10 option premium per contract.

COMPANY DETAILS

The Barchart Technical Opinion rating is a 100% Buy with a Strongest short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Through global brands, namely Micron, Crucial and Ballistix, Micron manufactures and markets high-performance memory and storage technologies including Dynamic Random Access Memory, NAND flash memory, NOR Flash, 3D XPoint memory and other technologies.

Its solutions are used in leading-edge computing, consumer, networking and mobile products.

Conclusion And Risk Management

One way to set a stop loss for a Bear Put spread is based on the premium paid. In this case, we paid $1,010, so we could set a stop loss equal to the 50% of the premium paid, or a loss of around $505.

Another stop loss level could be if the stock broke above $320.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Micron Technology Bear Put Spread Could Return 197% in this Down Move

- Costco Has Tumbled Despite Higher FCF and FCF Margins - Time to Buy COST Stock?

- The Saturday Spread: Using Risk Topography to Plan Your Options Strategies (JD, NTAP, ZS)

- Tesla + Robinhood + FedEx’s Unusually Active Put Options Could Deliver $Big Income Over the Next 30 Days