Quantum computing was one of the biggest investment stories of 2025. Most investors chased specialized quantum computing stocks like IonQ (IONQ), which saw massive price swings throughout the year.

However, a much larger company, Honeywell International (HON), is also part of this disruptive sector. Valued at a market cap of $125 billion, HON stock is down 8% year-to-date (YTD) and is in the midst of splitting into three separate businesses.

Most people still consider Honeywell to be a traditional industrial company that makes thermostats and building controls. However, the industrial giant also owns most of Quantinuum, a specialized firm that is currently leading the technical race in quantum computing.

To understand why this is a big deal, you have to look at how these computers are actually built. Standard quantum computers are prone to errors. To fix these errors and create one reliable, working unit of data, called a “logical qubit,” most companies need hundreds of individual “physical qubits” working together.

Quantinuum has a significant efficiency advantage due to its specific design. Its system requires two physical qubits to create one logical qubit. This 2-to-1 ratio makes the technology much more practical and closer to real-world business tasks.

For patient investors, Honeywell provides a way to bet on the future of computing without having to deal with the extreme volatility of loss-making startups.

Is Honeywell Stock a Good Buy Right Now

Honeywell International is executing a comprehensive portfolio transformation that could unlock significant shareholder value heading into 2026. Recently, CFO Mike Stepniak outlined aggressive plans to simplify the industrial conglomerate while monetizing quantum computing assets that have appreciated in recent months.

Honeywell will separate into three distinct entities. The first entity, its Advanced Materials division, became Solstice Advanced Materials (SOLS) on Oct. 30.

The second, its flagship Aerospace division, will become one of the largest pure-play aerospace suppliers post-spin-off. Aerospace CEO Jim Currier emphasized that all capital allocation decisions post-split will be made by the Aerospace leadership team rather than competing across Honeywell's diverse portfolio. The business has posted double-digit volume growth for 13 consecutive quarters and maintains a record $39 billion backlog, with book-to-bill ratios reaching 1.2.

Stepniak highlighted that aerospace margins bottomed in the second quarter and should expand throughout 2026, driven by multiple tailwinds. Moreover, pricing improvements on OEM contracts that previously lacked tariff provisions will flow through in the second half. Supply chain health is also improving measurably, with days of inventory declining for the first time in three years as constraints in castings, forgings, and precision machining ease.

The automation business will be simplified through reorganization and cost reduction. The Building Automation segment has emerged as a crown jewel and has delivered high single-digit organic growth driven by data center demand and outcome-based software services through the Forge platform. Segment margins reached 27% and should continue expanding as the Access Solutions acquisition proves accretive.

The company recently completed a successful capital raise for Quantinuum, attracting investment from Nvidia (NVDA) and J.P. Morgan (JPM). Stepniak emphasized management doesn't view Honeywell as the natural long-term owner but expects a high-return monetization event within 24 months as the technology matures commercially.

What Is the HON Stock Price Target?

Management expects organic growth to range between 4% and 7% annually, with 40 to 60 basis points of margin expansion each year. The company views 2025 as a transitional low point, positioning it for a stronger 2026 performance and accelerating growth in 2027 as separation benefits materialize and quantum assets convert to cash.

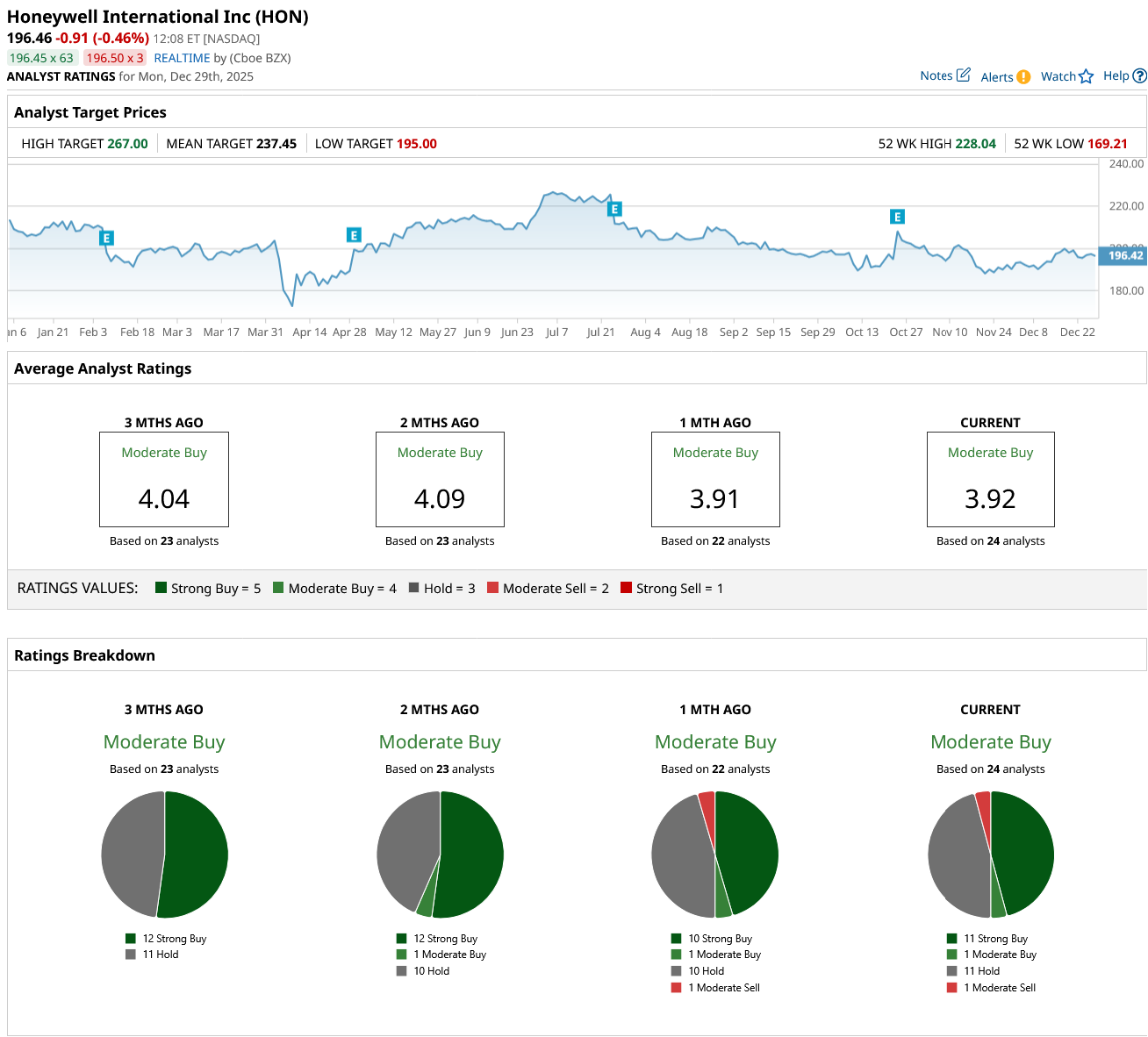

Out of the 24 analysts covering HON stock, 11 recommend “Strong Buy,” one recommends “Moderate Buy,” 11 recommend “Hold,” and one recommends “Moderate Sell.” The average HON stock price target is $237.45, above the current price of $196.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Bill Ackman Has a Bold Idea for a SpaceX IPO That Would Reward Tesla Stockholders. What Is a SPARC, and Does It Make TSLA a Buy Now?

- Risk Topography Signals a Contrarian Opportunity for Microchip (MCHP) Stock Options

- This 1 Cheap Quantum Computing Stock Could Be a Top Buy for 2026

- Short Sellers Are Betting Against Lumentum Stock. Will They Be Proven Right?