With Tesla's (TSLA) electric-vehicle deliveries contracting and the automaker significantly behind in the robotaxi race, the extremely high valuation of TSLA stock is unjustified. And although the company's robots have some potential, their value is unproven, and history suggests that investors should be skeptical about their outlook.

In light of these points, I agree with Michael Burry's contention that Tesla is “ridiculously overvalued,” and I recommend that investors sell the shares.

About Tesla

The largest seller of electric vehicles in the U.S. by a wide margin, Tesla delivered 1.2 million EVs globally in the first three quarters of 2025. Meanwhile, the automaker, according to crowdsourced estimates (as Tesla has not given an official number), had 29 robotaxis operating in Austin, Texas, and 106 robotaxis in service in San Francisco as of Dec. 2. These robotaxis, however, operate with human safety monitors in them. Tesla has also created humanoid robots that it says can perform many tasks, but large numbers of the robots are not supposed to be produced until late next year.

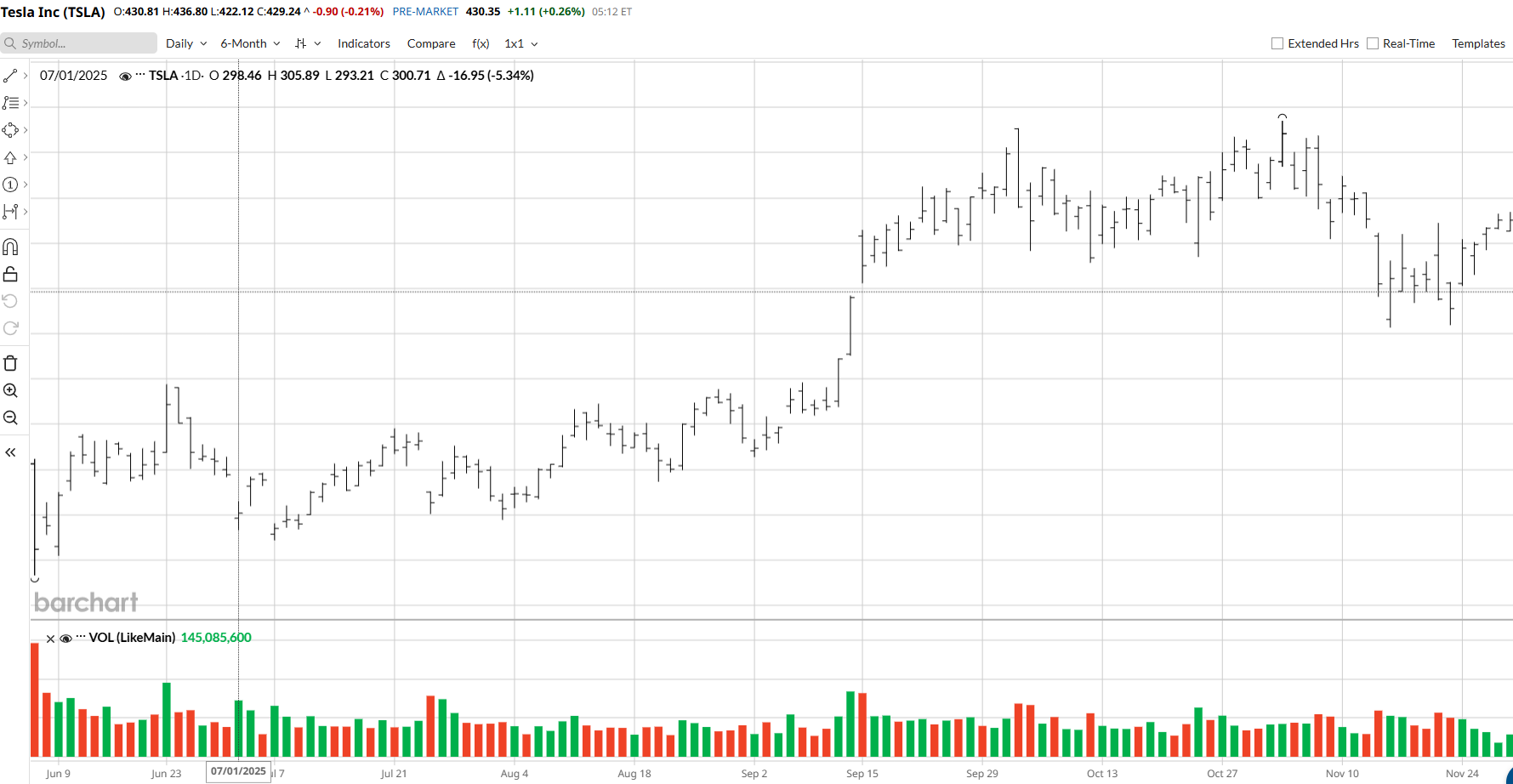

Tesla has a very high market capitalization of $1.4 trillion, while its trailing price-earnings ratio is a gargantuan 297 times. In the third quarter of 2025, it generated sales of $28 billion, up from $25.18 billion during the same period a year earlier. However, its earnings per share from continuous operations sank to 43 cents from 68 cents.

EV Deliveries, Robotaxis, and Robots

The decline of Tesla's EV deliveries in the first three quarters of this year strongly indicates that, hindered by competition from Chinese EV makers and anger on the part of some consumers about Musk's political views, the company's core EV business is contracting.

On the robotaxi front, given the low number of vehicles that TSLA has deployed and the fact that they are staffed by human safety monitors, the business appears to be a long way from making a profit, let alone significantly boosting Tesla's bottom line. Moreover, other companies, including Alphabet (GOOG) (GOOGL) and China's Baidu (BIDU), are way ahead of Tesla in the robotaxi race. Alphabet's Waymo has deployed about 1,500 robotaxis and has operations in Los Angeles, Phoenix, and Greater San Francisco. Waymo also has an alliance with Uber (UBER) in Austin and Atlanta, and it does not generally use any human safety monitors. Meanwhile, Baidu's fleet of robotaxis had reached a rate of “250,000 fully driverless weekly rides” as of the end of October.

Turning to robots, Musk has said that the company's Optimus robots “will eliminate the need to manually perform monotonous tasks, like cleaning, mowing the lawn, and folding laundry,” according to Teslarati. And the company reportedly hopes to start “high-volume” production of Optimus at an annualized rate of 1 million at the end of next year. Further, Musk has suggested that at some subsequent point, the annual production rate of Optimus will ramp to 10 million and then 100 million. Finally, the CEO has said that the robots will be five times as productive as humans.

But, based on history, Musk's statements have to be taken with a multitude of grains of salt, as many of his grandiose plans have failed to materialize. For example, in 2016, he indicated that by the end of 2017, a Tesla vehicle would be able to autonomously drive passengers from Los Angeles to New York City and then park itself. According to Elektrek, “Tesla is still not capable of doing that” now. More importantly, he has said “that Tesla would achieve unsupervised self-driving every year for the last decade,” and the company still does not seem to have reached the goal. And when Musk first touted the Cybertruck in 2019, he said it would cost $40,000, but its minimum price at its debut wound up being $61,000. Moreover, the demand for the once much-anticipated EV has been very disappointing.

Burry's Points About Tesla

Burry makes a good point about Tesla's fans consistently underestimating the company's competition, and he correctly suggests that Optimus may face tough competition. "As an aside, the Elon cult was all-in on electric cars until competition showed up, then all-in on autonomous driving until competition showed up, and now is all-in on robots - until competition shows up," the well-known investor wrote. Indeed, many firms are developing humanoid robots.

Finally, Burry calculated that Tesla dilutes its stock by about 3.6% annually because it uses a large amount of its shares to compensate its employees. While I don't view this point as one of the more important reasons to sell TSLA stock, I do think that it's an additional factor weighing on TSLA stock that investors should consider.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Is Selling Palantir Stock. Should You?

- Netflix Stock Breaks Below 20-Day Moving Average Amid Selloff. Should You Buy the Dip?

- Michael Burry Says Tesla Is ‘Ridiculously Overvalued.’ Should You Ditch TSLA Stock Here?

- Why Is Michael Burry So Bullish on Lululemon Stock? And Should You Be, Too?