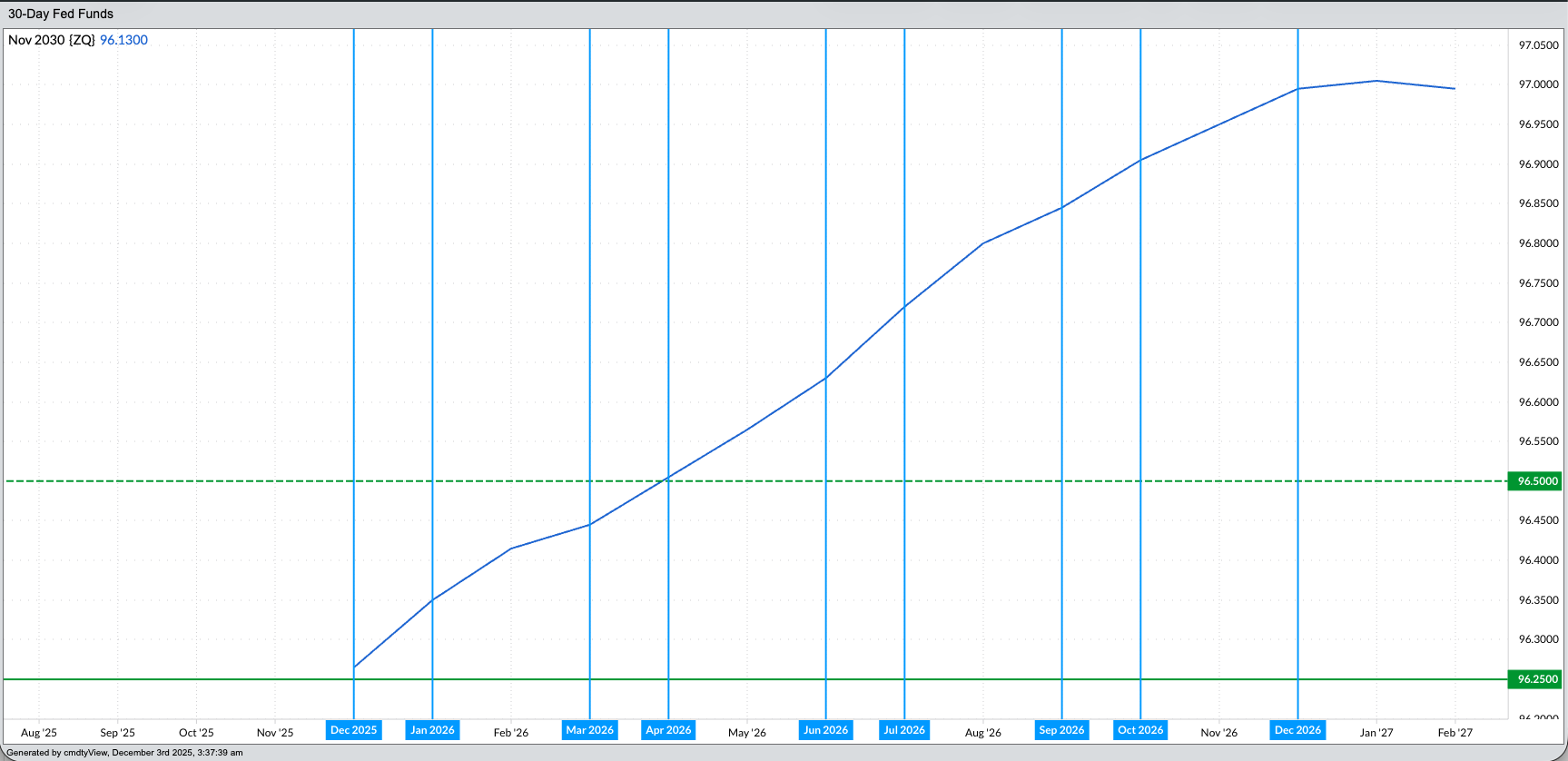

With the conclusion of the next US FOMC meeting a week away, the Fed fund futures forward curve is indicating a 25-basis point rate cut is coming.

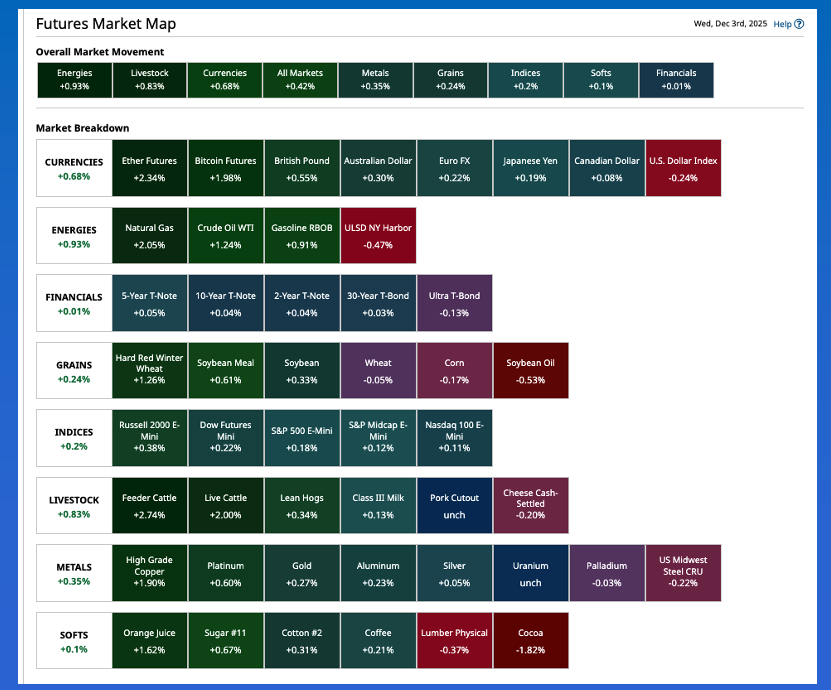

The commodity sector was green across the board pre-dawn Wednesday, with the Metals sector and Dr. Copper the economic indicator posting a strong showing.

Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily.The US president is expected to roll back Biden administration fuel standards Wednesday, putting the spotlight on Silver. (No, not the Lone Ranger's horse, but the industrial metal.)

It is early Wednesday morning, meaning the next interest rate announcement from the US Federal Open Market Committee is a week away as its December meeting concludes on Wednesday, December 10. A look at the latest Fed fund futures forward curve (see above) shows the market has priced in another 25-basis point rate cut, with the December futures contract (ZQZ25) at 96.265 putting the expected rate at 3.735%, just below the current range of 3.75% to 4.0%. The talking heads of financial television have put the odds of a rate cut between 85% and 90%. Theoretically, such a move would be expected to weaken the US dollar and provide more incentive to buy US equities. Pre-dawn finds the greenback weakening against foreign currencies, the Index down as much as 0.26 overnight and sitting near its session low at this writing. On the other hand, US stock index futures are in the green (ESZ25) (NQZ25) (YMZ25) while Asian markets closed lower and European markets are mostly higher Wednesday. A look at the Barchart Futures Market Heat Map (below) shows the commodity complex is green across the board, led by the Energies sector with a cumulative gain of 0.9%. Metals are up 0.4%, with Dr. Copper (HGH26), the economic indicator, showing an overnight gain of 1.9%. In other news, the US president has said he will roll back Biden administration fuel economy standards today, putting the spotlight on silver as demand from electric vehicles has been one of the drivers of the ongoing record rally. What might this mean for US ethanol? The easy argument is it could be bullish as an increase in gasoline demand could lift ethanol standards as well. However, we have to keep in mind this US president’s proclivity toward handing out refinery hardship waivers and his close business ties to leaders of key OPEC+ members.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart