Melbourne, Florida-based L3Harris Technologies, Inc. (LHX) provides mission-critical solutions for government and commercial customers. Valued at $55.5 billion by market cap, the company designs, develops, and manufactures radio communications products and systems, including single-channel ground and airborne radio systems. It also provides advanced defense and commercial technologies across air, land, sea, space, and cyber domains. The leading global aerospace and defense technology company is expected to announce its fiscal fourth-quarter earnings for 2025 in the near future.

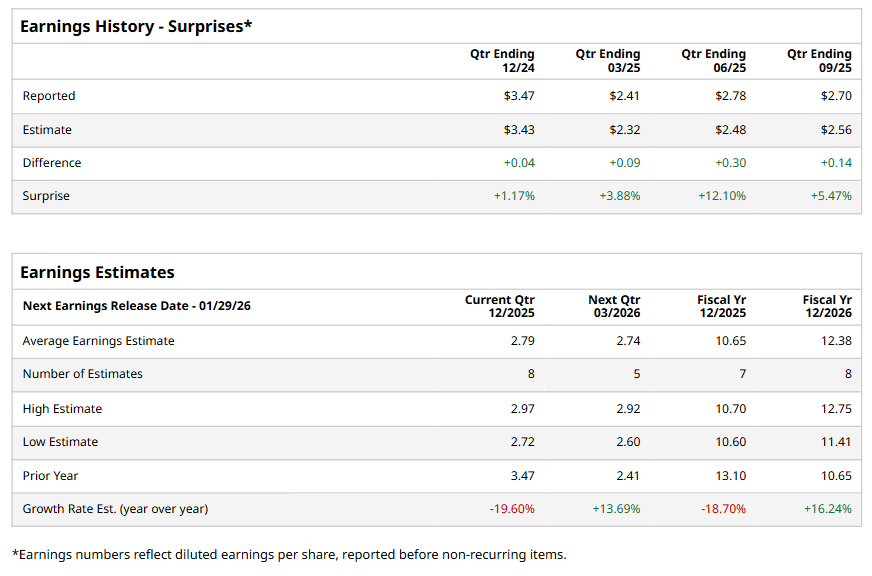

Ahead of the event, analysts expect LHX to report a profit of $2.79 per share on a diluted basis, down 19.6% from $3.47 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect LHX to report EPS of $10.65, down 18.7% from $13.10 in fiscal 2024. However, its EPS is expected to rise 16.2% year over year to $12.38 in fiscal 2026.

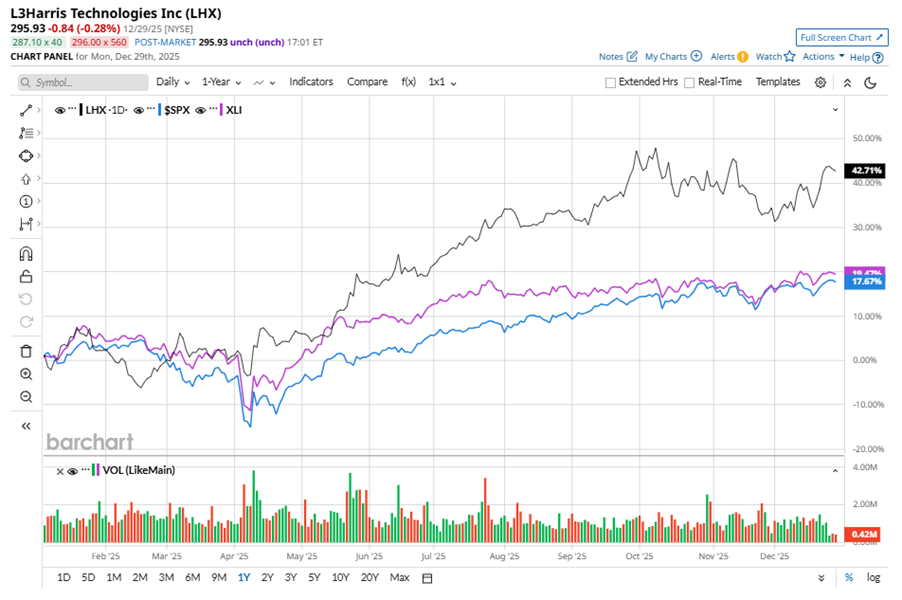

LHX stock has outperformed the S&P 500 Index’s ($SPX) 15.7% gains over the past 52 weeks, with shares up 39.4% during this period. Similarly, it outperformed the Industrial Select Sector SPDR Fund’s (XLI) 17.7% gains over the same time frame.

On Oct. 30, LHX shares closed up more than 3% after reporting its Q3 results. Its adjusted EPS of $2.70 topped Wall Street expectations of $2.56. The company’s revenue was $5.7 billion, beating Wall Street's $5.5 billion forecast. LHX expects full-year adjusted EPS in the range of $10.50 to $10.70.

Analysts’ consensus opinion on LHX stock is bullish, with a “Strong Buy” rating overall. Out of 21 analysts covering the stock, 15 advise a “Strong Buy” rating, and six give a “Hold.” LHX’s average analyst price target is $332.35, indicating a potential upside of 12.3% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Dividend-Yielding Gold Stock Is Up 184% in 2025. Should You Bet on Higher Gold Prices in 2026?

- The Next Two Years Will Belong To Breakups: Investors Who Miss It Will Miss the Cycle

- As Mortgage Rates Remain High, This 1 Stock Has Been a Big Winner in 2025

- Robinhood Stock Was Red Hot in 2025. Should You Keep Buying Shares in 2026?