Weyerhaeuser Company (WY) is one of the world’s largest private owners of timberlands and a leading supplier of wood products, operating as a real estate investment trust (REIT). Valued at $18.1 billion by market cap, the Washington-based company manages millions of acres of timberlands across the U.S. and Canada, giving it a unique asset-backed business model tied to forestry and land resources.

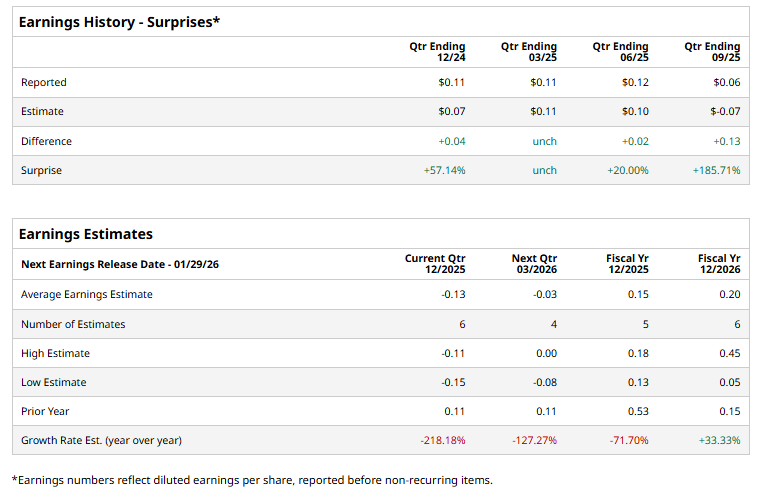

The timber powerhouse is expected to announce its fiscal fourth-quarter earnings for 2025 after the market closes on Thursday, Jan. 29. Ahead of the event, analysts expect WY to report an FFO deficit of $0.13 per share on a diluted basis, down 218.2% from FFO of $0.11 per share in the year-ago quarter. The company has consistently surpassed or matched Wall Street’s FFO estimates in its last four quarterly reports.

For the current year, analysts expect WY to report FFO per share of $0.15, down 71.7% from $0.53 in fiscal 2024. However, its FFO is expected to rise 33.3% year-over-year to $0.20 per share in fiscal 2026.

WY shares have dipped 14% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 16.8% gains and the Real Estate Select Sector SPDR Fund’s (XLRE) marginal rise over the same time frame.

On Dec. 11, Weyerhaeuser and Aymium announced a memorandum of understanding to jointly produce and sell 1.5 million tons of sustainable biocarbon annually for use in metals manufacturing, marking a strategic push into low-emissions alternatives to coal. WY shares rose marginally following the announcement.

Analysts’ consensus opinion on WY stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 13 analysts covering the stock, seven advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and four give a “Hold.” WY’s average analyst price target is $29.82, indicating a potential upside of 24.3% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart